The week of September 16 will be highlighted by the Federal Reserve meeting on Wednesday afternoon. This is a quarterly meeting so the Fed will also release its growth and inflation forecasts, as well as projections surrounding future interest rates.

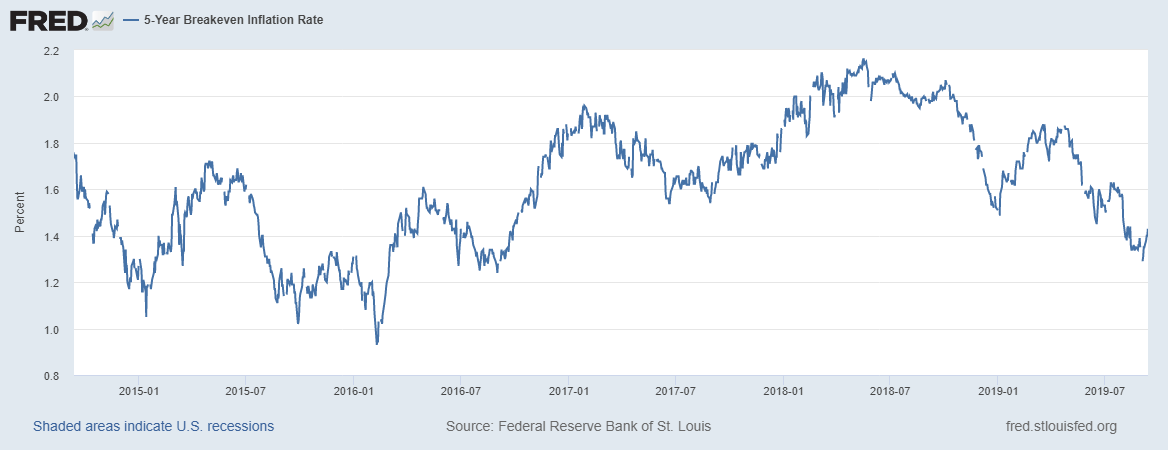

Breakeven inflations have been falling steadily, with the 5-year rate now at 1.43% and are down dramatically since April. I predict that we will see the Fed’s inflation expectations fall for this meeting projections.

This is where the Fed will be able to say that they need to cut rates, as they want inflations expectations to rise.

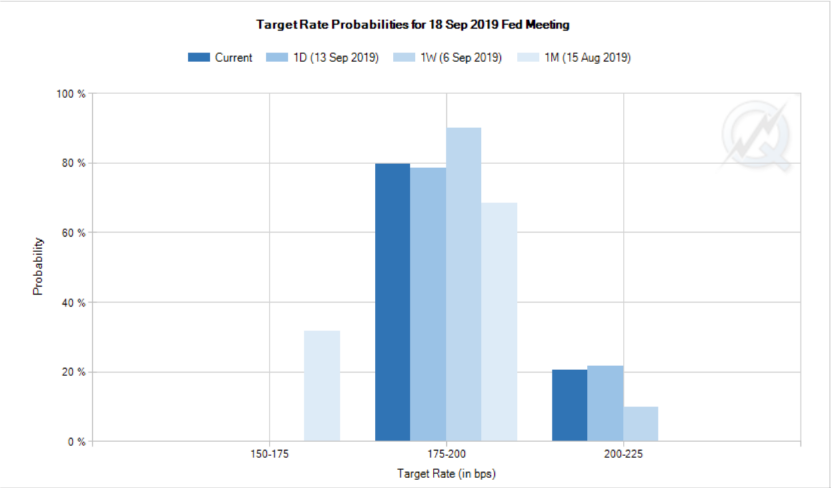

Odd of a Rate Cut

The CME Group is now projecting an 80% chance of 25 basis point cut. But those odds have fallen in recent days. For the Fed not to cut rates by 25 bps would be too much of a risk for unleashing financial market chaos. The safe road to take is too cut rates and continue down the path of acting as appropriate to support the economic expansion.

S&P 500 (SPY)

The S&P 500 Futures should find support at 3,000, and the uptrend should there be any selling pressure on the headlines of the drone attack in Saudi Arabia.

Oil

Should oil rise just the headlines? Resistance would come around $57 and then again at $61.

NVIDIA (NVDA)

NVIDIA (NASDAQ:NVDA) has been trending higher recently. I expect that trend higher to continue. Support can be found at $178 and resistance at $198.

Roku (ROKU)

Roku (NASDAQ:ROKU) had a lousy week, and I expect that it will continue to get worse. A drop below $143 sends the stock to $120.

Blackberry (BB)

Blackberry (TSX:BB) has stalled out around $7.50, and the RSI is trending higher, and I think that pushes the stock higher $8.10.

Netflix (NFLX)

Netflix (NASDAQ:NFLX) is finally rising above the downtrend, and the RSI is beginning to rise too. That is a good sign.

JD.com (JD)

The Jd.Com (NASDAQ:JD) chart is still looking bullish. I saw that option buying last week too, that suggest the stock continues to rise.

Alibaba (BABA)

Alibaba (NYSE:BABA) has a very similar chart to JD.com. Hard to ignore the bullish setup, with the ascending triangle. $188 looks likely. I’m going to have to check the options activity this week.