A gutsy trader has made a very large bet that oil prices will spike significantly in the medium to long term, according to some recent unusual options market activity.

The $100 December 2018 call option was the most actively traded contract on Tuesday of this week in the entire ICE Brent market. According to ICE, “The ICE Brent Crude futures contract is a deliverable contract based on EFP delivery with an option to cash settle.”

In laymen’s terms, this means a certain big-money trader — most likely working for a large fund manager — has placed a bullish lottery ticket-type bet on rising oil prices. Oil doesn’t have to surge to $100 for the trade to pay off, either. If oil jumps significantly in the short term, the value of the contract will rise significantly, and the trader could cash out then.

How much money is at stake? Quite a bit, according to Bloomberg:

The options probably cost a little more than $1 million, according to data compiled by Bloomberg. They would be worth multiple times that if futures prices spiked any time soon. It’s also possible the trades were part of a wider hedging program.

Such a long-shot bullish bet would likely never have been made even six months ago. But with oil prices recovering this year from multi-year lows and seemingly settling in for the long term above $50 per barrel, these sorts of traders are bound to start happening more frequently.

The bottom line, as this interesting bet illustrates, is that investors are getting increasingly bullish on oil.

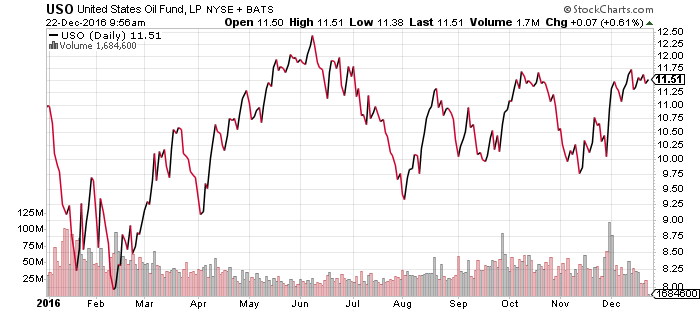

The United States Oil Fund (NYSE:USO) LP ETF (NYSE:USO) rose $0.07 (+0.61%) to $11.51 per share in Thursday morning trading. Year-to-date, the largest ETF tied to crude oil prices has gained 4.64%.