Those that view the message of the market on daily basis are likely confused by trading noise. While trading noise contributes to the long-term trends, it does not define them. Human behavior tries to explain trading noise as a meaningful trend. This confuses the majority which, in turn, contributes to their role as bagholders of trend transitions.

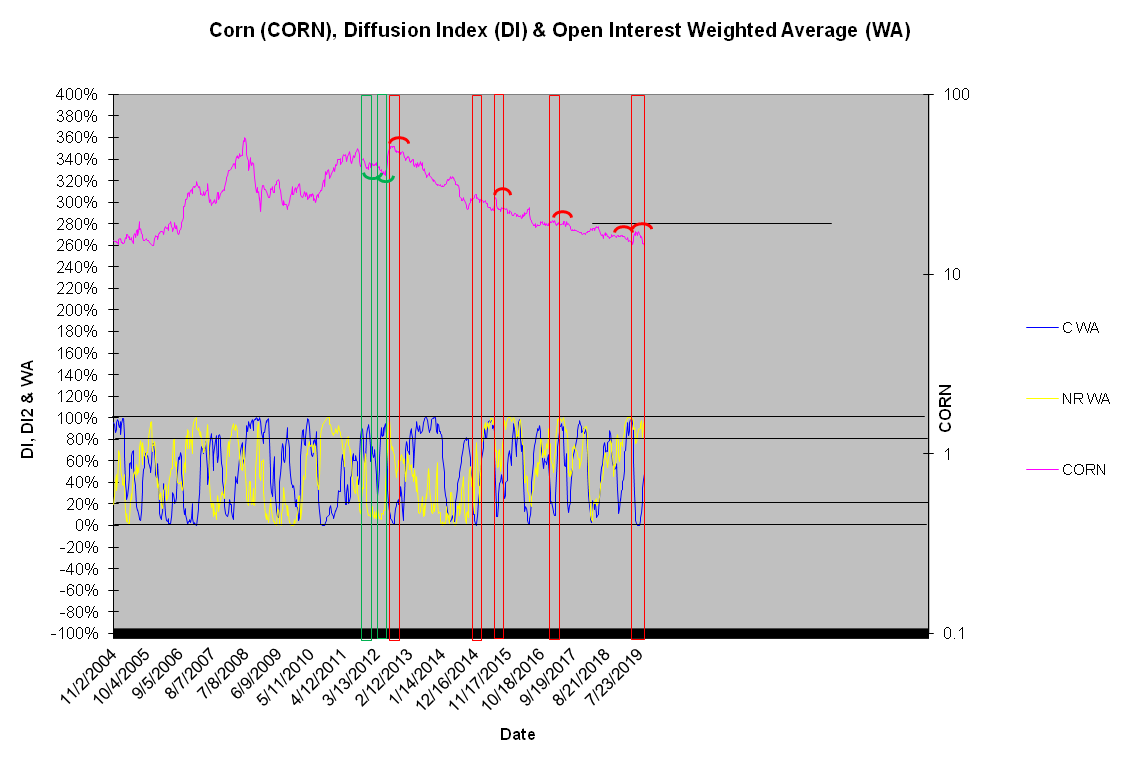

Corn is certainly an ongoing discussion. The latest decline that challenged the previous low allowed commercial traders lightening up their shorts. This is a common observation that leads to increasing DIs as price declines. Commercial short liquidation means nonreportable (specs) increased their short position.

The interesting group, the reason why DI did not climb too high during decline, is retail traders or NR WA (Commercial & Retail WA); commercial and Retail WA are components of DI. Retail traders, a group that normally chases strength and weakness, refused to sell as prices broke to a new low. In trader's speak, the weak hands didn't get flushed. The non-flushing of retail is bearish, since they always get timing wrong.

I know, reports of worse than expected yields should be sending corn higher, but the distribution of leverage is not right. Meaning, the invisible hand is still bearish on corn. The distribution is not as bearish as it was from May to July, but the bulls weren't listening then either.

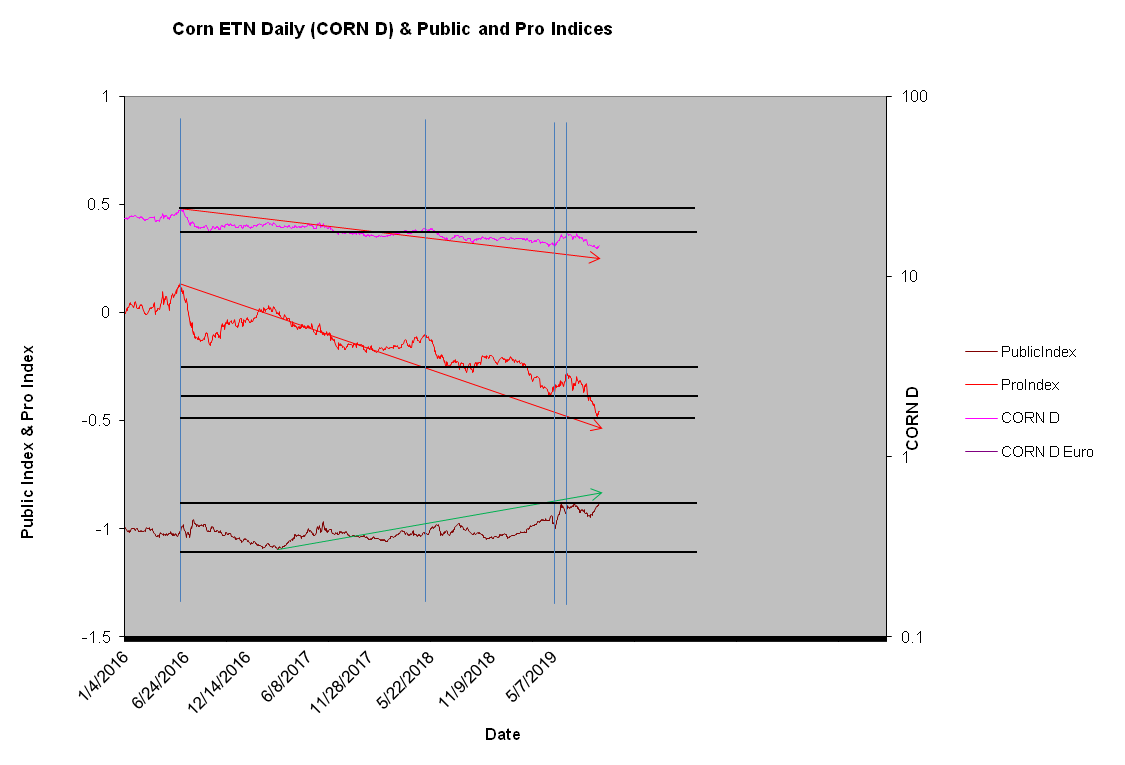

Corn's ProIndex also suggest heavy selling. The ProIndex continues to set new lows ahead of price. This is bearish and must change to support a durable rally.

Commercial and Retail WA

Corn ProIndex PubIndex