- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

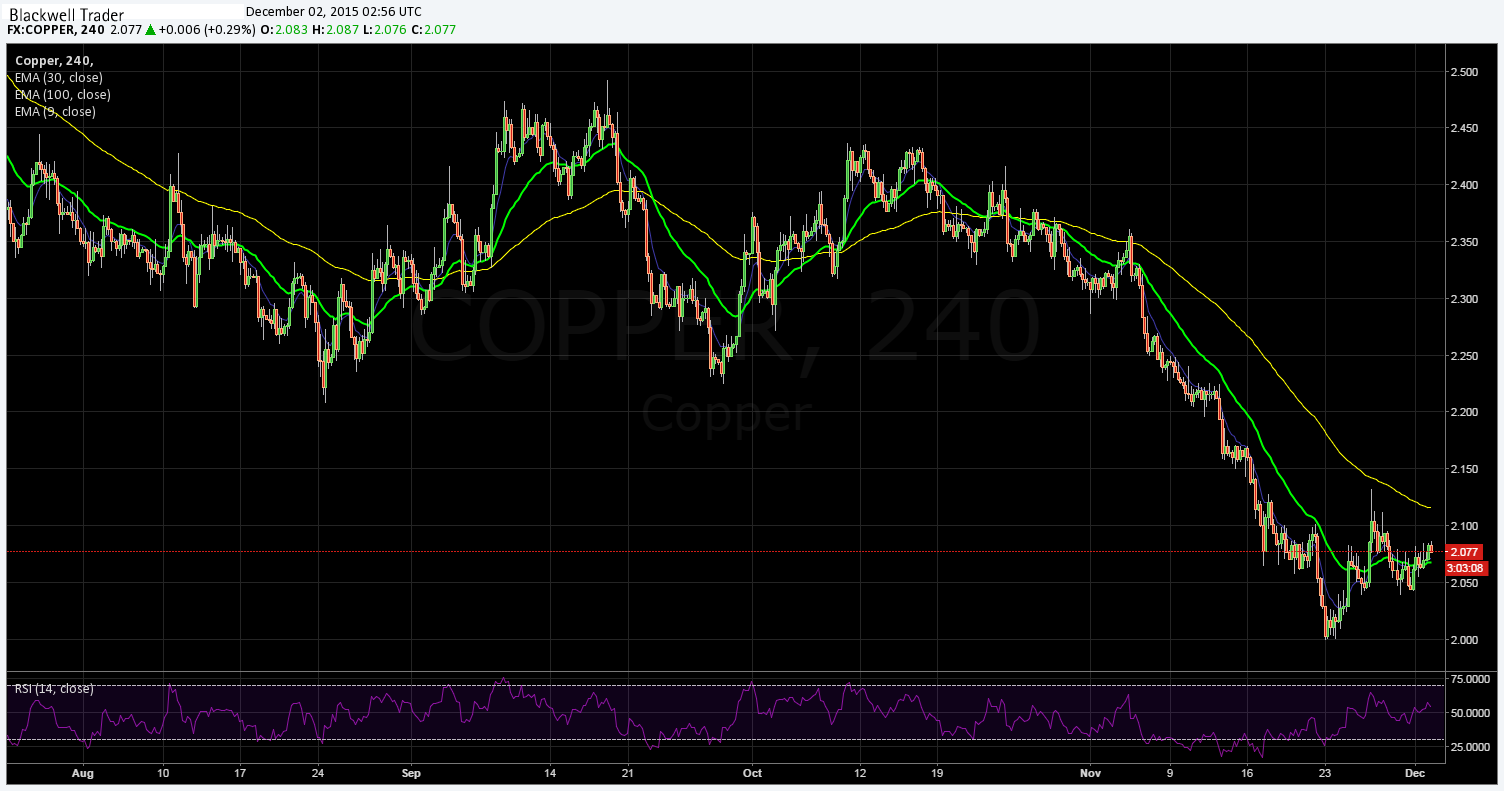

Copper Bottom Still Nowhere In Sight

2015 has been a relatively down year for copper prices as a combination of slow growth in supply and diminished demand have ravished the commodity. However, despite a relatively static level of supply, prices continue to decline and many are now asking what lays ahead for the industrial metal.

Over the past year, copper bulls have continued to point towards a rebalancing of equilibrium for the metal and the fact that significantly lower prices would eventually cause some mines to shutter their operations. However, 2015 has seen copper prices decline over 20%, whilst supply has actually seen a small increase. Subsequently, global copper prices have remained under significant pressure and the implications of the current over-supply are likely to remain in place for the near future.

In fact, the potential for an imminent increase in supply growth is a significant concern to copper markets. During the copper boom period, large CAPEX programs were undertaken with the expectation of expanding demand. These capital investments are now nearing fruition and could place a significant strain on an already over-supplied market. Based on the current known CAPEX programs, there is potential for at least another 1.4mtpa to enter the market by the end of 2017.

Much of the modelling undertaken within the copper industry has presupposed that this additional supply would be absorbed by growing Chinese demand into 2017. However, given the recent concerning growth indicators emanating from China, that assumption must be questioned. This is an especially prescient point given the economic transition that is occurring within the Asian powerhouse’s domestic industries towards more service based endeavours. Although that pivot is likely to take the better part of a decade, growth in copper demand from China is most definitely not assured.

In fact, modelling undertaken by Goldman Sachs) points to an increasing divergence between supply and demand. Despite evidence that some rebalancing is occurring within inventory stocks and the lack of visible refined metal, much of the stock is currently being held back in concentrate and SRB inventories. This means that those often under-reported stockpiles will continue to grow as global macroeconomic and inflationary conditions remain lacklustre.

In conclusion, growing supply capacity will continue to put copper prices under pressure despite the potential for moderate gains in demand. In addition, much of the current pricing modelling is predicated upon a strong Q4 result from China, of which I possess little conviction. Subsequently, I disregard many of the current analyst opinions pointing to a pricing range around the $4,800/t level by year's end. Instead, given the likely depth of the Chinese domestic slowdown, coupled with additional productive capacity, my modelling points towards pricing around $4,000/t by the close of Q1 2016.

Related Articles

Oh man, can President Trump’s leadership move markets. President Trump’s deal-making and negotiating skills are changing the hearts and minds of world leaders as he leaves his...

Gold Gold (XAU/USD) continues to hit heavy selling pressure on every rally, as we established a week ago. Yesterday we collapsed to support at 2904/00 but longs were stopped...

Energy prices are under pressure amid demand concerns and improving prospects for a Russia-Ukraine peace deal. But tariff risks continue to hit metal markets Energy-WTI Below...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.