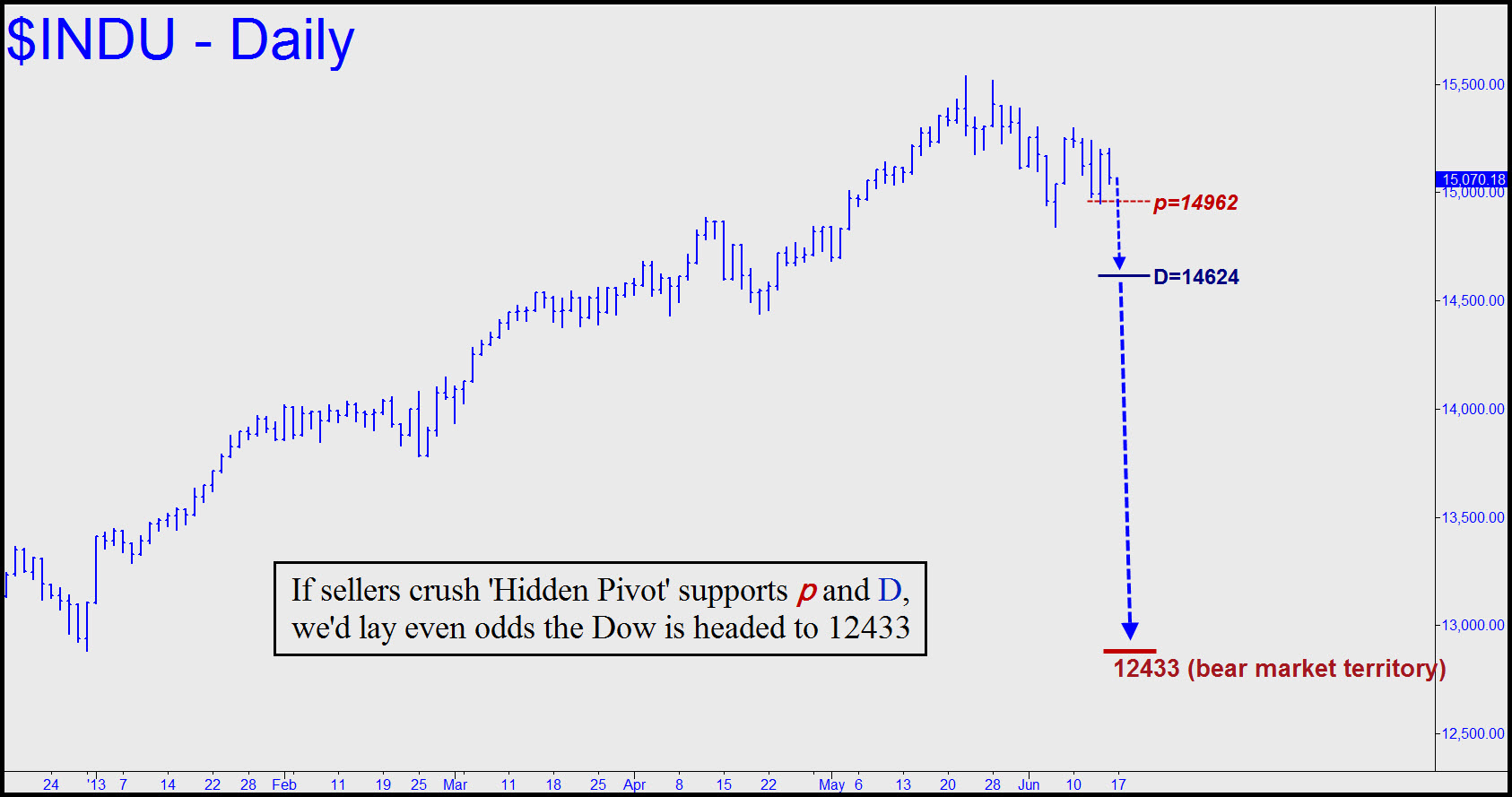

Are U.S. stocks in a bear market? Although we don’t pretend to have a crystal ball, the chart below could soon give us enough information to quote odds on it. From a technical standpoint, using our proprietary method of analysis, the key feature is the 14953 low made last week. Thursday’s swoon to that number overshot an important “Hidden Pivot” correction target at 14962 (aka ‘p’) by a hair – i.e., nine points, or 0.10 percent. That’s not enough to regard the support as having been violated, nor to provide a solid basis for predicting the direction of the next big move. It the move is higher, however, then a 16800 bull-market target broached here earlier will be back on the marquee. Alternatively, if the Indoos decisively breach last week’s low, we would expect the sell-off to continue to at least 14624, a three percent decline from Friday’s settlement price and a 6% fall from mid-May’s all-time high at 15542.

That would be little more than a stumble, of course, since it would fall well shy of the 20 percent threshold needed to signal a bear market. A 20-percent decline would imply a 3108-point selloff to 12433. Again, Hidden Pivot Analysis should be helpful in determining whether an initially mild selloff to 14624 – what bulls will undoubtedly regard as a healthy correction – is likely to snowball into an avalanche to 12433 or lower. How will we be able to predict this in advance? Very simply, by closely monitoring price action at the two numbers given above: 14962 and 14624. If the first is exceeded by more than 10 points intraday, then the second will become an odds-on bet. And if the second is exceeded on a closing basis for two consecutive days, then look out below. At that point we’d rate the bear-market scenario no worse than a 50-50 bet. That would be the best odds bears have gotten since the stock market left the launching pad in March of 2009.

The chart summarizes at a glimpse everything noted above. Keep in mind, however, that the more easily sellers obliterate Hidden Pivot supports ‘p’ and ‘D’, if indeed they do, the greater the odds a bear market has commenced.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

A Bear Market?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.