Gold has always been controversial. Is it a hedge against inflation? Is it a store of pure value? Is it a safety play when there is world turmoil? Or is it just good for jewelry? You could have a heated argument on any one of these points and never dissuade your challenger from his opinion. What is clear though is that the price of gold moves on emotion.

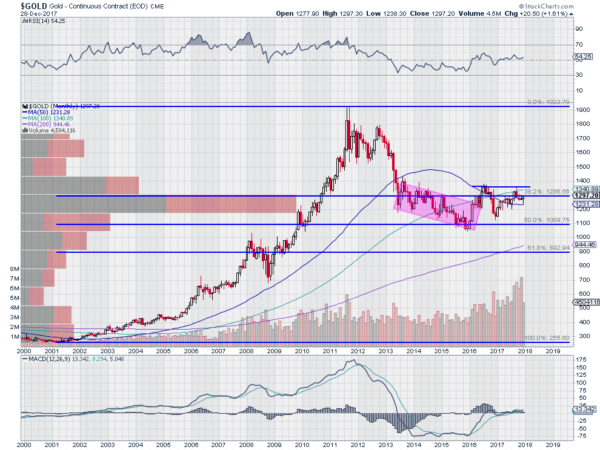

The chart below shows the price of gold on a monthly basis over the last 17 years. I have chosen to start at 2001 as this was the beginning of an extraordinary bull-market run for gold. For 10 years the price did nothing but go up. You saw geniuses minted on this run just for buying and holding gold. Many have shown their lack of genius over the last 5 years as they continue to profess gold's greatness as it falls in value. But for 10 years it's been nothing but up. Your favorite actors went on television and tried to sell you rare gold coins. Shops popped up at the mall that would buy your gold jewelry. It was a bit of a frenzy.

And then it ended. On the chart, this is signaled by a Tweezers Top, the two candles with long upper shadows in August and September 2011. The price action morphed into a sideways consolidation at first, and continued that way into early 2013. It dropped then and continued lower in a channel for 3 years. This resulted in a 50% retracement of the 10-year move higher. Then in 2016 the price broke above the channel. It continued higher to the 38.2% retracement level and stalled as it moved over the 50-month SMA. A pullback from there found support at a higher low and it has moved higher in 2017. Ending the year it is approaching 1300, a nice big round number, between the 50- and 100-month SMAs, bouncing in that range.

Prices To Watch

Volume has picked up dramatically in 2017 and yet it has not resulted in a major move either way. The price history between 1175 and 130 dwarfs all other areas. there is clearly a major battle between buyers and sellers in this range. Momentum indicators give no clue as to which will win out. The RSI is flat at the mid line while the MACD is flat at zero. We will have to wait and see if gold falls again, dropping below 1175, signaling its death. Or whether buyers gain control and move the price over 1370 to a higher high, confirming a renewed uptrend. Until either happens, gold is a trading vehicle in a range.