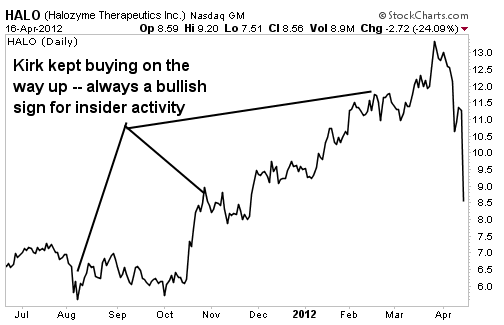

Randal J. Kirk is beside himself right now. The legendary biotech investor, who is now worth more than $2 billion, made a rare misstep by plunking down $14 million (at $10.61 a share) on Halozyme Therapeutics (Nasdaq: HALO) in February, only to see that investment lose a quarter of its value on Monday, April 16.

His nearly 8% stake in the company is now worth roughly $70 million, down from nearly $100 million before Monday's plunge. That's when the Food & Drug Administration (FDA) told Halozyme -- along with key partner Baxter (NYSE: BAX) -- that further clinical testing for a key drug would be required.

This put an abrupt end to a solid upward move in the stock, which only recently saw the company's value move past the $1 billion mark. But Kirk figures to still profit handsomely, as Halozyme's biotechnology platform should still reap solid rewards in the years to come.

Halozyme has been garnering a steadily rising buzz in biotech circles, thanks to the impressive action of its key product, hyalurodinase. The drug mimics hyoluric acid, which is naturally produced by the body as a gel-like substance. Halozyme's hyalurodinase has proven quite effective at helping drugs to be absorbed into the bloodstream. Baxter and Roche Holdings (Pink Sheets: RHBBY.PK) have poured money into Halozyme in exchange for the rights to market several drugs that are currently before the FDA. In both instances, those two Big Pharma players want to use hyalurodinase to convert existing intravenous (IV) drugs into subcutaneous (injectable) drugs.

Roche, for example, has paired up Halozyme's drug with its own Herceptin and Rituxan drugs, both of which are seen as key parts of Roche's future sales growth. Analysts at Brean Murray have repeatedly suggested that Roche might look to buy Halozyme (at around $13 a share) if the FDA issues a full set of green lights for the drug combinations. (Shares had been surging in recent months on news that clinical trials pairing hyaluronidase with other drugs were going very well.)

Biotech investors first began chatting about Halozyme in late 2010 when the company brought in a new business development team that subsequently initiated several new key partnerships. In June 2011, Halozyme signed a development deal with privately-held Intrexon to develop a subcutaneous version of A1AT, a protease inhibitor used to stop inflammation in respiratory conditions such as cystic fibrosis and emphysema.

A partnership with Viropharma (Nasdaq: VPHM) was also launched, and clinical tests are now underway for pairing hyalurodinase and Viropharma's Cinryze, which treats a fairly obscure genetic blood disease.

These partnerships are being pursued in tandem with Halozyme's own proprietary drug-development efforts. For example, the company recently announced solid Phase I testing data for HTI-501, which treats extreme cellulite. The opportunity in the cosmetic market possibly holds even higher potential than Halozyme's multiple partnerships. Lastly, Halozyme is also developing PEGPH20 to treat pancreatic cancer, and Eli Lilly (NYSE: LLY) is looking at using it in tandem with its gemcitabine drug, which is used in chemotherapy.

Parsing the FDA's response

So does the FDA's move to ask Baxter and Halozyme to submit more long-term data render hyalurodinase much less worthwhile? Not at all. To be sure, a possible 2012 product launch is now unlikely to happen, and conservative investors may wish to assume that that the Baxter/Halozyme drug, known as HyQ, won't get approved at all. Analysts at Goldman Sachs still think HyQ will get approved, though that may come as late as 2014 if a new clinical trial is required.

Here's the key takeaway: The FDA has not cast doubt on HyQ, but says the companies should be providing more long-term clinical-testing data. So shares were dumped on Monday because Halozyme's expected revenue ramp will be pushed out by at least several quarters. And as is the case with many biotech stocks, this quickly leads to concerns about financial strength while the move to profitability is delayed.

Halozyme was fortunate to raise roughly $80 million in February (which is when Randal Kirk bought his shares). The company now has an estimated $120 million in the bank, which is likely sufficient to fund operations for another 12-18 months. In the interim, the company may also receive royalty payments from other partners as key drugs advance in the clinical testing process.

Taking account of the FDA setback, analysts at Brean Murray lowered their target price from $13 to $11, although some biotech investors, including Randal Kirk, presumably believe Halozyme's biotechnology platform could be worth much more than that.

Risks to Consider: Halozyme is expected to report a range of other clinical-testing information in the coming 12 months and will need to show continued positive results before shares can rebound.

This is all about risk and reward. Monday's setback has removed much of the near-term risk from the stock. Shares may simply tread water in the absence of near-term catalysts. But shares would quickly spike well north of $10 again if the cellulite drug opportunity starts to heat up, or if Roche's marketing efforts start to pay off and Halozyme starts to report an impressive sales ramp.

by David Sterman

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

A Legendary Biotech Investor Just Spent $14 Million On This Stock

Published 04/18/2012, 07:12 AM

Updated 07/09/2023, 06:31 AM

A Legendary Biotech Investor Just Spent $14 Million On This Stock

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.