Oil and Gold are titans in terms of market stature. Able to take control of global economies, start or squelch inflation, create or destroy value. They have a storied following with deeply entrenched disciples. For Gold we call them Goldbugs, those that see a reason to buy Gold with any headline that comes up, good or bad. The rallying body for Oil is not so organized, but maybe it should be.

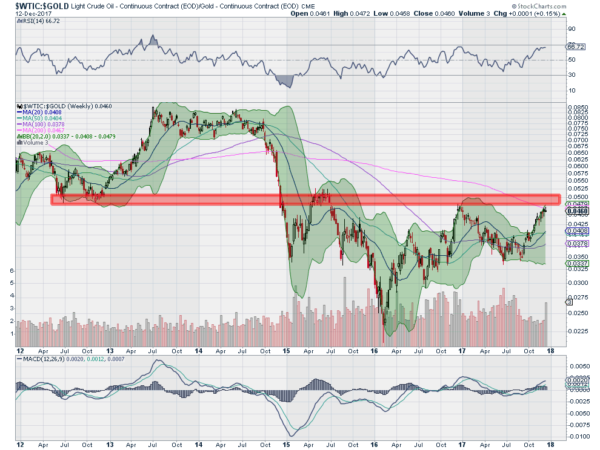

The reason for that is that the ratio between Oil and Gold prices is about to pivot. After the drop in Oil prices in the second half of 2014, the ratio of Oil to Gold has languished. It fell below a key zone that has been support or resistance over the last 6 years. Since then it has tested that are twice and fallen back. Now it is there a third time as it rises.

Prospects for the ratio to move back over this key range are good. As the ratio rises momentum is also rising. The RSI is deep in the bullish zone with the MACD positive and rising. The ratio is also crossing its 200 day SMA for the first time since the Oil crash in 2014. This sets up to be a major flip in the Oil to Gold ratio.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.