The recent Federal Open Market Committee (FOMC) meeting minutes are treated as ‘gospel’ by the markets, and rightfully so, seeing that the Federal Reserve (FED) is the world’s most powerful central bank. But market reactions overnight saw a selling off in equity markets and metal markets.

The reason for this was positive sentiment from the FED, but while also being positive, they were reserved in their statements, and expressed only a few concerns from overseas markets. For the most part, the FED mandates the inflation be set at 2% and for the most part, it has yet to achieve this as for 2013, it remained around 1%. But more importantly, the unemployment rate was heavily discussed as it looks to approach the 6.5% threshold that the FED mentioned. However, the FED has since moved away from a fixed goal from unemployment – a large u-turn for the FED – and are now estimating ideal long term unemployment between 5.2-5.8%. It’s good to see the unemployment rate falling, but the FOMC meeting also reveals that long-duration unemployment declined, which is a positive sign for middle class America.

The FOMC meeting also pushed on the tapering issue, with members still hawkish and wanting to see a reduction in the pace of purchase by around $10 billion at each meeting. On top of this, after a long period of time, the federal funds rate issue was brought up, and some members suggest it should be raised above its lower bound by the middle of this year. This would require a lot more positive economic data I believe, as tapering is one thing, but raising rates is another and can have economic shocks to an economy that’s still a bit shaky. Certainly, this sets the scene for the next two meetings, where we could hear more noise regarding the Federal funds rate. If anything, the possibility of a rise in rates could be expected if we see a strong quarter for 2014.

The roll on effect to markets was widespread with equities and metals dropping, but the Dollar Index certainly got a boost from it all.

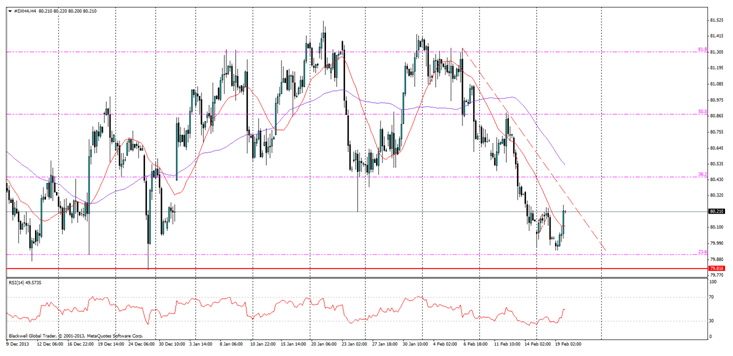

This news helped push the Dollar Index away from the 23.6 fib level and back over the 80 mark. A positive turn of events for the struggling index, which as of late has fallen considerably in quite a steep bearish trend line. Will the positive news be able to push it through further? It’s certainly possible with today’s CPI data and Initial Jobless Claims, we could see the present trend line broken and a big push back come into the works.

The main thing to take from all this though, is that the USDX could be set to climb back as the US economy strengthens, but mainly that the FED could be set for more aggressive action in FOMC meetings to come, as it looks to raise the federal rates and wash its hands off QE after the financial crisis. A strong CPI reading tonight would certainly help the case for the FED, as well as better employment data – but for now, we will have to wait and see.