NutriSystem Inc (NASDAQ:NTRI) stock had a rough day in the market on Tuesday February 27. Shares dropped -21.55% and closed the day at $31.3. They're now trading 53.94% below their 52-week high of $67.95.

With today's big drop, Nutrisystem now has a market cap of $941 million. That makes it a small cap company.

The business operates in the commercial services industry and employs 487 people. Its shares trade primarily on the NASDAQ stock exchange.

Nutrisystem has 30.05 million shares outstanding and 8.71 million traded hands for the day. That's well above the average 30-day volume of 686,608 shares.

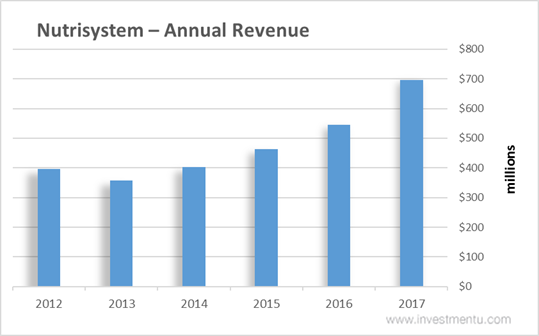

Over the last five years, Nutrisystem's revenue is up by 75.61%. You can see this growth in annual revenue chart below...

In the last year alone, Nutrisystem's revenue has grown by 27.78%. That's a solid sign for Nutrisystem stock owners.

We like to invest in companies that grow their sales. A growing top line is a sign of a healthy business.

For now, Nutrisystem will continue to pull in revenue. So let's take a closer look at the company's total financial health. And the best way to do that is by looking at its balance sheet...

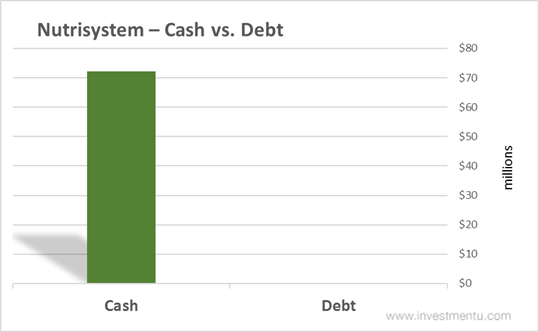

Nutrisystem's cash comes in at $73 million and the company's debt is $0 million...

Nutrisystem's cash pile is larger than its total debt. The company is financially sound for now and can take on new projects.

What is Nutrisystem Stock Worth?

Let's look at a few key ratios to determine the value of Nutrisystem stock…

Price-to-Earnings (P/E): This is one of the most widely used metrics and it comes in at 16.47. That's a reasonable level and generally, the lower the better. Investors will bid up stock prices and in turn, P/E ratios, when they expect future earnings to grow.

Price-to-Book (P/B): This ratio is a cornerstone for value investors. A lower number here indicates a better value play. And at 6.93, Nutrisystem looks reasonable… but P/B varies greatly based on the industry.

These two metrics are a great place to start when valuing a company... but your analysis should go much deeper...