The formerly high-flying utility sector has stumbled in recent weeks, shifting the leadership baton to the technology sector, based on a set of proxy ETFs. Expectations that the Federal Reserve could raise interest rates before the year is out is weighing on yield-sensitive utility stocks. Meantime, the tech sector continues to trade near record highs.

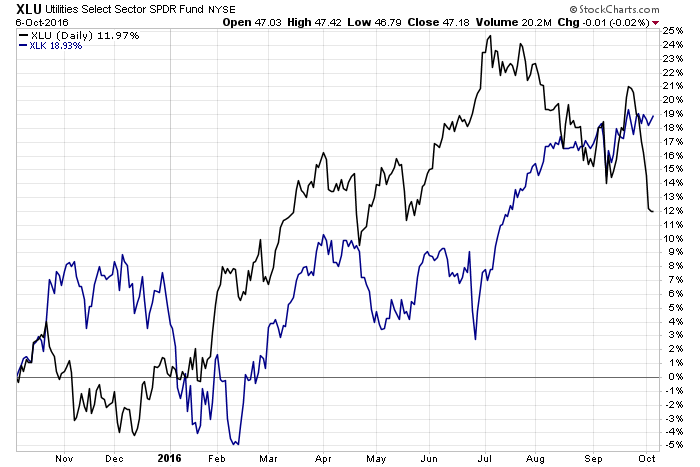

The shift in relative strength for the two sectors is clear in a chart of representative ETFs for recent history. While Technology Select Sector SPDR (NYSE:XLK) has held onto its gains this year (blue line in chart below), Utilities Select Sector SPDR (NYSE:XLU) peaked in early July (black line). XLU’s downside bias has accelerated in recent weeks, cutting the ETF by more than 7% since September 26 through yesterday (October 6).

One bullish factor for technology shares these days is the expectation for robust merger-and-acquisition activity. “The booming tech sector is gearing up for a wave of consolidation,” notes financial columnist Matthew Lynn at The Guardian. The trend “will drive the next stage of what is already turning into an epic bull market,” he predicts.

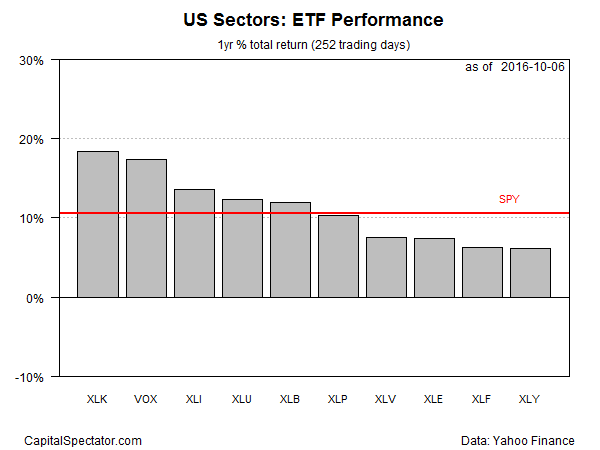

Looking past the short-term noise via one-year returns highlights XLK’s relative strength. The ETF is up nearly 19% for the trailing 12-month period through Thursday.

XLU is still in the black over the past year, but the sector’s leadership has been substantially pared to a relatively mediocre 12% total return. That’s just slightly ahead of the broad market’s 11.5% gain for the trailing one-year window, based on the SPDR S&P 500 (NYSE:SPY).

Meanwhile, Consumer Discretionary Select Sector SPDR (NYSE:XLY) has been reduced to last place for the one-year ranking. But with all the sector funds still posting gains for the trailing 12-month period, XLY’s lagging results translate into a 6.1% total return (based on 252 trading-day results).

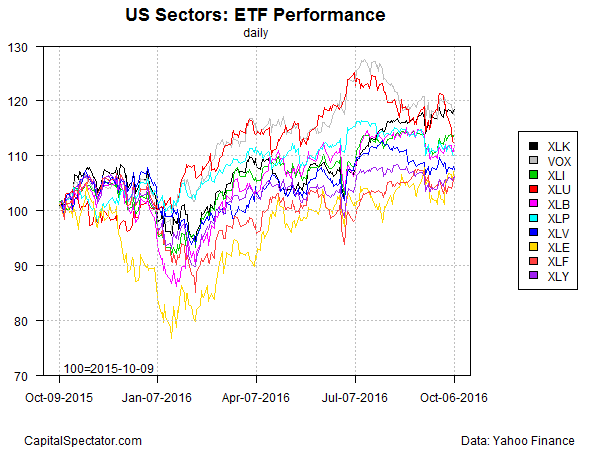

Reviewing all the sector-fund performances over the past year, however, reveals that the upside bias that was prevalent in the first half of 2016 is looking a bit tired in the third quarter.

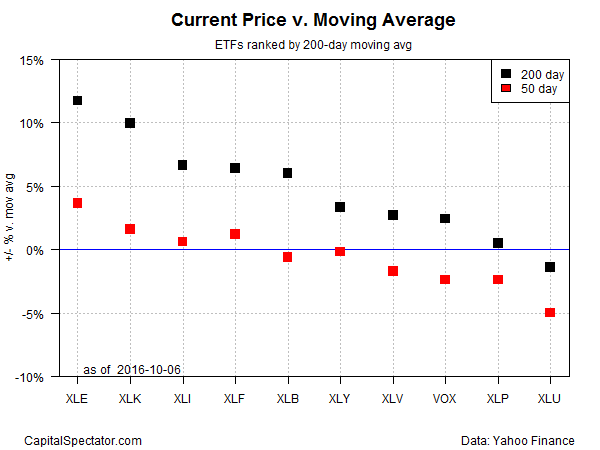

Ranking the sector ETFs based on moving averages continues to reflect a mixed picture. At one extreme is the energy sector, which is currently posting a bullish profile in terms of price momentum. Energy Select Sector SPDR ETF (NYSE:XLE) is trading well above its 50- and 200-day moving averages.

At the opposite end of the spectrum, utilities are suffering from negative momentum. Reflecting the recent reversal of fortunes, XLU is now trading well below its 50- and 200-day averages.