Investing.com’s stocks of the week

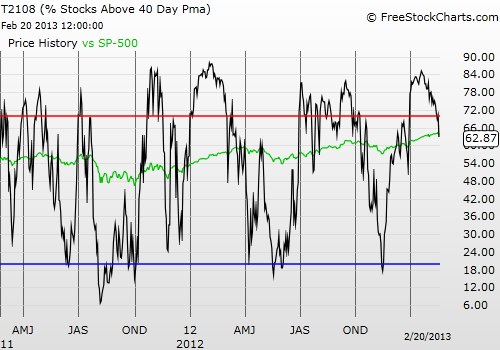

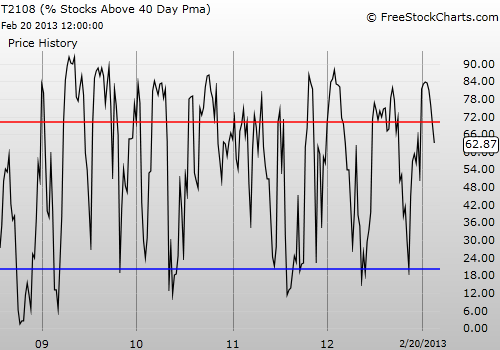

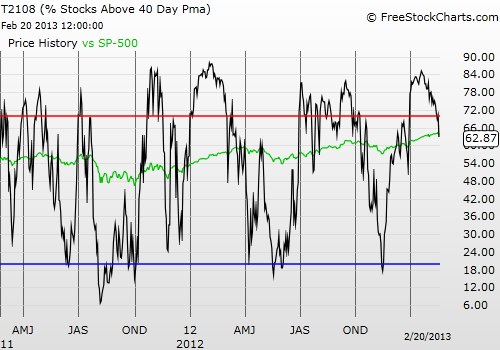

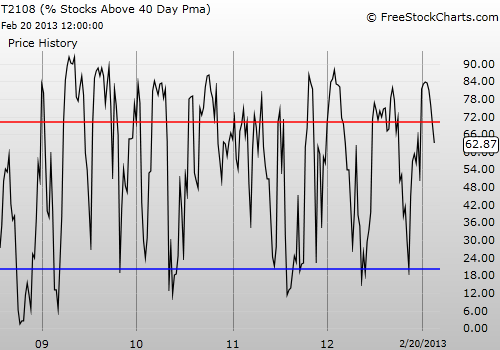

T2108 Status: 62.9% (ends a 1-day overbought period

VIX Status: 14.5

General (Short-term) Trading Call: Sell more longs, initiate shorts if none on-hand.

Commentary

T2108 plunged 10.5%, dropping to levels last seen in December, 2012. Not only did this plunge end a brief 1-day overbought period, it officially seals the history of the 31-day overbought period that began 2013. My decision to choose the aggressive strategy of grabbing fresh SSO puts in the face of Tuesday’s rally has turned into a winner for now.

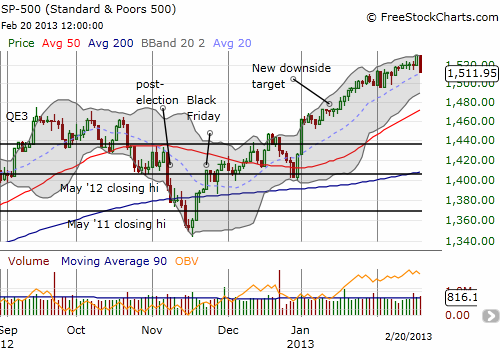

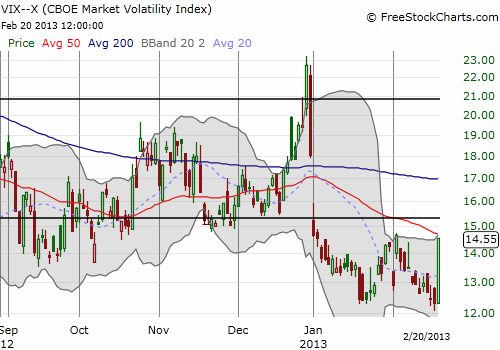

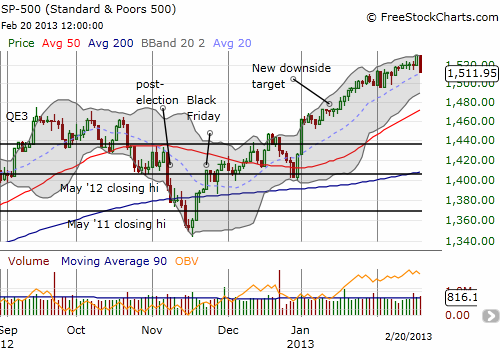

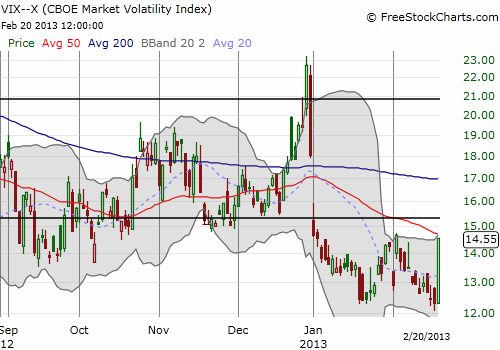

The S&P 500 dropped 1.2%, forming a bearish engulfing pattern. The VIX soared off 7-year lows with an 18.2% gain which put it right back under presumed resistance around 15, a level that has held all year.

The S&P 500 is now resting directly on top of the 20DMA that has loosely defined this year’s gradual yet persistent uptrend. I do not expect this support to fail right away, but if it does, it will all but confirm a correction is underway (and a top is in for now). The bearish engulfing pattern is all the more bearish coming directly on the heels of a 1-day overbought period that followed an extreme overbought period (consider that 1-day overbought period a fake-out).

Similarly, the VIX’s rise yesterday was awesome to behold, but it must break through the 15 level to signal that a “real” correction is likely underway.

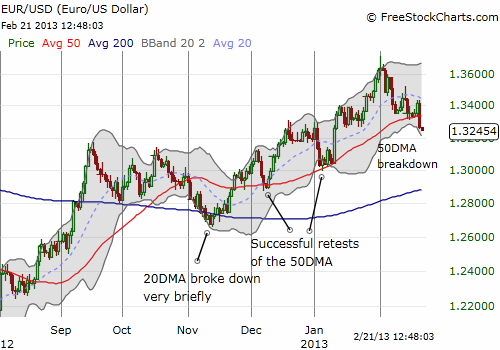

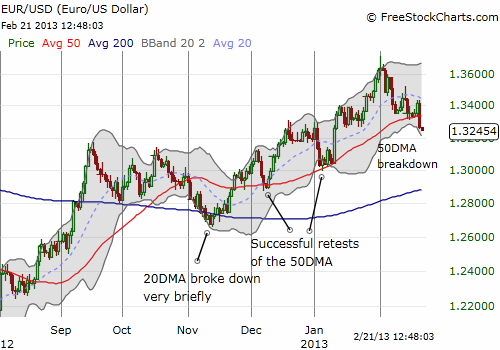

Perhaps most telling of changes in the wind are the tremors subtly revealing themselves in the currency market. In particular, the euro (FXE) broke through its 50DMA with the 20DMA now in decline (EUR/USD). This combination suggests the euro has much lower to go from here (target the 200DMA).

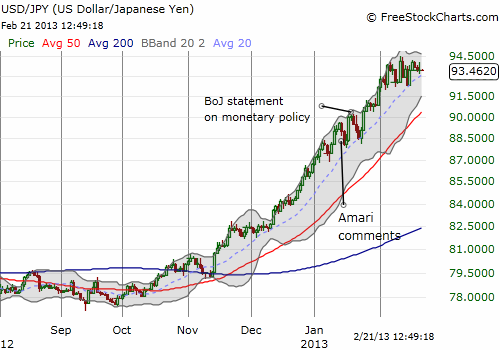

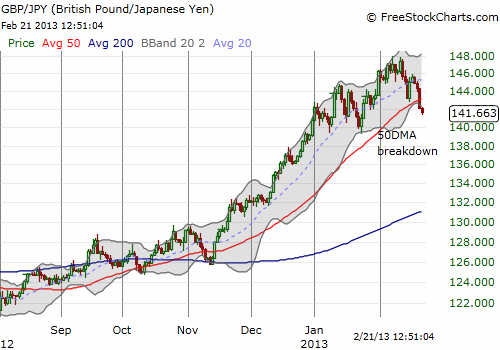

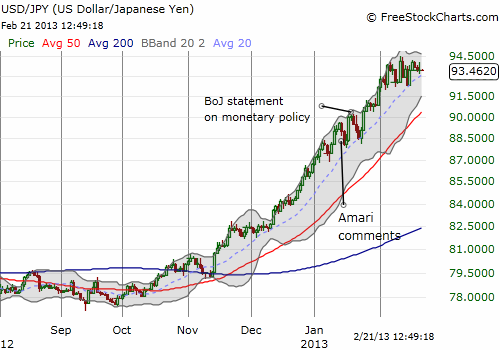

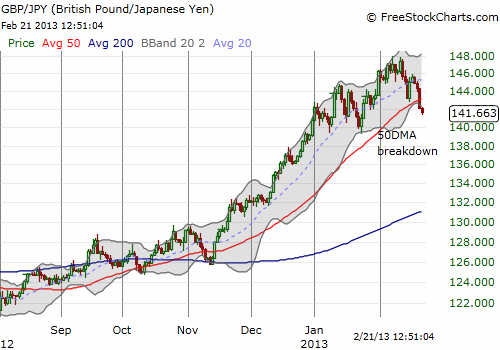

The yen (FXY) has gone nowhere against the U.S. dollar (USD/JPY) for most of this month and is about to challenge the strong uptrend represented by the 20DMA. Against the pound and the euro, definitive corrections are underway with the 20DMA violated on EUR/JPY and the more important 50DMA violated on GBP/JPY.

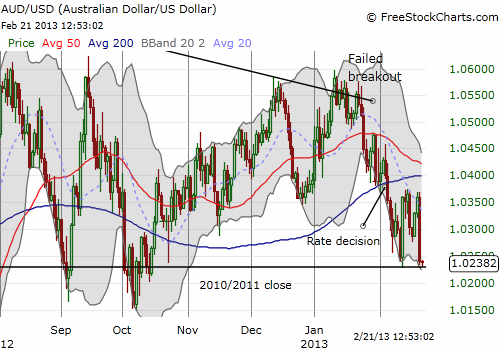

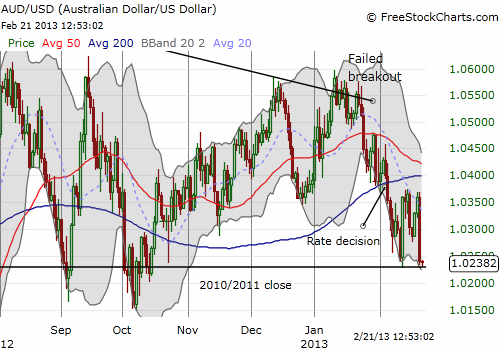

Perhaps most importantly, enthusiasm for the Australian dollar (FXA) continues to wane (USD/AUD). For most of February, it has struggled against stiff overhead resistance at the 50 and 200DMAs. Yesterday, it plunged back to levels that closed out both 2010 and 2011.

Here are some charts….

EUR/USD" title="EUR/USD" width="500" height="350">

EUR/USD" title="EUR/USD" width="500" height="350">

In isolation, any one of these developments could represent warning flags. All combined, coming on the heels of an extreme overbought period, they tell me that a fundamental change is likely occurring. The winds of change seem to be swirling. I think it makes sense to at least brace myself with the SSO puts and to emphasize short opportunities over long ones for now.

For those who want to stick with the overall bullish trends (for example, the Black Friday trade I pointed out last November), buy only when (if?) the correction gets steep; my chart of the S&P 500 reminds you of my first downside target. Obviously, oversold conditions will get bought, but that is not on my radar right now.

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Be careful out there!

Disclosure: long VXX shares and puts, long SSO puts, net short British pound and the Australian dollar, long Japanese yen

VIX Status: 14.5

General (Short-term) Trading Call: Sell more longs, initiate shorts if none on-hand.

Commentary

T2108 plunged 10.5%, dropping to levels last seen in December, 2012. Not only did this plunge end a brief 1-day overbought period, it officially seals the history of the 31-day overbought period that began 2013. My decision to choose the aggressive strategy of grabbing fresh SSO puts in the face of Tuesday’s rally has turned into a winner for now.

The S&P 500 dropped 1.2%, forming a bearish engulfing pattern. The VIX soared off 7-year lows with an 18.2% gain which put it right back under presumed resistance around 15, a level that has held all year.

The S&P 500 is now resting directly on top of the 20DMA that has loosely defined this year’s gradual yet persistent uptrend. I do not expect this support to fail right away, but if it does, it will all but confirm a correction is underway (and a top is in for now). The bearish engulfing pattern is all the more bearish coming directly on the heels of a 1-day overbought period that followed an extreme overbought period (consider that 1-day overbought period a fake-out).

Similarly, the VIX’s rise yesterday was awesome to behold, but it must break through the 15 level to signal that a “real” correction is likely underway.

Perhaps most telling of changes in the wind are the tremors subtly revealing themselves in the currency market. In particular, the euro (FXE) broke through its 50DMA with the 20DMA now in decline (EUR/USD). This combination suggests the euro has much lower to go from here (target the 200DMA).

The yen (FXY) has gone nowhere against the U.S. dollar (USD/JPY) for most of this month and is about to challenge the strong uptrend represented by the 20DMA. Against the pound and the euro, definitive corrections are underway with the 20DMA violated on EUR/JPY and the more important 50DMA violated on GBP/JPY.

Perhaps most importantly, enthusiasm for the Australian dollar (FXA) continues to wane (USD/AUD). For most of February, it has struggled against stiff overhead resistance at the 50 and 200DMAs. Yesterday, it plunged back to levels that closed out both 2010 and 2011.

Here are some charts….

EUR/USD" title="EUR/USD" width="500" height="350">

EUR/USD" title="EUR/USD" width="500" height="350">

In isolation, any one of these developments could represent warning flags. All combined, coming on the heels of an extreme overbought period, they tell me that a fundamental change is likely occurring. The winds of change seem to be swirling. I think it makes sense to at least brace myself with the SSO puts and to emphasize short opportunities over long ones for now.

For those who want to stick with the overall bullish trends (for example, the Black Friday trade I pointed out last November), buy only when (if?) the correction gets steep; my chart of the S&P 500 reminds you of my first downside target. Obviously, oversold conditions will get bought, but that is not on my radar right now.

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Be careful out there!

Disclosure: long VXX shares and puts, long SSO puts, net short British pound and the Australian dollar, long Japanese yen