So far this year, the overall market has traded with a significant amount of resiliency. Despite ongoing uncertainty from Europe, weak manufacturing data from China, and growth concerns in India, equity prices have continued to advance.

This is a welcome shift from last year’s environment of constant shifting between “risk on” and “risk off” – with few trends, sector differentiation, or sustained trade opportunities. Today’s Teflon market (bad news doesn’t stick) makes sense as managers scramble to keep up with benchmarks, and its not surprising to see high beta names being accumulated.

While two weeks ago we had the “official” start to earnings season, this week earnings reports are picking up momentum with dozens of names reporting each day. The information flow gives us a good chance to evaluate both fundamental and sentiment strength.

The key in this environment is to look at not only the data being reported, but more importantly the reaction to individual company releases. Just because a company “beats expectations” doesn’t mean the stock will shoot higher. Management guidance, whisper numbers, product commentary, and a myriad of company-specific items can affect the trading reaction.

Our trading book is now almost exclusively bullish (with a short euro trade as our only bearish position), but we still have a material amount of cash and the ability to use leverage if the environment continues to strengthen. We can shift our exposure quickly if necessary, but for now the reward-to-risk is attractive for adding bullish exposure on pullbacks to support or breakouts from wedge patterns.

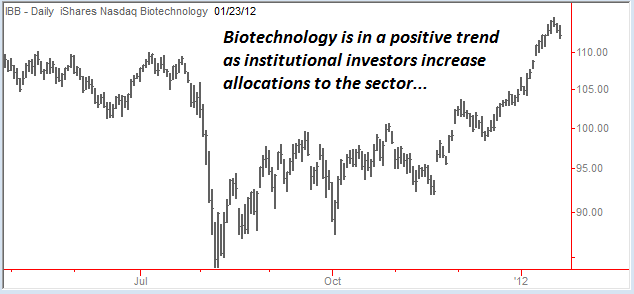

Biotech Benefits From New Technology

The biotech area has been particularly strong over the past few months as advances in technology are creating new opportunities. This weekend, Investors Business Daily ran an interesting piece on “biosimilars” – biotech drugs that are similar to the “live” drugs that are currently in use, but more efficient and less costly to produce.

The FDA has indicated that they will be evaluating this new class of drugs with rulings on particular situations expected early this year. Approvals for particular biosimilars would open both opportunity and risk as the potential for generic reproduction could cut profit margins for legacy drugmakers, while increasing profit for generic firms – or increasing volume due to lower-priced offerings.

So far this year, the iShares Nasdaq Biotechnology (IBB) ETF has been a winner with the group breaking to a new high early and following through on the breakout. At this point, the broad sector is a bit extended and may pull back for a few sessions.

But given the strength over the last several months, a pullback would be more likely to set up a strong buying opportunity barring a major negative announcement from the FDA.

At the beginning of December, we took a bullish position in Biogen Idec (BIIB) as the stock broke out of a tight consolidation. The bullish action has been slow to develop for this position, but as the sector continues to move higher, we are able to tighten our risk point and have a meaningful unrealized profit at this time.

As equities continue to rally, gold and silver prices are starting to come out of their slump as well. The fact that precious metals can rebound despite a relatively strong dollar is a healthy indicator of demand.

Gold prices have recently been associated with a “safety bid” as retail investors and professionals alike have used the yellow metal to hedge against inflation.

But silver prices can have significantly different characteristics. Silver has become much more of a speculative vehicle – rising when managers are willing to accept more risk, and falling during times of liquidation. Part of this price action stems from the fact that silver is both a precious metal AND an industrial metal.

Silver has uses in circuitry, medicine, and other industrial sectors; so as expectations for an economic rebound increase, the perceived demand for silver also grows.

Last week, silver prices rallied sharply and crossed above the key 50 day EMA (Exponential Moving Average). This after the commodity broke to a new low in December and immediately reversed higher. Today, we could see both short covering as well as organic buying driving prices higher – and a consolidation after last week’s action could set up a nice buy point for later in the week.

Building Materials – Following Housing Trend

Over the last few weeks, we’ve talked several times about the positive homebuilder action. Sentiment is shifting in this area as housing starts pick up, prices stabilize, and shadow inventory begins to move.

While home construction stocks may be the logical “first step” to investing in this rebounding area, building suppliers also offer a unique opportunity. The building supply industry is benefiting not only from a strong housing market, but also from a positive farm environment.

Two weeks ago, Tractor Supply Co. (TSCO) gapped to a new high after pre-announcing strong fourth quarter numbers. The company will officially release earnings on February 1st, but the preliminary figures were strong and investors bid the stock sharply higher.

TSCO caters to recreational farmers and ranchers – along with a number of small business clients. Overall rising sentiment for the broad economy has had a positive effect on TSCO’s business, and the company is smaller and more nimble than heavyweights in its industry. This puts TSCO in a better growth position – making the company attractive to growth managers and institutional investors seeking “high beta” exposure to the construction / machinery industry.

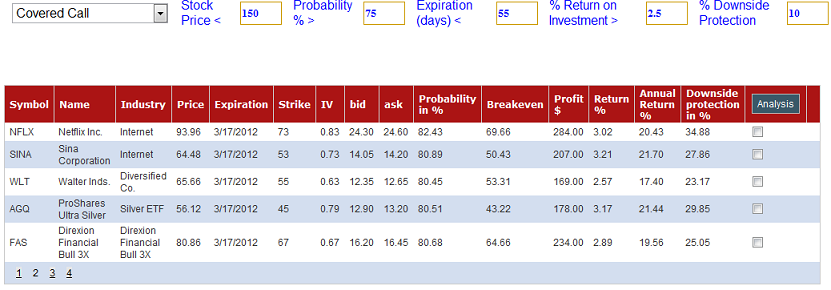

Options Spotlight

Our screen from the Mercenary Options Dashboard turned up an interesting setup for this week. The ProShares Ultra Silver (AGQ) has a very attractive buy write opportunity that provides nearly 30% downside protection while still yielding more than a 20% annualized return.

Obviously, silver prices have been more volatile lately (hence the attractive option premium). But with a bullish environment and silver breaking through resistance levels, the reward to risk looks extremely positive.

According to the screen, traders can buy AGQ and sell the March 45 calls against the ETF for a nominal return above 3%. The expected breakeven point would be $43.22 – roughly allowing for a 30% drop in the ETF before the position turns negative.

With our cash position relatively high, and our perspective turning more bullish, this looks like an attractive place to park some capital as we continue to scout for attractive swing trade opportunities.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

A Day Late and a Dollar Short

Published 01/25/2012, 05:00 AM

Updated 07/09/2023, 06:31 AM

A Day Late and a Dollar Short

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.