A wild week for markets who gapped most days leaving us out of the trade for the most part.

I just can’t really hold much overnight with a gap one way or another quite likely according to recent history.

That said, this sloppy action generally leads to downside so I am actively looking for shorts or potential bounce plays off support areas for relatively quick trades.

It is not an easy market at the moment and I only play small in tough markets but the good news is that good and easy to make money in action always follows tough times.

Gold broke out this week, then began to look weak only to get a major catalyst as the Swiss de-pegged their currency.

We really need to see how gold acts over the next week to see if this is just a quick pop on news or perhaps a more sustainable move.

Gold gained a large 4.65% this past week as it moved nicely past $1,220 then stalled before the Swiss currency de-pegging.

Early in the week it looked like gold was going to roll over as miners were not acting great and many were even acting weak and I warned members of this and I even was short some miners via and ETF.

Then we woke to the Swiss news and all hell broke loose.

The news came without warning and moved markets and gold violently with nothing that could be done until the markets opened.

Luckily we aren’t trading heavily in this market so damage was limited but still, it is no fun waking up to see your position gapping some 10% or more against you.

This is the trading game though and it does happen on occasion.

Anyhow, the Swiss news lit a fire under gold and it ran strongly into the close Friday.

With Monday a US holiday nobody wanted to be short of anything over the weekend and Monday with the rest of the world trading gold.

I’m still not totally convinced that gold is in a sustained uptrend now for the reasons stated above.

I really need to see how it holds up once the Swiss Franc news is digested for a few more days.

We’ve seen gold move large on news only fail shortly thereafter so being cautiously bullish is good.

Resistance still sits in $20 increments above up to $1,320.

Silver gained a solid 7.66% this past week and is moving strongly now, following gold.

Silver is moving strongly on great volume now and looks set to test the 200 day moving average before we see any major rest.

All in all, great action for silver as it follows gold higher for now.

It is certainly possible that the major low is now in for gold and silver but I really do prefer to see more days of trading before I am totally convinced of that.

A great start but there is no major rush to pile into the metals quite yet.

If this is a major low, we will have years of upside to come and many, many great and perfect buy points.

Platinum rose 2.79% as it follows gold higher on the way to $1,300.

Great action on strong volume that looks to be sustainable for the week ahead.

If we see platinum move back under the 100 day at $1,265 that would be a warning that the move to $1,300 may not come but I don’t see that coming.

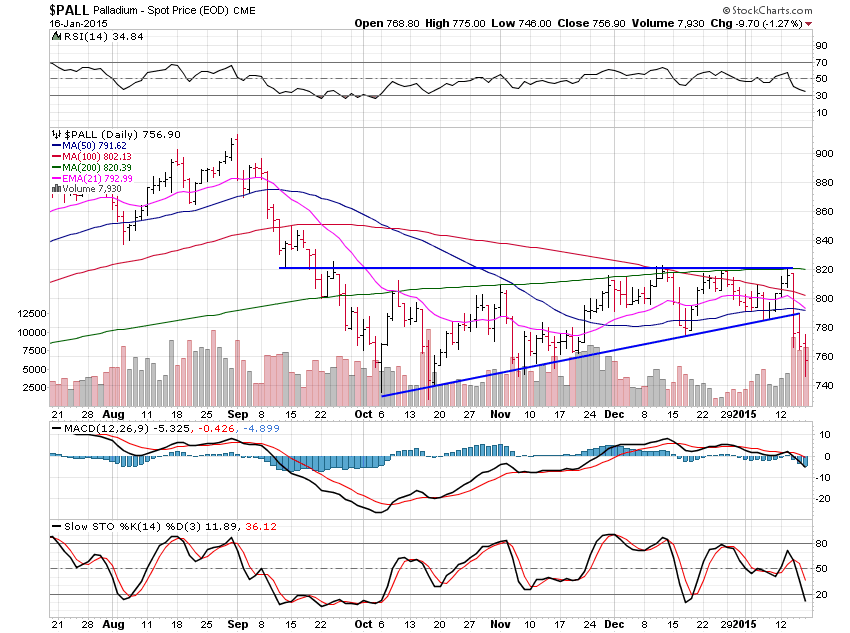

Palladium lost a heavy 5.80% even in the face of gold strength.

Palladium has acted much better than the other metals during the major downswing but now this week it followed copper lower which was something I did not see coming at all and really don’t understand yet.

Palladium has some support here at the $750 area and below that support sits at $725.

All in all, the metals look to continue their moves higher with the exception of palladium.

I’d be carefully cautious trading metals and very cautious trading stocks and the general US markets in the week and likely few weeks ahead.

I am doing another round of real-time trading to help people make money and avoid damage and danger in this tricky market.