Today was options expiration for the Metals.

In my experience, the Metals markets have a tendency to make meaningful highs/lows in thin, overnight trading. Last night Gold and Silver were under pressure on the reopen, but turned and closed higher on the day. (A couple hallmarks of a key reversal.....but I don't recommend trying to pick bottoms).

There is no real "fundamental" catalyst for the Metals to move higher. Then again there was no real fundamental catalyst for their break in early/mid April (leaked FOMC minutes?). In short, I believe there will likely be some short term (trading) opportunities as well as longer term (positioning) opportunities in the next few weeks.

Options volatility (30 day) in Gold and Silver are lower than they've been since March/April (which were 7 year lows).

Moving from minutiae to the macro......

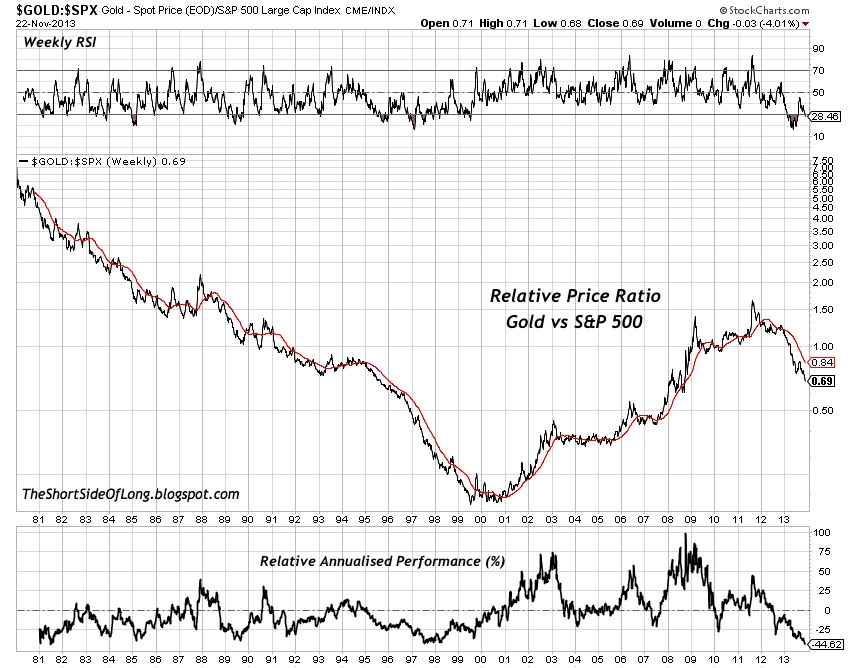

Here's a 30 year look at Gold v. the S&Ps.

Equities outperformed Gold fairly consistently between 1980 and 1999 (Volker Era - Greenspan).

- Exceptions: Marine Barracks bombing in Beirut (1983),

- Post 1987 "crash",

- Iraq/Kuwait (1991),

- Original World Trade Center Bombing (1993)

Between 1995 and early 2000 (exception Y2K fears) money funneled into equities and out of commodities. The Dollar was very strong and the US was ascendant. That changed on September 11, 2001. (The Dollar Index was trading around 120 in late 2001 - now chopping around 80).

For the next decade (late 2001 to late 2011) Gold outperformed the S&Ps. Originally the Metals popped on dollar weakness and an escalation of geopolitical tensions. The "relationship" made a short term peak as Shock and Awe began (Operation Iraqi Freedom) in Spring of 2003. The spread remained fairly stable between 2003 and 2006 with both stocks and gold performing well.

In his last year and a half at the helm, Greenspan raised the Fed Funds rate incrementally from 1.00% to 5.25%. In 2006, Bernanke took the reins just as the Housing market started to roll over. For the next 5 years, Gold vastly outperformed the broad based US Equity Indices.

Gold outperformed dramatically between late 2005 and March 2009 (equities bottom). The spread reached ~25 year highs in late 2011 when Gold traded over $1900 and the S&Ps were around $1150 following the US Debt downgrade and European Sovereign crisis.

Here's a look at the price spread over the past 8 years. (S&P Cash less Gold). Notice:

- S&P @ $600-$900 premium between 2005-early 2008.

- March 2008 = Bear Stearns implosion

- May 2010 = Greek riots and Flash Crash

- Late 2011 = PIIGS/US Debt downgrade

Since US/Japanese elections late last year the equities have dominated. Today the S&Ps traded back to a nearly $600 premium to Gold (Highest since early 2008).

As I mentioned at the outset, picking tops and bottoms is a fools errand. However, options afford you tremendous flexibility, especially when implied volatility is trading this low. If you care to discuss alterative approaches using options strategies - let's set aside some time to talk over the holiday week.

Risk Disclaimer: This information is not to be construed as an offer to sell or a solicitation or an offer to buy the commodities and/ or financial products herein named. The factual information of this report has been obtained from sources believed to be reliable, but is not necessarily all-inclusive and is not guaranteed to be accurate. You should fully understand the risks associated with trading futures, options and retail off-exchange foreign currency transactions (“Forex”) before making any trades. Trading futures, options, and Forex involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more than your initial investment. Opinions, market data, and recommendations are subject to change without notice. Past performance is not necessarily indicative of future results. This report contains research as defined in applicable CFTC regulations. Both RCM Asset Management and the research analyst may have positions in the financial products discussed.