People change their mood all the time. It is no big deal. And when they do there can be a range of potential outcomes. One can go from happy to sad or mad or ecstatic or bored. Or any of a million other shades along the way. We all understand that and accept it. So why is it that when a market stops rising we immediately think the only possible alternative is for it to fall?

Markets are not like a ball fighting gravity to escape the Earth’s pull. They are more like humans in their range of emotions. That will make total sense to the behavioral traders. Markets are made up of the emotions and opinions of people so it should not surprise that they can reflect that. It is with that understanding that we should look at the price action in Crude Oil lately.

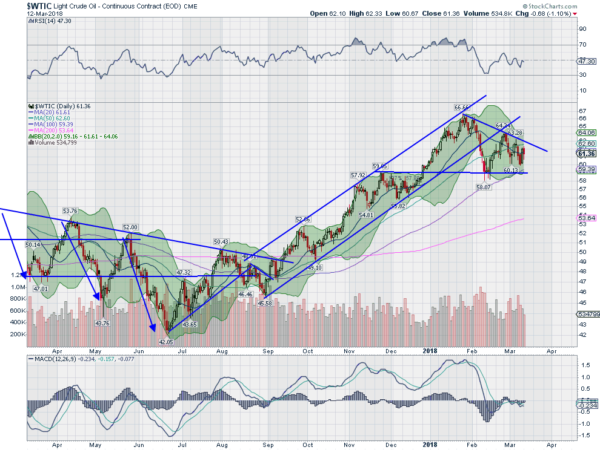

The chart above is the canvas to review. It shows a long rising channel from August 2017 into January 2018. It was then that the price broke below the channel. A shift from bullishness. But was it a shift to bearishness? Many in the media would have led you to believe so. But look what happened. The price found support at a prior high and bounced. Does that mean it was bullish again? Probably not as the price found resistance at a lower high.

So not bullish and not bearish. How can that be? Remember there are a range of emotions for people and markets. And this market is in between bullish and bearish, or neutral. A sideways consolidation. It can always change again to either bullish or bearish. Or it can just keep marking time heading sideways being neither.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.