I’m serving up answers to three key questions (and a tad more) in this week’s Friday Charts edition:

- What could Bitcoin (BTC/USD) and the Chinese yuan possibly have in common?

- Have hedge fund managers lost their mojo forever?

- Was earnings season really that good?

Since it’s Friday, I’ll let the pictures do most of the talking. Enjoy!

Things That Go Bump in the Night

Earlier in the week, Bitcoin suffered a devastating blow when the most prominent exchange, Mt. Gox, literally went poof in the night, along with investors’ fortunes.

The turn of events sent prices for the cryptocurrency tumbling.

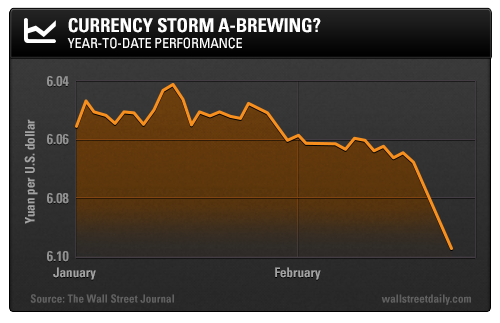

Meanwhile, over in the real currency world, the Chinese yuan also suffered an unexpected setback.

The yuan is usually a predictable, steady riser. Yet it nosedived on Tuesday, hitting a six-month low. This is the first time the currency demonstrated any material weakness versus the U.S. dollar since 2012.

As Edmund Harriss, Fund Manager at Guinness Atkinson Asset Management, said, “China’s Central Bank is reminding us all that the stronger currency is not a given in the short term.”

Indeed!

For years, going long the yuan has been a sure thing. Since 2005, the currency is up 33% with most of those gains coming in the last couple of years.

While it’s highly unlikely that the Chinese government will let the currency drop substantially, it appears “the era of steady appreciation may be drawing to a close,” says Binqi Liu, Portfolio Manager at HSBC Global Asset Management.

Or, more simply, the easy money trade is officially over.

Don’t Let Your Kids Grow Up to Be Hedge Fund Managers

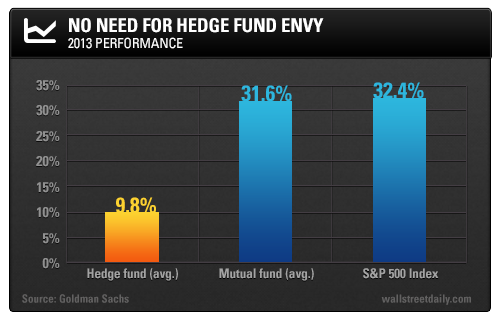

It’s official. After lagging the S&P 500 for much of 2013, the average hedge fund manager completely blew it.

Forget failing to outperform the stock market. They even failed to outperform lowly mutual fund managers.

Keep that terrible performance in mind should you receive any glossy advertisements aimed at enticing you to invest in an “exclusive” fund.

Yes, hedge funds can market to the masses now. And after last year’s showing, they’ll be looking for some new, accredited “suckers.” Don’t become one.

You stand to do much better by simply investing in a no-hassle, low-cost stock market ETF like the SPDR S&P 500 Fund (SPY).

A Turnaround in the Coal Patch

Fourth-quarter earnings season is pretty much over. And after all the bellyaching early on over the terrible stats, the final tally pretty much put all the fearmongers into hibernation.

A solid 61.9% of companies beat earnings expectations. What’s more, 63.8% of companies beat sales expectations, which represents the strongest revenue “beat rate” since the second quarter of 2011.

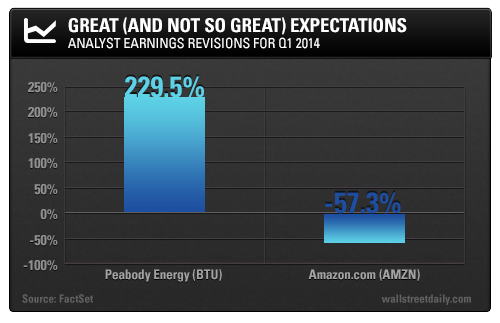

Of course, based on these past results, analysts quickly updated their future expectations. And that’s where the two most shocking earnings-related stats materialized.

I’ve been the lone contrarian on the coal patch for quite some time. But it appears a turnaround is finally materializing. (You can check out Oil & Energy Daily’s coverage of coal.)

For the second quarter in a row, Peabody Energy Corp. (BTU) torched expectations, which prompted analysts to raise first-quarter expectations by a staggering 229.5%. That’s the largest upward revision for all S&P 500 companies.

On the other end of the spectrum, online retailing giant, Amazon.com (AMZN), suffered the largest downward revision. Trade accordingly. That is, if you’re brave enough to be a contrarian.