Since eclipse day — August 21 — markets have been surging higher thanks, it seems, to the distinct lack of nuclear missiles flying through the air. The small caps are up nearly 6% in that brief timespan but I think it would do us all good to keep the big picture in mind.

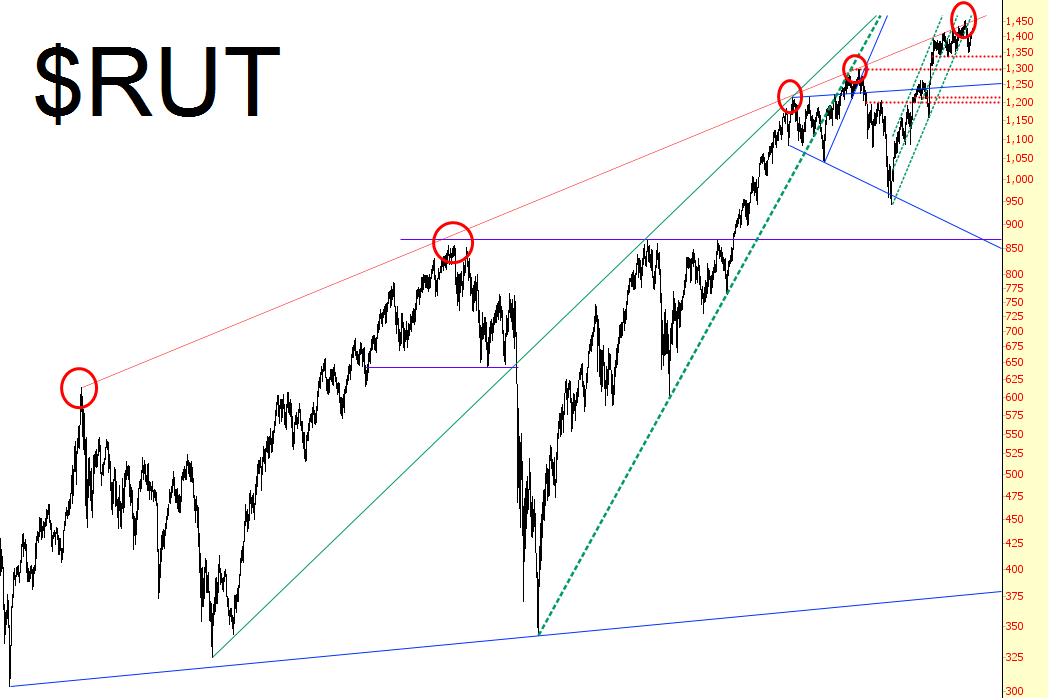

Here’s the index for the past twenty years. As you can see, we have hit that red resistance line five times now, turning back in each instance.

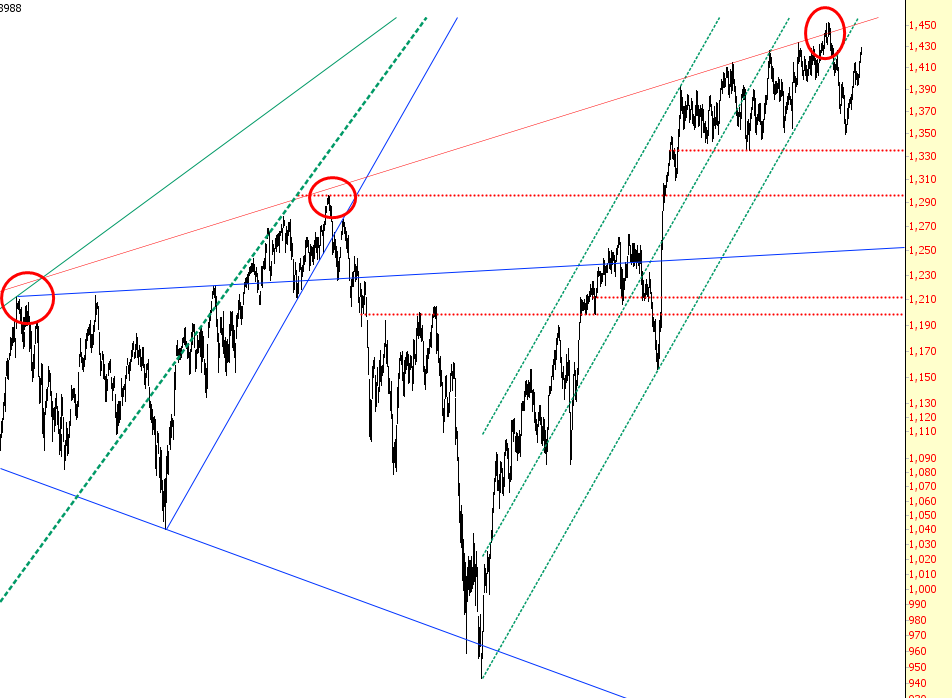

Looking closer, you can see that the most recent three instances were much closer together in time than the prior two. The fifth and most recent one overshot the line briefly before tumbling hard, down to the aforementioned eclipse day.

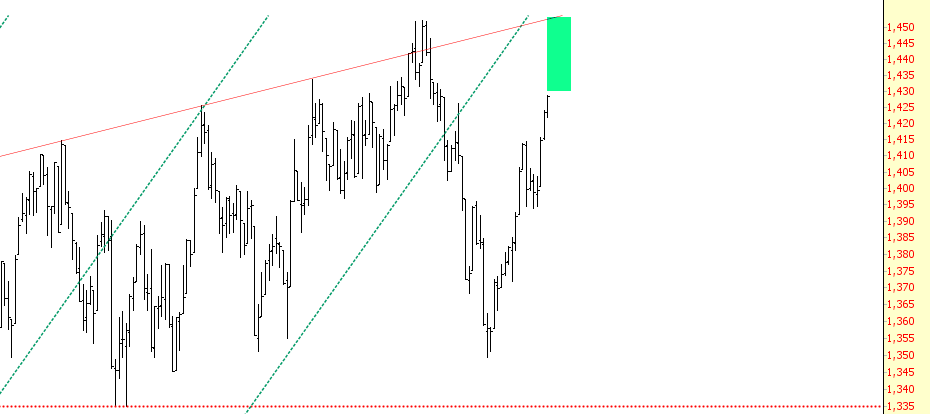

The annoying part is the strength we’ve seen lately, which has been persistent across all equities. My view is that between (a) the important repulsion away from that multi-decade trendline and (b) the fact we’re simply coming to the underbelly of the same line, this strength is temporary. However, we bears are still at risk for some more strength between present price levels and that trendline, as represented by the green tint:

Bottom line is that I remain short the Russell by way of IWM puts (October 20 expiration) and RUT puts (November 17 expiration).