Data returns front and centre this week in Canada. Two reports will most likely capture the market’s attention: the May inflation report and April retail sales.

First, the market expects a slight uptick in headline inflation (0.9% YoY) following the deceleration to 0.8% YoY from 1.2% prior. The rise in the headline figure reflects the pickup in prices after the impact of the oil shock has waned. Still, market participants expect core inflation to moderate in May, reflecting in part the impact of the surge in CAD in early Q2 and the negative output gap.

Retail sales will also be closely watched given the BoC’s hopes of a growth revival in Q2 and Q3. The market expects a slight downtick in the data to 0.5% MoM from 0.7%. The report should continue to support our view that the economy is growing but the recovery should lag the BoC’s lofty expectations.

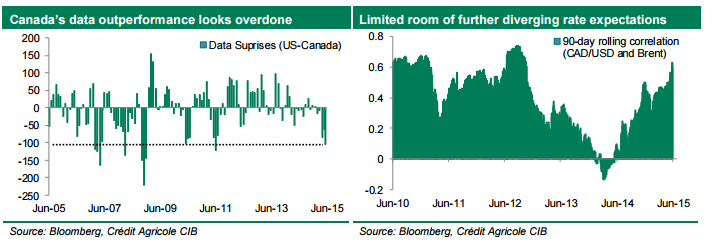

While Canadian data surprises have outperformed US surprises, we still expect the US to see its output gap close faster than Canada’s, supporting policy divergence (and rate spreads) between the Fed and BoC. For now, USD/CAD continues to track coincidental drivers closely but we think a shift in high frequency data and soft oil prices should push the cross higher.

CA maintains a short CAD/CHF position from 0.7675, with a target at 0.7180, and a stop at 0.805.