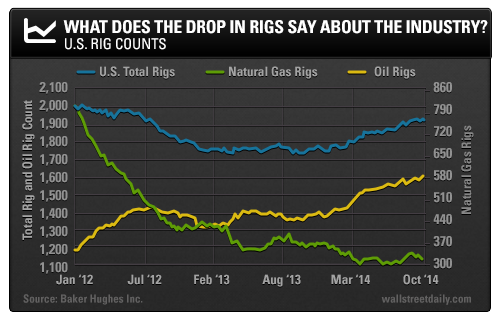

U.S. oil and natural gas rig counts just dropped for the second time since August.

Why is that significant?

A drop in the number of rigs is usually an indication that the companies doing the drilling and exploring are less sanguine about future prospects.

But the two biggest oil companies’ CEOs are putting on a happy face, saying their production is actually going to increase.

Are these CEOs lying about their prospects, or is something else going on?

Digging Deeper Into Data

Rig counts are a measure of the number of active rigs that are developing or drilling for oil or gas.

Between February 2012 and this past September, rig counts for the oil industry increased by more than 33%. This reflects the boom period for oil production in the United States.

On the other hand, natural gas rigs fell from almost 2,000 a few years ago to around 300 today.

Yet in spite of these telltale signs of slowing production, Halliburton (NYSE:HAL) and Schlumberger (Schlumberger NV (NYSE:SLB)) are reporting rather chipper futures.

Halliburton CEO Dave Lesar recently implied that his company’s activity and the boom in shale drilling aren’t ebbing. In fact, they’re continuing to grow.

“Service intensity levels surged to unprecedented levels, as completion volumes per well were up more than 50% compared to the third quarter of last year,” said Lesar.

Schlumberger, the No. 1 company in the industry, echoed these sentiments.

So what gives? Are the rig counts lying, or are the two biggest companies relying on backlog rather than looking forward?

Reading the Signs

Digging deeper into the numbers reveals that, actually, only a certain type of rig is shutting down.

More traditional vertical rigs are going offline, while the number of horizontal rigs has stayed the same.

This makes sense when you consider that horizontal drilling is much more cost effective and efficient than vertical drilling.

You see, numerous wells can be drilled from a single location, rather than one well at a time, which is the hallmark of vertical drilling.

This is an important distinction, and one of the reasons that companies like Halliburton, which has fallen more than 20% from its highs, are less vulnerable to the downside in prices than the oil companies.

Many of the drilling and exploration companies have seen their fortunes plunge by twice that of Halliburton, as measured by share price performance.

This is also an indication that plays like the Permian Basin are definitely the next hot thing, and that the lure of cheap horizontal drilling is the driving force.

Thus, Lesar’s sunny outlook isn’t some plan to deceive the shareholders, but rather a measure of the oil services it provides to the industry. And that’s a reflection of the boom in drilling in the United States and other parts of the world.

Stars Align

This is not to say that the company is immune from a protracted slump in prices.

But as long as oil and gas are being produced, rigs and wells have to be serviced, even if the companies that are producing are making less off each barrel, or thousand cubic feet.

The recent plunge in prices looks to have abated, and oilfield service companies like Halliburton may present a much better opportunity today than they did just a few months ago.

Rig counts are likely to stay at current levels (or even dip a little), but the boom in U.S. oil and gas shows no signs of abating right now.

In fact, the opposite is true. Oil and gas production is set to increase year over year.

And “the chase” continues,

BY Karim Rahemtulla