Forex News and Events

The Australian economy expanded 0.9% in the first quarter compared to Q4 2014. Despite the fact that the figure printed above markets’ expectations, we do remain Aussie bears, as the underlying details are weak. Indeed, domestic demand printed flat while consumption contracted -1.2% (sa) during the first three months. The positive figure is mainly due to net export, which proves that competitive devaluation definitely helps. In addition, total capital formation, used to proxy total investment, declined by -3.2%. All in all, those data confirm our bearish AUD/USD view, increasing the odds of further rate cuts by the Reserve Bank of Australia. On a slight note of caution, if growth does not pick up significantly in the US, it may not resume the dollar rally and allow the Aussie to strengthen against the greenback, forcing the RBA to act to keep the AUD weak – in the last statement, Glenn Stevens maintained that “further depreciation seems both likely and necessary, particularly given the significant declines in key commodity prices.” AUD/USD is currently testing the resistance implied by the 38.2% Fibonacci level (on mid-May - June debasement) at 0.7814. On the mid-term, we adjust our target to $0.76.

Copom rate decision

In South America, the BRL is taking advantage of a US dollar undermined by a delay in economic recovery, above expectations economic data, and major advances in the approval process of much needed austerity measures (April’s industrial production came in at -7.6%y/y verse -8.1% expected and Q1 GDP printed at -1.6%y/y versus -1.8%) to drag USD/BRL down to 3.1323 from 3.20 a day earlier. The BRL is also receiving support from the BCB as a rate hike of 50bps, that would take the Selic rate to 13.75%, is broadly expected across market participants. The Copom will announce its rate decision today. The release of the US job reports today (ADP) and Friday’s NFP will create volatility in the FX market and may erase recent BRL gains.

Greece threatens not to pay the IMF (by Yann Quelenn)

Greece has proposed to its creditors last night a 47-page proposal, in which the Greek government said that compromises have been made. Greece is now claiming for a deal to be reached, but added pressure by saying it would not fulfill the next IMF payment due this week if there is no deal by Friday or Monday. We do not think that unlocking funds again and again is a decent solution over the long run. The problem remains that Greece’s weak growth rate will make it impossible to repay its massive debt load. The truth is that three years ago, Greece should have already defaulted, even if now creditors are playing the fake “take-it-or-leave-it game.” We know that ECB’s credibility is more important than leaving Greece defaulting. In our opinion, a Greek default would not necessarily mean an exit from the Eurozone, but will alter considerably the ECB’s authority.

Of course, Greece’s uncertainties are weighing on global equity markets, as consequences of a Grexit seem impossible to predict for the moment. While the soft US data has emboldened the USD bears, we anticipate that the reality of the Greek crisis will weigh on the EUR and force a flight to safety. The USD-complex is set to gain positive traction regarding those European concerns, as well as our expected recovery in economic data coming in this week (starting with Friday payroll report).

GBP/USD - Breaking the Short-Term Declining Channel

Today's Key Issues / GMT Apr Unemployment Rate, exp 11.20%, last 11.30% EUR / 09:00 Apr Retail Sales MoM, exp 0.60%, last -0.80% EUR / 09:00 Apr Retail Sales YoY, exp 2.00%, last 1.60% EUR / 09:00 Real Estate Norway Releases May House Price Data NOK / 09:00 May 29 MBA Mortgage Applications, last -1.60% USD / 11:00 Jun 3 ECB Main Refinancing Rate, exp 0.05%, last 0.05% EUR / 11:45 Jun 3 ECB Deposit Facility Rate, exp -0.20%, last -0.20% EUR / 11:45 Jun 3 ECB Marginal Lending Facility, exp 0.30%, last 0.30% EUR / 11:45 Apr National Unemployment Rate, exp 8.20%, last 7.90% BRL / 12:00 May ADP Employment Change, exp 200K, last 169K USD / 12:15 Apr Int'l Merchandise Trade, exp -2.15B, last -3.02B CAD / 12:30 Revisions: U.S. Trade Balance USD / 12:30 ECB Pres. Draghi to Give Press Conference on Rate Decision EUR / 12:30 Apr Trade Balance, exp -$44.0B, last -$51.4B USD / 12:30 May HSBC Brazil Composite PMI, last 44.2 BRL / 13:00 May HSBC Brazil Services PMI, last 44.6 BRL / 13:00 May F Markit US Composite PMI, last 56.1 USD / 13:45 May F Markit US Services PMI, exp 56.4, last 56.4 USD / 13:45 May ISM Non-Manf. Composite, exp 57, last 57.8 USD / 14:00 Currency Flows Weekly BRL / 15:30 May Commodity Price Index MoM, last -2.14% BRL / 15:30 May Commodity Price Index YoY, last 6.11% BRL / 15:30 U.S. Federal Reserve Releases Beige Book USD / 18:00 Fed's Evans Speaks at Banking Symposium in Chicago USD / 18:15 Jun 3 Selic Rate, exp 13.75%, last 13.25% BRL / 20:00 Fed's Bullard To Give Welcoming Remarks at Homer Jones Lecture USD / 21:00

The Risk Today

Yann Quelenn

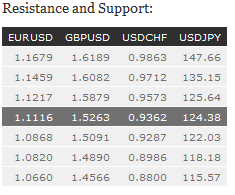

EURUSD EUR/USD has broken the resistance at 1.1006 and is now consolidating below the hourly resistance at 1.1217 (19/05/2015 high). Support is given at 1.0868 (28/05/2015 low), while stronger support can be found at 1.0820 (27/04/2015 low). In the longer term, the symmetrical triangle from 2010-2014 favors further weakness towards parity. As a result, we view the recent sideways moves as a pause in an underlying declining trend. Key supports can be found at 1.0504 (21/03/2003 low) and 1.0000 (psychological support). Break to the upside would suggest a test of resistance at 1.1534 (03/02/2015 reaction high).

GBP/USD GBP/USD has broken the upper bound of the declining channel. Hourly resistance can still be found at 1.5437 (27/05/2015 high) and support is given at 1.5171 (01/06/2015 low). Stronger support is given by the declining channel at around 1.5089 (05/05/2015 low). In the longer term, the technical structure looks like a recovery bottom whose maximum upside potential is given by the strong resistance at 1.6189 (Fibo 61% entrancement).

USD/JPY USD/JPY has bounced back on the 125-level. We still target the resistance at 125.69 (12/06/2002 high), and we still consider the pair as strongly bullish as we stay largely above the 200-dma. Hourly support is given at 122.78 (27/05/2015 low). Key resistance lies at 135.15 (14-year high). A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 118.18 (16/02/2015 low).

USD/CHF USD/CHF is still trading between the resistance at 0.9573 (29/05/2015 high) and the support at 0.9287 (22/05/2015 low). Stronger support lies at 0.9072 (07/05/2015 low). In the short-term, the pair currently lacks momentum, but we remain bearish over the next few weeks. In the long-term, there is no sign to suggest the end of the current downtrend after the failure to break above 0.9448 and reinstate the bullish trend. As a result, the current weakness is seen as a counter-trend move. Key support can be found at 0.8986 (30/01/2015 low).