Key Points:

- 100 day EMA and 38.2% Fibonacci level should encourage a reversal.

- Potential Gartley pattern looks like it is taking form.

- Both medium and long-term trend lines likely to be respected.

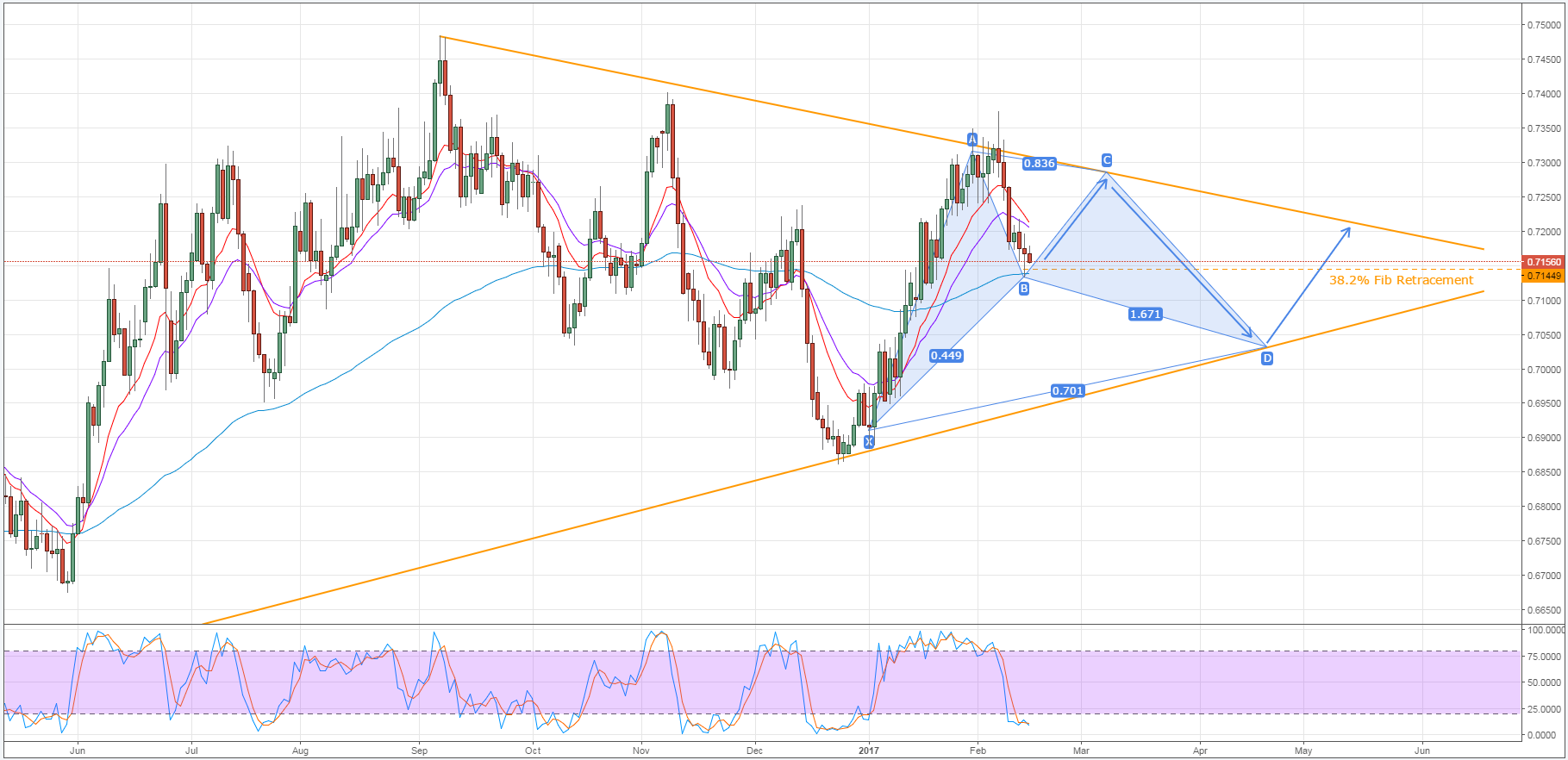

The kiwi dollar should be hitting a reversal point in the near future but this could simply be a set up for an even larger tumble in the weeks beyond. Specifically, a combination of technical signals are hinting that the recent downtrend may need to take a breather around the 0.7144 handle but a developing Gartley pattern could subsequently smack the pair significantly lower in the long-run.

As is shown below, the kiwi dollar ultimately failed in its recent bid to push beyond the confines of the medium-term declining trend line. Consequently, it has been hammered by the recent resurgence of the greenback and has sunken back to support. However, this spate of losses could be about to reverse as a near-term bottom seems to have been found if the stochastics are anything to go by.

Additionally, the bears seem to be having some difficulty breaking through the 38.2% Fibonacci level around the 0.7144 price. In part, this is due to the positioning of the 100 day EMA which is supplying some dynamic support around this level. However, the configuration of the 12, 20, and 100 day moving averages also reveals something else. Even with the recent slew of losses, the NZD retains an overall bullish bias.

As a result, rather than seeing an unbroken slide all the way back to the long-term ascending trend line, we could instead see the pair have another rally in the near-term. If this occurs, the price action would form the majority of a fairly convincing Gartley pattern which could subsequently generate a rather sizable decline in the medium-term.

This decline should end around the 0.7030 handle which represents the intersection of the final leg of the Gartley pattern and the long-term trend line. This level is likely to hold firm once again in the absence of some strong fundamentals and, if it does hold, a reversal should occur. Whether or not this push higher will have the support to break above the descending trend line is currently not clear but, given the narrowing of the pennant, it is not entirely impossible.

Ultimately, keep an eye on this pair as there is plenty of movement on offer which should mean it’s an interesting few weeks of trading. Moreover, whilst the technical bias is looking fairly clear, don’t neglect the fundamental side of things, especially when the kiwi dollar reaches a potential turning point.