At the end of July the Advisory Board of the Incrementum Fund held its quarterly meeting (a full transcript is available for download at the end of this post). The board was joined by special guest Simon Mikhailovich, a financial market veteran who inter alia co-founded the Toqueville Bullion Reserve. The title of the transcript and this post was inspired by his remarks.

We believe he is definitely on to something. By now most of our readers are probably well aware of terms such as “the everything bubble”, used to describe the post-GFC world in which asset prices have been driven to absurd levels on the back of the most massive central bank interventions of the post-war era. Simon argues that the complacency of market participants in a way represents a bubble in its own right – and the implications of what is happening in the world today are widely underestimated. Here is a quote:

“I just wanted to mention those two things first, but the main thing I wanted to talk about is complacency. I speak to quite a few institutional investors and what I see is that complacency in financial markets is pervasive. I also think that since imbalances in the financial markets have so far not been allowed to “clear,” we instead see the pressures being released in other arenas, such as political, geopolitical, and social. In the end, if the financial markets don’t “clear” the imbalances that have been taking place, then they are likely to clear in other areas. For example, I think the outcome of the 2016 election was a result of the pressures of inequality building up; it was a result of the skewed distribution of the spoils of the asset price inflation. Similarly, we see rising populism and nationalism in Europe; for example, there might be a hard Brexit in the UK, which few could have imagined being a possibility.”

We would describe this as the effects of a deteriorating social mood. The burgeoning trade war – which has in the meantime moved beyond the US and China, as evidenced by the growing trade spat between Japan and South Korea – is a symptom of this underlying malaise as well. It is astonishing that the US stock market has held up as well as it has in this environment, but it should be noted that this is not the case with other stock markets in the world. What’s more, the broad market as represented by the NYSE Index (NYA) has actually peaked in early 2018 (we have previously discussed the signs pointing to the growing risk of a sharp correction).

It is actually quite strange: there are a great many risks and it is not really a big secret what they consist of. And yet, at the same time the attitude of investors seems to be one of nonchalance. It has become accepted conventional wisdom that no matter what happens, central banks will be both willing and able to “fix” things with the printing press (or rather, its electronic equivalent). To be sure, we don’t doubt they are willing. The main question is whether they will be able. Experience suggests otherwise.

To quote Simon on the issue again:

“The reason I am recounting all these risk factors is because I see that there is a high level of complacency among investors with regards to these risks. It’s like there is a bubble in complacency. Investors know about all these problems, but they don’t seem to care that much. The institutional investors I talk to are not paid to think about these risks, they are paid to produce short term outperformance, or at least performance close to their benchmark.”

Not surprisingly, Simon believes that gold is an excellent hedge against all these risks that offers an asymmetrical payout. We would point out to this that since gold prices bottomed in late 2015, the gold price has held up quite well even in time periods in which the macro-fundamental drivers were net bearish. We have always suspected that the main reason for this was that some people had begun to purchase gold as an insurance policy; and perhaps more importantly, the reservation demand of current gold holders was probably growing (i.e., they became increasingly unwilling to sell).

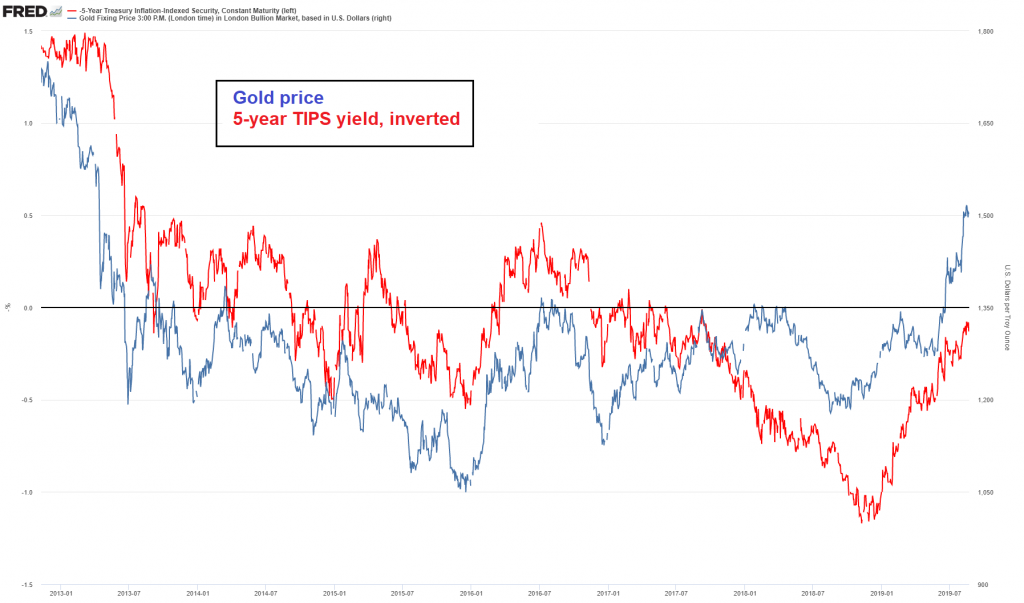

Having said that, gold prices continue to be well aligned with important fundamental drivers – as the following chart illustrates:

The gold price vs. the inverted 5-year TIPS yield (a proxy for real interest rates). Gold seems to be leading real interest rates, but the main point is that these trends remain strongly aligned.

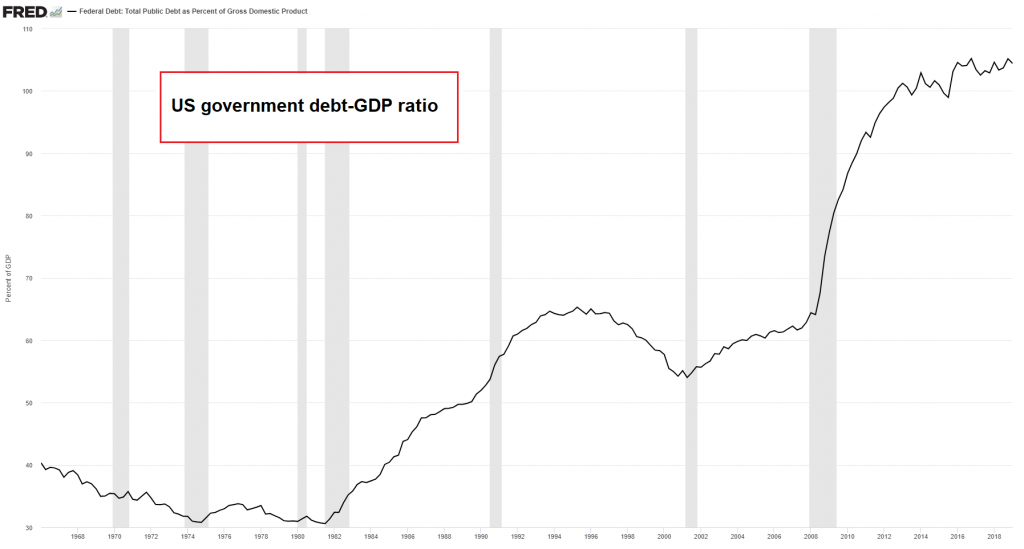

Jim Rickards also took part in the discussion and inter alia mentioned a risk that is not getting much attention these days, but probably should: namely the rapid growth in US government debt. Given the extent to which it has grown in an economic expansion and in the absence of a major war, one wonders what will happen once the expansion ends. It is certainly a good bet that debt growth will accelerate even further. While it is unknowable at what point the markets will finally become concerned about it, such a threshold presumably does exist.

US government debt-GDP ratio – despite a growing economy, it remains above 100. Not too long ago this would have been unthinkable.