Gold miners are starting to get some attention again. As for why, is beyond my comprehension. These stocks stink. Yes I said that. They have historically been vehicles for the corporations’ management to steal money from shareholders. They do this buy granting more stock for management and then they sell it to you. You will no doubt give me all sorts of arguments against that view. You are entitled to your view and I will read your well thought out comments to discern whether there are any facts that dispel my thinking. They are not a proxy for gold and never will be though. On that note if you want to own gold because it looks pretty or it is cool to have a bar to show your neighbors or to get checks that is fine. Just don’t ever tell me that it is an inflation hedge or a safety trade. It is a commodity that is subject to hype and sentiment. That is all. Send your rebuttals there too.

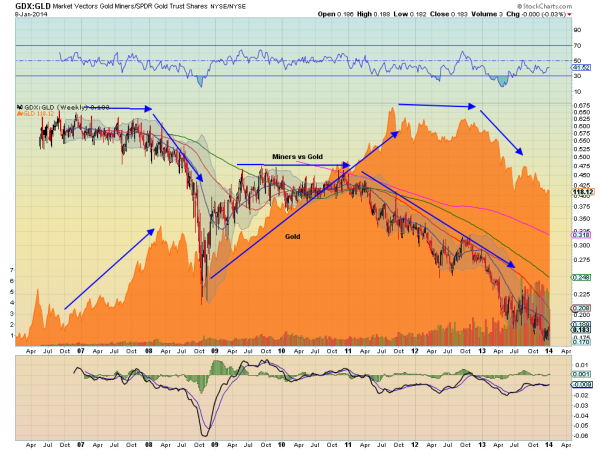

But we can put both of those lines of thinking aside for now and focus on nondisputable facts. Traders or investors that are buying miners as a turn around play on gold are just lunatics. Set your attention to the chart above. It shows that over the 8-year life of the Gold Miner ETF, GDX, the relationship between the miners and Gold, GLD, has been one where the miners have lagged Gold as it is rising and the miners fall off before Gold turns. Translation: The miners at best match but more often underperform on the way up and on the way down.

The 2007 to 2008 period when Gold was rising the ratio of the miners to gold was flat. And that was the best relative performance. The ratio turned lower in in late 2007 before Gold dropped and gold started to rebound and continued higher into 2012 while the ratio topped in mid 2009 and started falling in early 2011. Since then the ratio has just been falling and gold joined it moving lower as 2013 started. What would it take for the miners to reverse higher? History says a sustained move higher in gold. But the down trend in gold is no where near run its course. Even the most optimistic goldbug can only make a case that the fall has stopped, not a for a reversal. So why is it that you want to buy the gold miners?