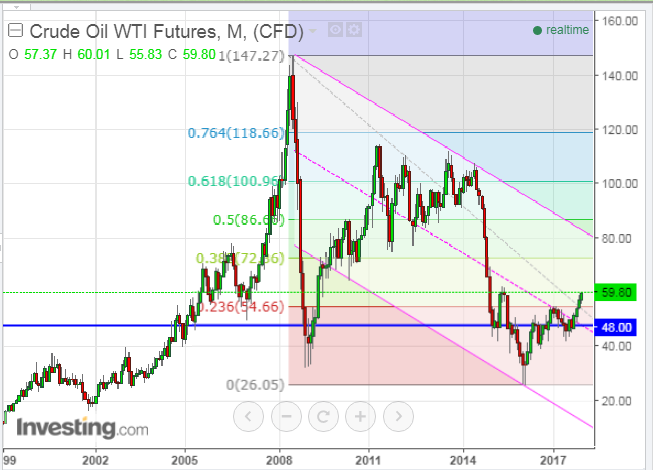

As noted on the following Monthly chart, 72.00 (40% Fibonacci retracement level) could be the next major target for WTI Crude Oil.

Price briefly hit the 60.00 level yesterday (Tuesday) and is trading above two levels of major support—54.66 (23.6% Fib retracement level) and 48.00 (price and channel center line support).

As long as price can re-take 60.00 and hold above that level, there's a good chance we may see it climb to its next major resistance level of 72.00.

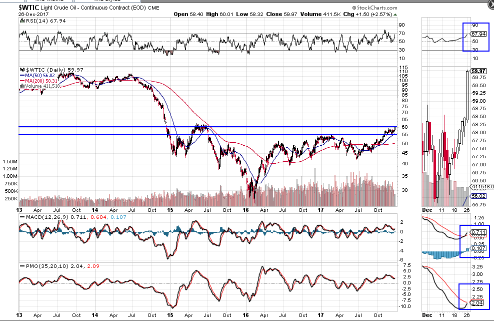

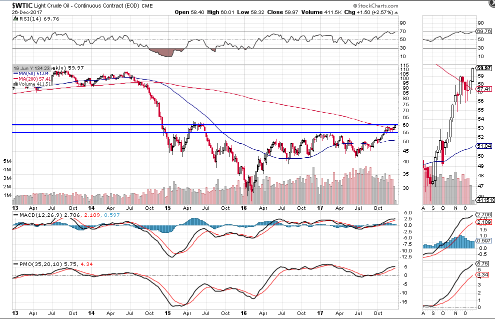

On a shorter (weekly) timeframe, price will, first, need to hold above 57.41 (200-week moving average) and 55.00 (price support), inasmuch as there is very high volatility below.

In addition, on a Daily timeframe, watch for a bullish crossover to form on the PMO indicator, the recent crossover to hold on the MACD, the RSI to hold above 50.00, and price to remain above the 50-day moving average at 56.02.