- That said, we keep the view that weakness in global data, low inflation expectations, more Fed cuts and ECB QE will keep yields low. We have a -0.60% 3M (NYSE:MMM) target for 10Y bund yields.

Seven factors that triggered the recent bond sell-off

1. ECB has been repriced

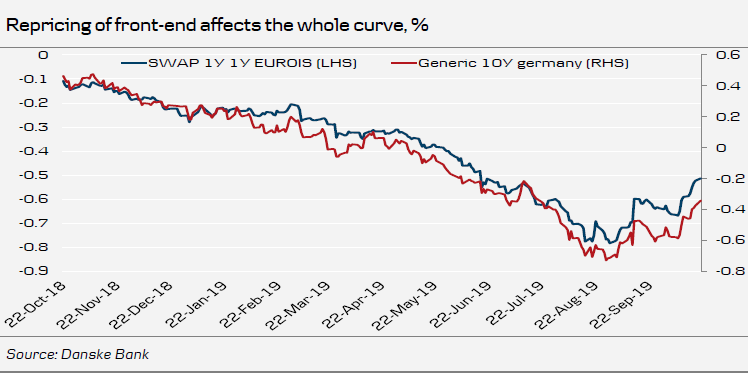

We have recently seen a pronounced change in market ECB pricing. Ahead of the ECB September meeting, the market was pricing that the 1M Eonia would drop below -0.70%. Now the market has lifted pricing close to 20bp to just below -0.50%. In particular, the important 1y1y point, which is most prone to changes in policy outlook, has moved higher. This is pivotal as there is still a very close correlation between the 1y1y rate and 10Y bund yields.

The repricing of ECB expectations reflects the better risk picture in respect of Brexit and the trade war, but it is certainly also a reflection of the divergent views in the governing council members. The comments after the September ECB ‘package’ that were put forward by the hawks of the ECB underline that further easing from the ECB for the time being is unlikely, and that Lagarde might face strong opposition if she favours new stimuli.

We underline that we see little impact on OIS rates from the implementation of the tiering system that starts 30 October. However, it cannot be ruled out that the underperformance for German Schatz (2y bonds) versus swaps that is bigger than for bunds (10Y) and Buxl (30y) might reflect that the market expects a lower demand for short-dated bonds as European bank treasuries next month can place c.EUR800bn in excess liquidity at zero. It takes away a sizeable demand for especially deeply negative yielding short-dated bonds.

2. Concerns that the ISIN limits will constrain PSPP purchases

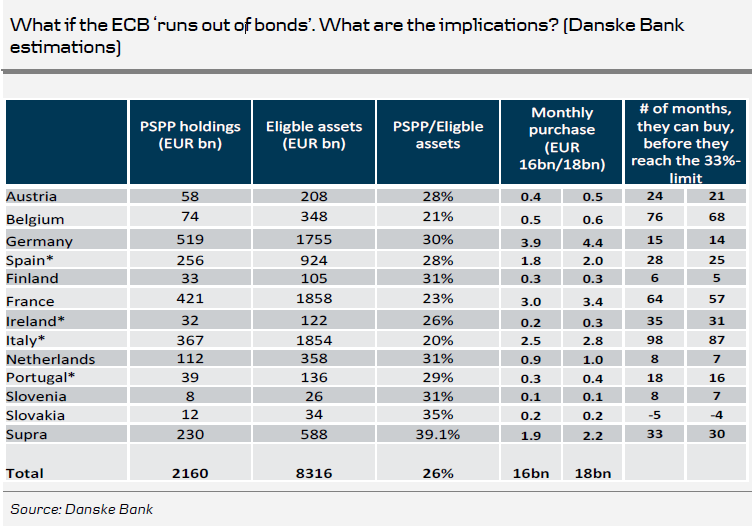

The move higher in longer-dated yields might also reflect some investors starting to lose faith over whether the ECB QE is in fact open-ended and whether or not there is a ‘permanent’ buyer in the market, despite the ECB’s clear promise that QE will continue until shortly before policy rates are hiked. There is currently a lot of discussion of what the ECB will do if it ‘runs out of bonds’ especially in core markets where the issuer limit might become a binding constraint as early as 2020.

We estimate that the ECB can buy bonds for example in Germany for 14-15 months before it reaches the 33% ISIN limit. In the Netherlands, the number of months might be as low as 7-8 months. The ECB has so far been reluctant to discuss the apparent issuer limit. It has only mentioned that higher bond supply will be a ‘helping hand’ going forward. The latter we are quite doubtful about, given the continued focus on balanced budgets especially in Germany.

If the ECB decides to bend the capital key implementation further or lower the share of the PSPP programme in the APP programme, all else being equal, it would be negative for core markets, whereas periphery and credit markets potentially could benefit spread wise.

When the first round of QE was initiated in 2015 the market sold-off rapidly as investors concluded that everything had now been ‘priced in’. Importantly, the first QE was not an open-ended programme compared to the current programme. However, if the market is uncertain whether the ECB is ready to do ‘whatever it takes’ when the issuer limits almost inevitably become binding, the open-ended nature of the programme might be questioned.

3. Trade war and Brexit concerns are falling

Brexit developments together with the ‘phase 1’ agreement between China and the US have been important triggers for the move higher in yields and improved risk appetite. Events are now clearly pointing towards yet another Brexit-extension, with Brexit unlikely to happen on 31 October. For more see our recent Brexit Monitor that we published this morning. There are still a lot of uncertainties in respect of the trade negotiations, but they seem to be moving in the right direction. In our Weekly China Letter from 18 October we revised the probability of a bigger deal to 50% from 40%.

4. Pricing is no longer for lower rates and momentum has shifted

While we do not want to rely only on technical analysis, we find the concept interesting as a way to gauge momentum. Most recently, the RSI on Bunds is showing that Bunds are significantly oversold at a z-score of -1, which is a stark contrast to the close to historic overbuying at more than +2.5 z-score at the ‘darkest hour’ in late August. Added to this we notice that the 50-day moving average has turned positive and 100d is close to joining it should the recent sell-off continue (or even stabilise). With the turn of the risk sentiment, one should be cautious going against current momentum.

We do not believe economic fundamentals could explain the pace of the rally we saw earlier this summer, neither have we seen a shift in economic fundamentals that can justify the sell-off now. From a risk / reward perspective, it is noteworthy that markets attach equal probability of a further sell-off versus a rally based on the volatility skew. The payer skew is now virtually flat, compared to being negative for a few months (in a sign of higher probability for lower rates than higher rates).

Furthermore, we also note that part of the explanation of the raging rally this summer is to be found in hedging of long-term liabilities from pension funds and other institutional agents. Most recently, such investors do not find themselves in need to engage in new receiver positions. Note that the 30y euro swap rate is now 40bp higher compared to the trough, but still 40bp lower compared to the July high.

5. Incipient signs of better economic data from China

The economic outlook is still looking weak in advanced economies, in particular the euro area / Germany. Emerging markets and in particular China seem to have reached a trough in the business cycle (China Weekly Letter, 18 October) and are now heading higher supported by both fiscal and monetary stimulus. In the case of the euro area, manufacturing PMIs have continued their downtrend and signs of adverse spillovers to service sector activity have increased (see Euro Area Macro Monitor, 2 October), so the recent sell-off is not driven by the euro area economic fundamentals. Conversely, we have also argued that the decline in summer was not grounded in fundamental readings either, but was part of a loss in sentiment, see point four.

For European rates, the main risk factors to the growth outlook are still expected to be the external environment (and to a lesser degree the German business cycle).

6. Inflation expectations have rebounded

After a dramatic collapse in market-based inflation expectations in the aftermath of the ECB September meeting, reaching record lows of 1.13%, inflation expectations have somewhat rebounded to 1.21% (5y5y inflation swap). However, with realised inflation at current low levels around 1% and projections not pointing upwards from stubbornly low levels, inflation expectations are not expected to rise markedly from here.

The ECB’s survey of professional forecasters, which has an update due on Friday, will be important for the overall tone from the ECB in the near-term monetary policy outlook. The recent reading from July indicated 1.74% inflation expectations in the ‘long-term’.

7. Financial risk appetite has improved

Global equities markets have performed since mid-August when yields bottomed out. It is particularly noteworthy that cyclical stocks and banking stocks have performed. That global equity investors expect a better economic outlook, and see the rise in yields as sustainable, is reflected in the higher equity prices in general for European bank stocks.

That said, some of the cyclical currencies such as SEK have not done particularly well. We have also not seen any upside for copper and oil prices.