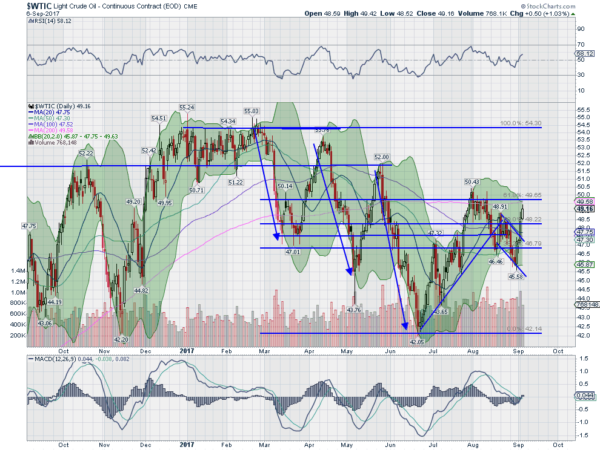

Crude oil has been the subject of much discussion the last 6 months. First it was over OPEC and quotas. Would they come to agreement (yes) and would everyone cheat and produce more than their quota (yes). With the strong supply from the US oil prices seemed destined for a fall. And fall they did. After a top at the beginning of the year near $55 per barrel it fell sharply to $47 in March. It bounced from there but too a lower higher in April. A second drop followed taking oil to a lower low, a downtrend.

The second bounce to a lower high then created a need for one more drop to a lower low to complete a 3 Drives pattern. It did so in mid June, making a bottom near $42. Since then it retraced 61.8% of the 3 Drives at the start of August and pulled back, making another lower high. So far just a continuation of the down trend. It reversed again and fell.

Things started to change though. By making a higher low at the end of August the continuation of the downtrend was put in question. Earlier this week it pushed up through a short term downtrending channel, adding weight to the possibility of a change of character. What would seal the deal for a reversal to an uptrend would be a higher high, over the top near $50 at the beginning of August. Hurricane’s Harvey and Irma may be providing the cover for traders to push it there now.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.