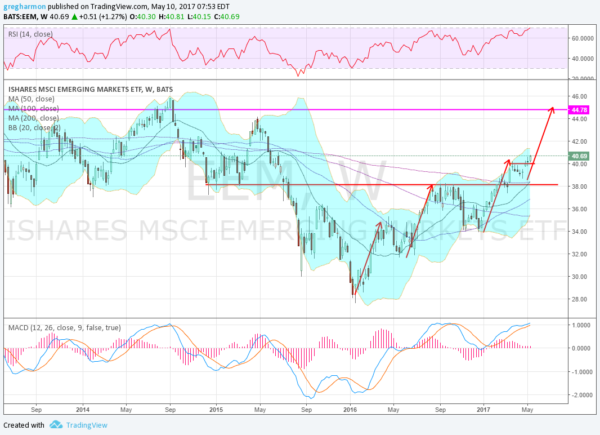

US and European markets are not the only ones that are going up. It has been a banner year plus for stocks everywhere, and that includes Emerging Market stocks as well. The Emerging Markets ETF (NYSE:EEM) is up over 45% from its low in January 2016. And from the chart below it looks like this may continue for some time to come.

The ETF touched what was prior support in September and stalled after a 8 month move up. That prior support acted as resistance and it pulled back. It found support at the 50 week SMA and made a double bottom before reversing higher in the latest move up. This time it moved right through that prior resistance to the 200 week SMA. A brief pause and retest of the break and it was rising again.

This week it is breaking to another new high. As it moves up the Bollinger Bands® are rising, a positive. Momentum is also supportive of more upside with the MACD rising and the RSI moving up near 70. The 50 week SMA is moving up towards a bullish cross of the 200 week SMA as well. After 3 moves of $6 to the upside, a fourth would place it back at the top of a resistance zone that held for 4 years from mid 2011 to mid 2015. What will happen beyond there we will have to wait and see. But for now Emerging Markets are looking very strong.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.