The average American investor holds a diversified portfolio of stocks, and their government holds a diversified portfolio of debt-funded wars.

The horror in Gaza will likely become regional, but by then it may already be overshadowed by US neocon meddling in the China Sea going “off the rails”.

Got Gold?

The key weekly gold chart. The hefty consolidation of the 2020 breakout appears to be ending. Also, gold is typically strongest during the November to February timeframe, and this joyous season begins now.

The short-term gold chart. The $2000 price is a big round number and gold has rallied from my $1810 “All bugs buy zone” with almost no pause.

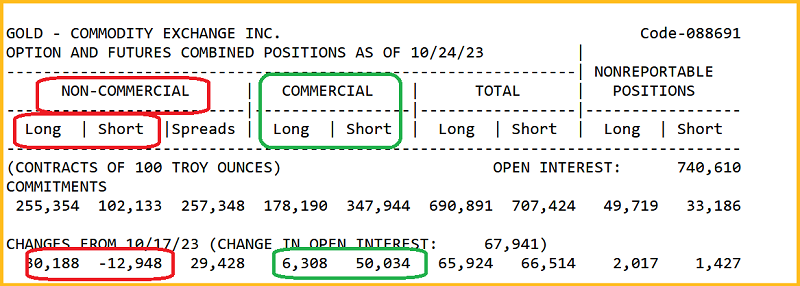

Commercial traders are piling on short positions and my suggestion has been for gold stock enthusiasts to book partial profits but only.

On individual miners that are showing 20%+ profits.

It’s not a top call, but the commercial trader's track record is strong, and no investor loses money by booking great profits

The rally in rates has stalled and a potential H&S top is forming.

There’s significant resistance at 5%-5.25% on the long-term chart and that zone is also targeted by the Fed as a likely peak.

Interestingly, tomorrow features the Fed’s interest rate decision and an important speech from Chair Jay.

The DXY dollar index mirrors the US rates chart; the rally has stalled, and while there could be a push to 108 on a final hike from Jay, the next big move is likely a drop to 103.

After hitting my $93 profit booking zone, oil has formed a loose H&S top pattern and…

The neckline broke yesterday. A drop in the price of oil would likely indicate failing global growth and perhaps a lull in the numerous wars that are promoted by deranged US government workers.

Still, US GDP growth remains decent (albeit mainly because of $2 trillion in fresh government debt). That means Jay could still do a “one-and-done” hike tomorrow.

A hike would fit with a final 10-year rate push to 5.25%, a gold pullback to $1950-$1930, a drop for oil, and more losses for the stock market.

Gold bugs who bought gold, Silver, and/or miners at $1810 won’t be bothered by a tiny pullback to $1950.

Regardless of whether it’s a fiat rate hike trick or a golden Halloween treat from Jay, the next big move for gold is likely a rally to $2200, route to $2480.

What about silver? There’s a nice inverse H&S pattern on the silver chart now, and it suggests gold could make it to $2080 before there’s a more significant dip.

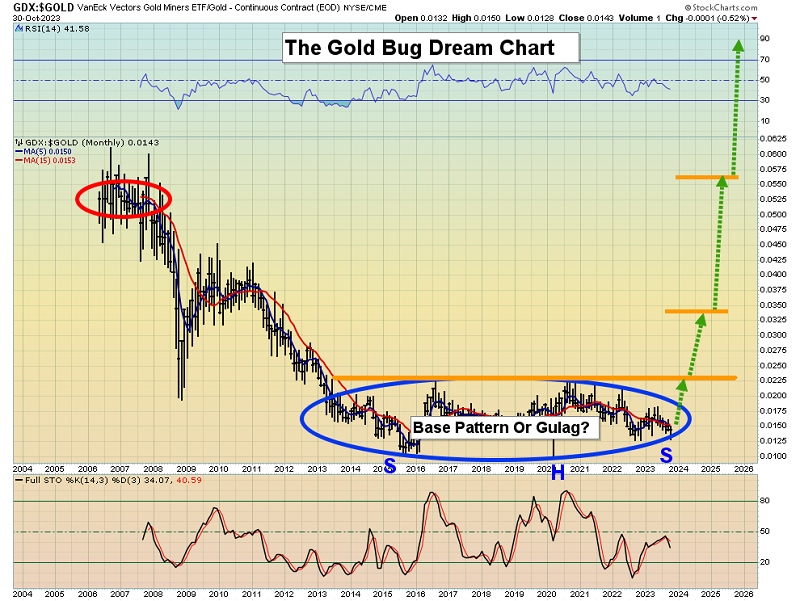

For some gold stock bugs, the dream of miners permanently outperforming gold has perhaps become more of a gulag than a dream.

Is the situation set to change? Well, the massive inverse H&S pattern suggests that it will, and soon.

The short-term (NYSE:GDX) chart. On the one hand, GDX has again failed to take out a recent high ($30 in this case) while gold pushes through its equivalent high ($1985) with ease.

On the other hand, falling oil, especially relative to gold, is going to help drive down the all-in-sustaining costs for the miners, and the end of the current hiking cycle is likely to play a very helpful role.