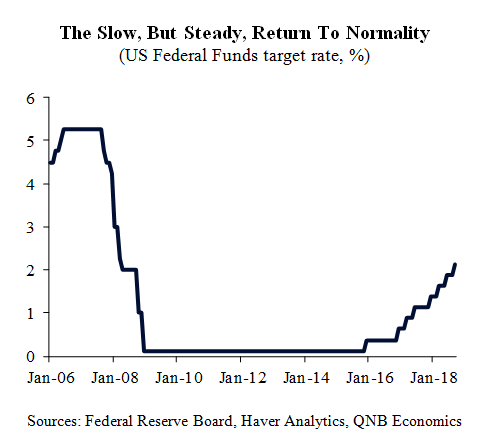

The US Federal Reserve, widely known as simply ‘the Fed’, duly hiked short-term interest rates by 25bp for the third time this year following its 26-27th September meeting. The decision comes despite the continued escalation of trade tensions between the US and China.

With the decision to lift interest rates for an eight time since December 2016 to 2-2.5% a foregone conclusion, the Fed continued confident about the need for further tightening, probably as soon as December.

Both the policy statement accompanying the decision and Fed Chair Jay Powell’s remarks in the post-meeting press conference signalled that the Fed remains unusually bullish in its assessment of the economy and for the time being sees little impact on the economy from trade tensions.

Accordingly, the Fed strongly signalled its resolve to press on with its well-established policy of delivering a steady drip feed of interest rate hikes until short term interest rates get to at least the 3-3.25% zone that it regards as being the economy’s likely ‘neutral’ rate, if not even a tad higher.

In terms of the policy statement, one important development was that long-standing language referring to the stance of policy as being ‘accommodative’ was removed. This change probably should not be over interpreted however. After eight rate hikes, the level of interest rates is clearly becoming more normal and the additional rate hikes that the Fed expects to deliver will further normalise policy settings.

The outlook for continued slow, but steady, interest-rate hikes was also confirmed by the Fed’s rate updated forecasts for the policy outlook – the so-called ‘dot plot’. These continue to show that the median, or average, expectation of the Fed’s rate-setting committee is for one further 25bp rate hike by the end of this year, a further three rate hikes in 2019 and than one further rate increase in 2020. If delivered, these further five quarter point rate moves would lift the Fed’s short–term interest rate to 3¼-3½%; slightly above their current best estimate of the economy’s neutral short-term interest rate.

While these forecasts are, in reality, little changed from the Committee’s previous views, the confidence with which they are held appears solid. This is important given the emerging downside risks to the US economy from the escalating trade war between the US and China.

Despite the US imposing tariffs on additional $200bn of China imports since the Fed’s last meeting at the end of July, there was still no mention of the risks to the economy from the trade war in the Fed’s policy statement. Fed Chair Powell also emphasied the absence of trade tensions so far in his press conference. He stressed thatFed is ‘not seeing it yet – we just aren’t and we are watching really closely.'His overall tone remained bullish, emphasising repeatedly that ‘our economy is strong.’

With the US economy seeming on course for back-to-back quarters of 4% annualised GDP growth, small business and consumer confidence either at, or near, 50 year highs and trade tensions yet to bite, the bar to deflect the Fed from its intended course would seem to remain unusally high.

The Slow, But Steady, Return To Normality

(US Federal Funds target rate, %)

Sources: Federal Reserve Board, Haver Analytics, QNB Economics

The Fed’s confident and increasingly uncluttered approach to monetary policy under Chair Powell is exemplified by the increasingbrevity of itspolicy statement. Excluding the roll call of how various members voted, the latest statement was cut to just 252 words. This is down nearly 500 words at the same meeting a year ago and is only around one third of the length of the bumper September 2014 statement which clocked in at 748 words. Less is increasingly more for the Powell Fed it seems.

For global investors, there are perhaps two stand out conclusions. First, the unprecedented decoupling of US monetary policy from most other developed economies, especially the euro zone and Japan, looks set to continue. While the European Central Bank looks on course to end its bond-buying programme this time next year, any tightening of policy in the euro zoneremains unlikely before 2020, at the earliest. Tighter policy continues to look even further away in Japan where CPI inflation’s failure to pick up ensures that the Bank of Japan remains fully committed to further quantitative easing.

There is therefore a real possibility that the US rate hiking cycle may have finished in early 2020 before those in Europe and Japan have even begun. This unprecedented asymmetry should keep the US dollar firm against both the Euro and particularly the Japanese yen in the coming months as interest-rate spreads, especially at shorter maturiries, continue to move in the US dollar’s favour.

Second, the continued drip feed of US interest rate hikes and a firm US dollar will ensure that global liquidity continues to tighten. Emerging markets with external financing requirements, who have already been under acute strain in recent months,are therefore unlikely to see much respite any time soon. They look setto remain under continued pressure to raise their interest rates in response to rising US rates to staunch capital outflows and defend their currencies. For its part the Fed has made clear that emerging market volatility cannot deflect it from its domestic policy goals. All in all, rumours of the US dollar’s demise continue to be exaggregated in our view: a strong US dollar looks here to stay for the foreseeable future as the Fed carries on hiking.