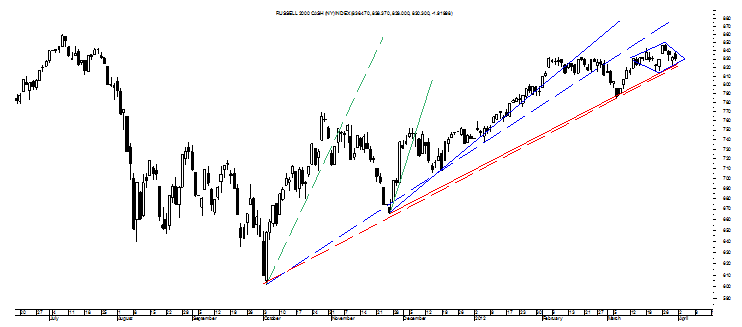

A Diamond Top showed up in the Russell 2000’s intraday charts weeks ago with the pattern producing the rarer upside breakout.

Now there’s a bigger Diamond Top showing in this small cap index and a potential break to the downside could have big implications around the Russell 2000’s intermediate-term uptrend.

Prior to treating the downside scenario and what it might mean for the Russell 2000 and perhaps the risk rally, though, let’s look at the upside possibility that confirms at 848 for a target of 880 and nearly 3% above last year’s highs.Such a potential move up would serve to either bust the Rising Wedge shown below to the upside or create an apex of all apexes that might precede what would be a spectacular fall.

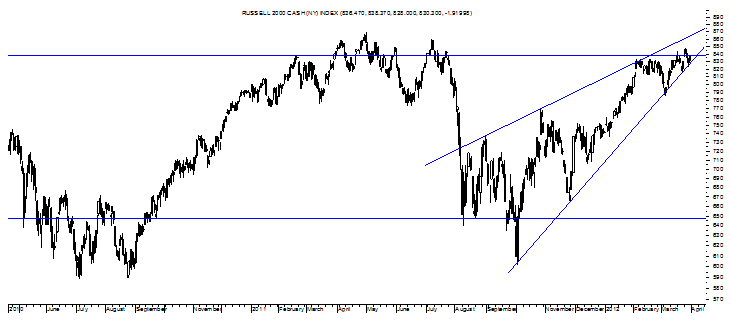

Certainly the two-year chart above allows for it, even it encourages it and so maybe the Russell 2000’s Diamond Top does peak out near 880 to complete the Rising Wedge as shown above or ignore it all together to climb higher yet.

As drawn another way, an earlier way, though, the Russell 2000’s Rising Wedge is trying hard to confirm now and something that supports the Diamond Top breaking to its “proper” downside destination of 784 on confirmation of 816.

It is this sort of drop that would put the Russell 2000 back below its 50 DMA as is the case with many of the Dow components with the two indexes linked by the Symmetrical Triangle showing outright in the latter index and in the right side of the Russell 2000’s Diamond Top.Perhaps what really stands out about this potential decline is the fact that it would provide some nascent proof of the Russell 2000’s intermediate-term uptrend reversing with what would be its positioning below the third Bear Fan Lines marking the last hoorahs of its near- and intermediate-term uptrends.

Levels are the only way to watch what way this typically bearish pattern will go and those levels are 816 and 848 with a few days of tight consolidation into the payrolls report seeming likely.

Before the week is out, though, it should be known what became of a bigger Diamond in the RUT.

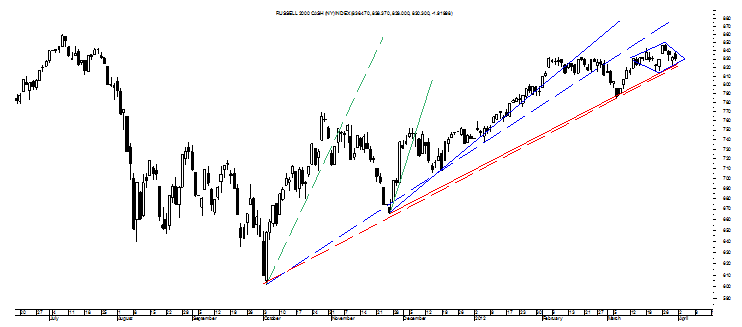

Now there’s a bigger Diamond Top showing in this small cap index and a potential break to the downside could have big implications around the Russell 2000’s intermediate-term uptrend.

Prior to treating the downside scenario and what it might mean for the Russell 2000 and perhaps the risk rally, though, let’s look at the upside possibility that confirms at 848 for a target of 880 and nearly 3% above last year’s highs.Such a potential move up would serve to either bust the Rising Wedge shown below to the upside or create an apex of all apexes that might precede what would be a spectacular fall.

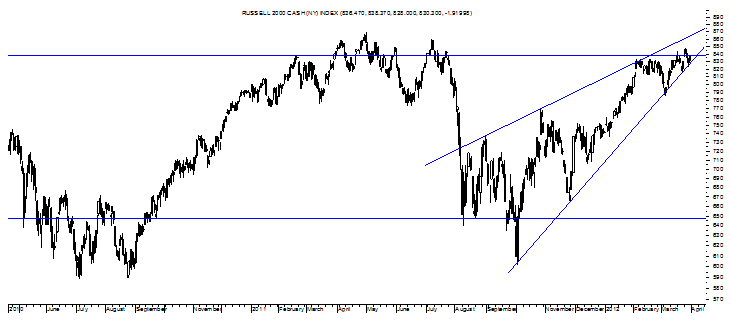

Certainly the two-year chart above allows for it, even it encourages it and so maybe the Russell 2000’s Diamond Top does peak out near 880 to complete the Rising Wedge as shown above or ignore it all together to climb higher yet.

As drawn another way, an earlier way, though, the Russell 2000’s Rising Wedge is trying hard to confirm now and something that supports the Diamond Top breaking to its “proper” downside destination of 784 on confirmation of 816.

It is this sort of drop that would put the Russell 2000 back below its 50 DMA as is the case with many of the Dow components with the two indexes linked by the Symmetrical Triangle showing outright in the latter index and in the right side of the Russell 2000’s Diamond Top.Perhaps what really stands out about this potential decline is the fact that it would provide some nascent proof of the Russell 2000’s intermediate-term uptrend reversing with what would be its positioning below the third Bear Fan Lines marking the last hoorahs of its near- and intermediate-term uptrends.

Levels are the only way to watch what way this typically bearish pattern will go and those levels are 816 and 848 with a few days of tight consolidation into the payrolls report seeming likely.

Before the week is out, though, it should be known what became of a bigger Diamond in the RUT.