In a previous series of energy-related articles, I discussed how the resurgence of natural gas would give us a solid alternative to oil for transportation energy needs. In addition, natural gas will also provide us with additional supplies of petrochemicals to offset the world's insatiable demand for them and their end products, which includes just about everything you might currently purchase at Walmart.

The gas shale boom has come along just in time to offset declining cheap oil supplies and offer the U.S., in particular, the enviable position of net energy exporter of the future. Those who have excess energy tend to have stronger and more resilient long-term economies.

In addition to boosting our prospects of economic stability based upon a solid foundation of domestic energy supplies, the boom in natural gas and oil production in the United States provides investors with many potential choices for stock appreciation and dividend plays.

In this series, I will present some companies across the natural gas sector that may profit investors handsomely for several years. I'll begin by discussing a midstream energy company, Plains All American Pipeline, LP (PAA), and will weigh benefit versus risk.

Foundation

Plains is a vertically integrated oil and gas midstream company providing facilities, supplies and logistics, and transportation.

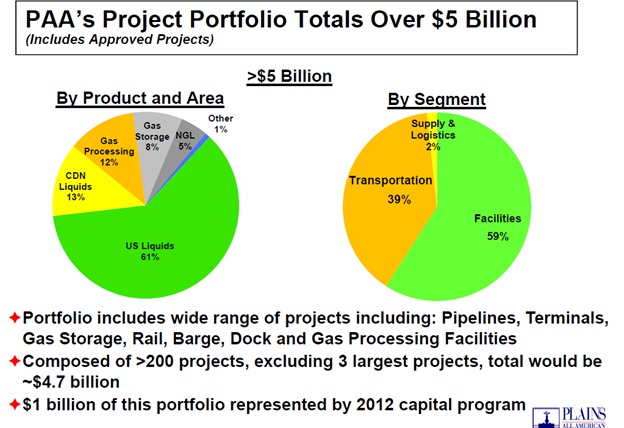

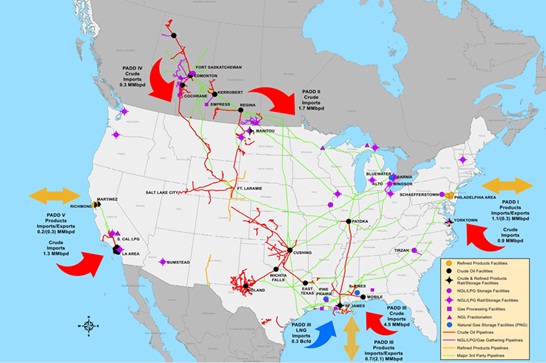

The company sports over $5 billion in portfolio across a range of assets. The company has over 19,000 miles of pipeline in North America as its largest transportation asset, and is beefing up rail transportation to address short term shortages with $1 billion in rail depot projects in the last several months. The segment also includes trucks, trailers, and barges.

Facilities provide storage, terminals, and throughput services for oil, natural gas, LPG, and refined products. The segment also offers LPG fractionation and processing of natural gas.

Supply and Logistics purchases product and resells it at the other end of their transportation networks.

Plains dropped down its natural -as storage into a separate LP, PAA Natural Gas Storage (PNG), which I will discuss in a future article.

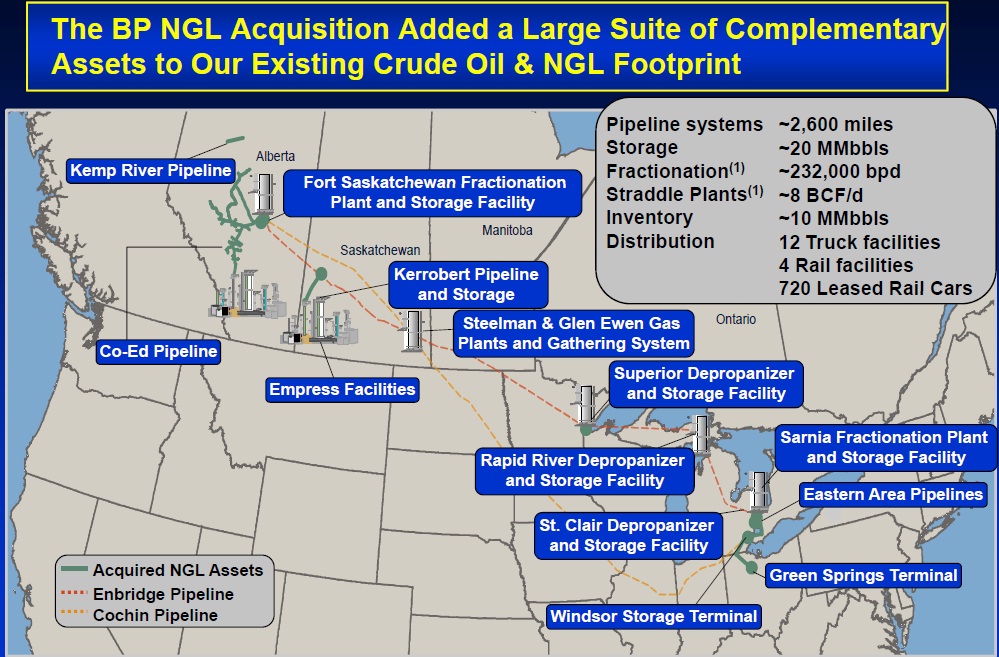

The recent purchase of BP's Canadian NGL assets provides Plains with an opportunity to process and transport those products in Canadian to U.S. markets, as well as using the infrastructure for moving other refined products that capture higher premiums on the market. Plains management expects their retail approach to raise margins on these former assets which BP used primarily for internal purposes.

Outside of the BP purchase, Plains has concentrated on expanding pipelines, storage, and rail at existing sites to take advantage of local market knowledge while reducing the risk of asset under-utilization. Plains management has positioned assets in active and sizeable oil and gas plays that should allow smooth monetization and provide solid returns for investors.

The approach to Plains' expansion is a solid one with real gains seen in each business segment. I believe that Plains business model closely aligns with growth in the oil and gas segments, specifically in pipelines and rail to markets and in fractionation of natural gas liquids. The company has a forward-thinking market approach and has appeared to spend their money wisely given current market trends.

Business Risk

In keeping with my risk-based approach to investing, the following is my analysis of the risks that Plains All American Pipleline faces in the market.

First, the recent expenditures in rail appear to alleviate the near-term shortage of transportation needs to various markets. However, pipelines have a higher return over time and the industry is expected to invest very heavily in pipelines that will compete in some areas directly with Plains rail expansion.

Determining what competition will arise is difficult as future demand volumes are in many cases difficult to predict accurately. Some of Plains’ rail may compete with pipelines and receive lower margins while some of it may sell at a premium due to lack of alternatives in the area. This is a chance that investors must take in assessing any of the midstream energy companies. Generally Plains has added rail where large pipeline alternatives do not exist to mitigate this risk, but it should not be expected that this scenario will hold true for all Plains future projects.

One mitigating factor for the rail projects is that pipelines face political and environmental challenges that rail has tended to avoid thus far. Another is that pipelines are very costly, and rail can more quickly be implemented to support current market demand waiting on pipeline build out.

Because U.S. natural gas infrastructure is woefully behind, my instinct is that Plains will be fine. The rail expansion serves critical market needs and is profitable now. Likely it will be years before pipelines catch up to market demands and they may never meet all localized requirements for oil and gas products by themselves.

Another risk for companies structured as MLPs are that most profits are distributed to the investors. As such, most expansion projects, being CAPEX intensive, are financed by share dilution and debt. Therefore, debt grades for PAA are one step above speculative. But I feel this rating is a bit misleading for those who understand how the sector operates in the long run.

Normally I would warn away from companies that have relatively low operating margins and high debt levels, but in the case of energy MLPs I make an exception. I do not see many scenarios in a normal market hungry for grid power, transportation alternatives to rising oil costs, and cheap petrochemicals where income drops significantly for Plains and similar MLPs. Natural gas serves as a hedge for the trend of expensive oil and its byproducts and both products will experience strong demand.

Plains' assets should be slowly and methodically be monetized by the market. In addition, Plains targets a near 50-50 debt to equity ratio in order to keep finance options balanced. Too much share dilution will reduce distributions while too much debt may scare away lenders and investors wary of future liquidity issues. The financing balance targeted by Plains management has appeared to work as planned so far.

Plains' profits are fairly immune from market prices for oil, gas, and refined products because the company mostly operates as a toll road charging fees to various companies for transportation of the fuels. Certain parts of the company income including liquids re-sales, storage, and fractionation fluctuate by demand for a given product. Those portions of the Plains portfolio, however, make up a minority share of the income stream for the company. Profits and distributions should remain fairly consistent and independent of market prices in a normal market.

Taxation

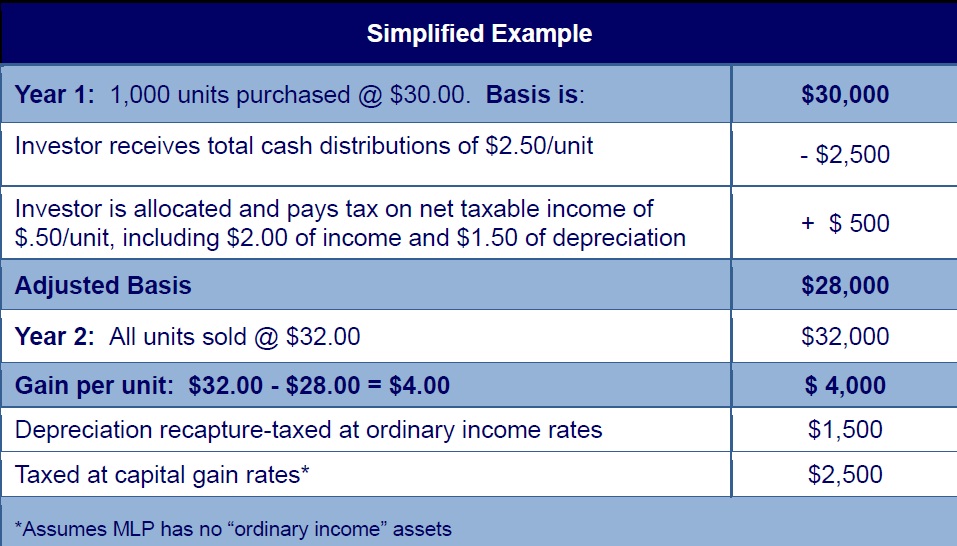

One thing that must be mentioned with Master Limited Partnerships is that taxation for investors is treated differently by the IRS. Because income is not taxed twice, but passed down to investors, some of the income received from investment will be taxed at ordinary income tax rates and some will be taxed at capital gains rates.

The National Association of Publicly Traded Partnerships has provided an easy to understand example of how MLPs are taxed.

Taxes are assessed yearly on net income per unit owned (which equals income minus depreciation taken by the partnership). A K1 will be issued to each investor for their yearly taxes which details what is taxable. In addition, upon sale of the asset, the investor is taxed yet again. Essentially, any depreciation deducted each year the MLP is owned will be ‘recaptured’ at sale at ordinary income tax rates. Capital gains are applied on the portion of cash distributions owing to growth in unit value.

MLPs offer tax deferral of some taxation, but the taxation of recaptured depreciation at ordinary rates upon sale of the units can more than offset the tax deferral benefits depending on the unit yield (currently at 4.6% yearly for Plains) and holding time.

Since the yield is taxed at the capital gains rate, MLPs which offer consistently rising yields over long time periods offer valuable tax shelters that may offset future ordinary income taxes for some investors. MLPs are a complicated investment vehicle for this reason, and each investor should consult with a tax professional before making any investment purchases to fully understand the tax implications.

Financials

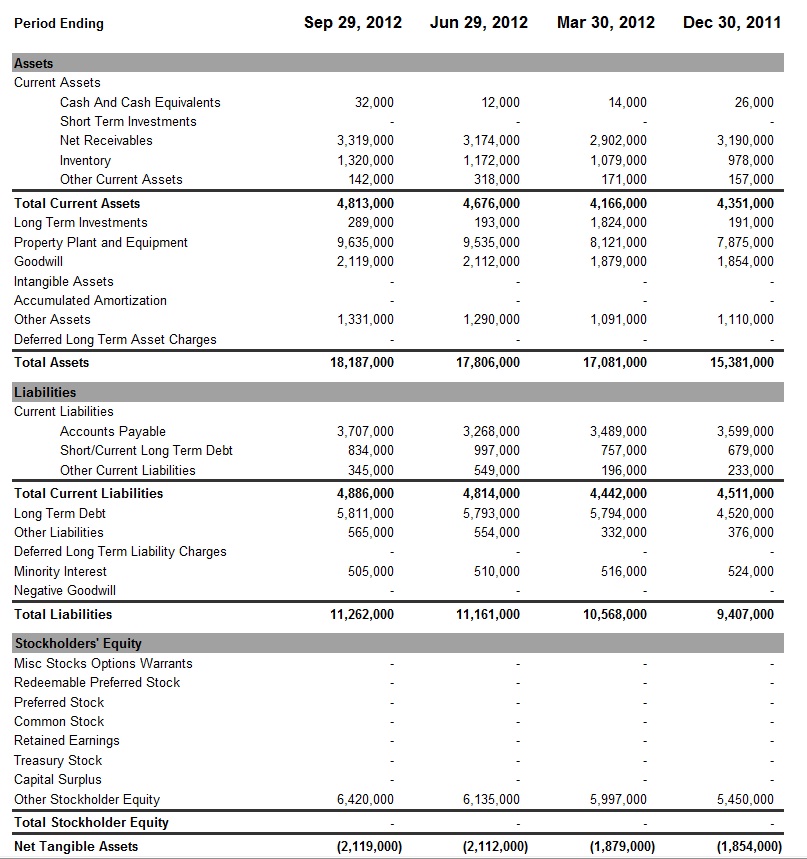

As mentioned previously, Plains has a high debt to account for expansion, leading to a current ratio of 0.99.

Data courtesy of Yahoo Finance

Accounts receivables and inventories exceed accounts payable, but not all current liabilities. Therefore, we know that Plains All American will need to use some future net income to offset these liabilities. The good news is that all assets (minus goodwill) are substantially larger than liabilities. This suggests that Plains has created value through recent investment and will need to monetize developments into positive cash flow over time. Investors should expect operating margin to increase somewhat (beyond Q3 of 4.1 %) due to strategically placed expansion projects and the ability to add value with the BP Canadian NGL acquisition, based upon management guidance.

The most important accounting metrics I look at are Book Value, Price / Book Value, and Enterprise Value EV / EBITDA. The first, currently at 18.65 per share, provides a basement value for the stock in the event several negatives earnings announcements lead the market to a fear of default, and the price drops. If earnings estimates are wrong and income falls precipitously for the company, inventors can generally expect to get something near book value for their stock at least. Plains trades at 2.83 times book ($52.78 price / $18.65 book value) which is not an unreasonable figure, but high for my tastes.

The company trades at a 13.54 EV / EBITDA which is high for any company that I consider buying. It suggests the company is ‘worth’ 13.54 times earnings potential to shareholders and debtors. I usually do not go above a measure of 10 EV / EBITDA.

Note that I am very conservative investor regarding valuations, and I don’t give much thought to competitor valuations in the same market. Too many times I have seen entire sectors become overvalued, rendering this analysis short-sighted and potentially dangerous.

Investors may have jumped the gun on Plains All American, and I would wait for a pullback before entering. Analysts expect Plains to beat earnings on February 6th, and the stock has run pretty high on expectations of extensive future growth yet to occur. Rising income will eventually 1) pay down debt and cause the company to 2) repurchase shares as they have in the past, while 3) raising cash distributions for investors in the process. But Plains is in expansion mode and current valuations shouldn’t be supported in the near term.

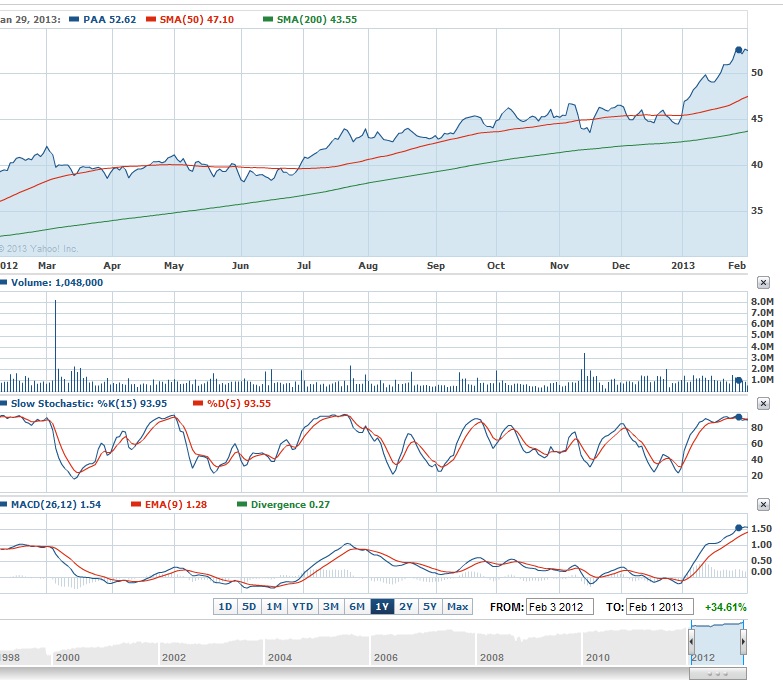

Technical Indicators

The yearly chart for PAA tells us that a slow, orderly climb has been replaced with a hard uptick in anticipation of earning announcements. However, technical indicators such as Stochastic and MACD indicate a leveling off on average volume. Last month’s run wasn’t based upon long-term fundamentals. Even if earnings adhere to predictions, I expect the stock to retest the 50 day moving average around $45 per share. That could be your short-term entry point, a week or two after earnings are announced this week, which will allow reasonable yield moving forward. Long term, I see the stock price leveling off lower than $45 and I personally would not enter into a long position until EV / EBITDA roughly equals a 10 multiple. Investing in MLPs, due to taxation and nature of oil and gas infrastructure build out is a long term proposition.

Investors should consider all factors before placing money on this bet.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

A Close Look At Plains All American Pipeline

Published 02/05/2013, 01:56 PM

Updated 07/09/2023, 06:31 AM

A Close Look At Plains All American Pipeline

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.