After six long years, Greece’s economy is finally expected to grow in 2014. GDP expectations of 0.6 percent next year is a remarkable improvement compared to a loss of 4 percent this year. In addition to rising GDP, here are a few other significant changes from Greece lately:

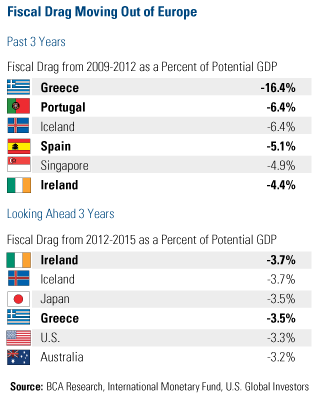

1) There’s Less Fiscal Drag

According to BCA Research, from 2009 through 2012, the fiscal drag as a percent of Greece’s potential GDP was a considerable -16.4 percent. However, the country’s fiscal situation is expected to be less of a drag over the next few years.

2) Improving Current Account Situation

Director of Research John Derrick, CFA, talked about Greece on VoiceAmerica last week, explaining that the current account should move from a deficit to a surplus by next year. He thinks it was only a matter of time before the economy naturally corrected itself.

One key reason the current account is improving is because of tourism. According to Reuters, in August alone, the money spent on tourism, which is “the country’s biggest money earner,” climbed about 12 percent on a year-over-year basis. And with the global economy recovering, Americans, Russians, Germans, and Asians have all been eager to soak up the sun on the Greek islands.

3) Entering MSCI Emerging Markets Index

In November, Greece will be added to the emerging markets index, which means that funds benchmarked to the index will be putting money there. However, Greece isn’t the only positive story in emerging Europe today. We think investors should look to the east, as Eastern Europe, Russia and Turkey offer meaningful opportunities.

Here Are Some Of The Area’s Strengths

- Emerging Europe countries offer free flowing currencies, lower taxes, and fewer regulations. They have a more competitive labor force, with lower wages and a more educated staff. All are tremendous advantages for companies located in these countries.

- The nations are only at the beginning of their journey to developed status and will likely benefit from a recovery in Western Europe because of their economic ties through establish export trade.

- A convergence with developed Europe is also in their future. The integration process in many of these countries is currently underway, with emerging countries in the east working to meet the European Union’s standards that include living standards, GDP, environmental standards, regulatory standards and infrastructure.

Our team believes this string of outperformance is only a matter of time.

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets.