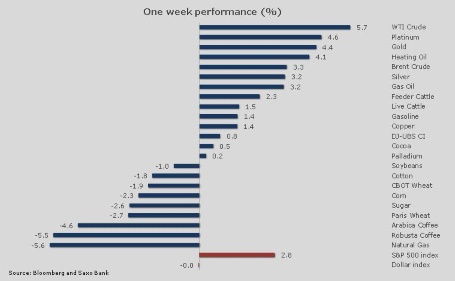

Commodity markets recovered this week as investors returned, after last week's carnage where heavy selling hurt key commodities such as oil, copper and gold. Following another week with dismal economic data from Europe, expectations have been lifted that the ECB will cut its key interest rate at the bi-weekly meeting next Thursday. This expected stimulus triggered a rally in stock markets and cyclical commodities such as oil and copper, which both saw the biggest weekly rise in months. As the raised expectations of a rate cut have been driven by continued deterioration in key economic indicators, the near-term outlook for growth dependent commodities seems limited. Resistance may present itself over the coming week after a recovery from oversold levels.

Gold spent the week recovering from the biggest two-day sell-off in three decades. The rally was mostly driven by news about a strong pick-up in physical demand, especially in Asia, but also signs that some central banks had taken the opportunity to accumulate the commodity. On Friday, gold traded as high as 1,485 USD/oz but resistance at 1487.9, being the 61.8 percent retracement of the sell-off, proved to be a hurdle too strong for the market to deal with. This could set up the market for some potential weakness.

Brent Crude has moved back above USD 100 per barrel. WTI Crude was the best performing oil contract with the discount to Brent falling below 10 dollars for the first time in 15 months. Weaker demand for North Sea Brent Crude and expanded pipeline infrastructure around Cushing, Oklahoma has begun to ease the bottleneck issues which for many months had seen WTI crude dislocated from the global oil market.

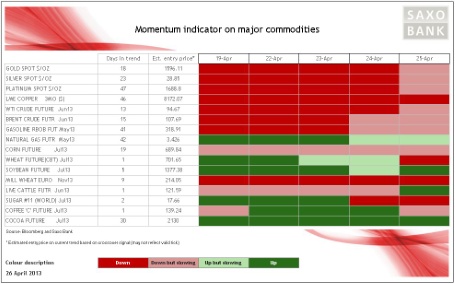

Our momentum monitor shows how the rally in the above mentioned commodities has helped negative momentum slow down. Several commodities within the agriculture sector have been blowing hot and cold in recent weeks, with no clear overall direction detected. Over the last couple of days negative momentum has returned to CME Wheat, Coffee and Sugar while Live Cattle has gone the other way.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

A Good Week For Commodities Sees Negative Momentum Slowing

Published 04/26/2013, 03:19 AM

Updated 03/19/2019, 04:00 AM

A Good Week For Commodities Sees Negative Momentum Slowing

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.