This article looks at six large-cap industrial companies that are expected to grow earnings at 15 to 20% over the next 3 to 5 years. Even though these industrial stalwarts do possess moderate levels of cyclicality,they usually generate above-average earnings growth as they come out of cyclical troughs. Consequently, if you can buy them when their valuations are attractive and as they are entering a growth phase, they can be very attractive intermediate-term investment opportunities.

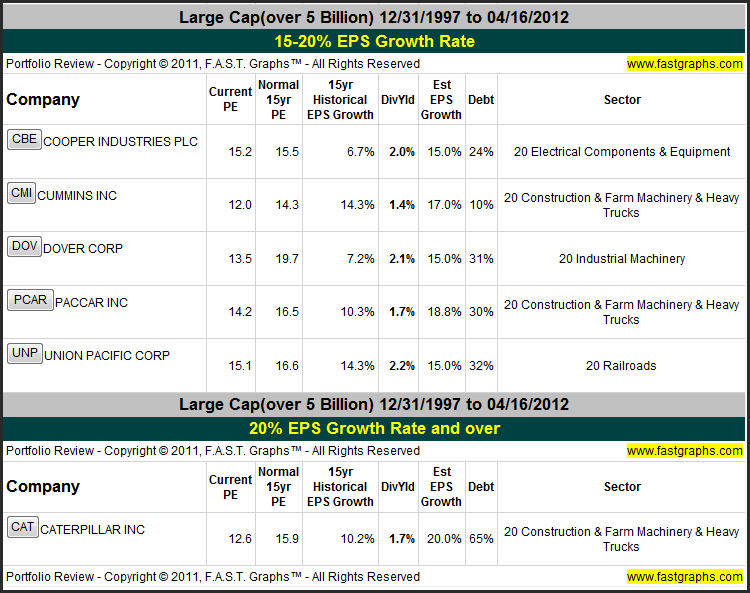

The following table summarizes six large-cap industrial stocks with forecast earnings growth of 15% or better that appear to be attractively valued, and lists them in order of dividend yield highest to lowest. From left to right, the table shows the company’s stock symbol and name. Next, two valuation metrics are listed side-by-side, the current PE ratio followed by the historical normal PE ratio for perspective. Then the five-year estimated earnings per share growth is shown next to each company’s historical EPS growth providing a perspective of the past versus the future growth potential of each company. The final three columns show the current dividend yield, the company sector and its market cap.

Closer Look at the Past and the Future Potential

Since a picture is worth 1,000 words, we’ll take a closer look at the past performance and future potential of each of our five candidates through the lens of F.A.S.T. Graphs™.

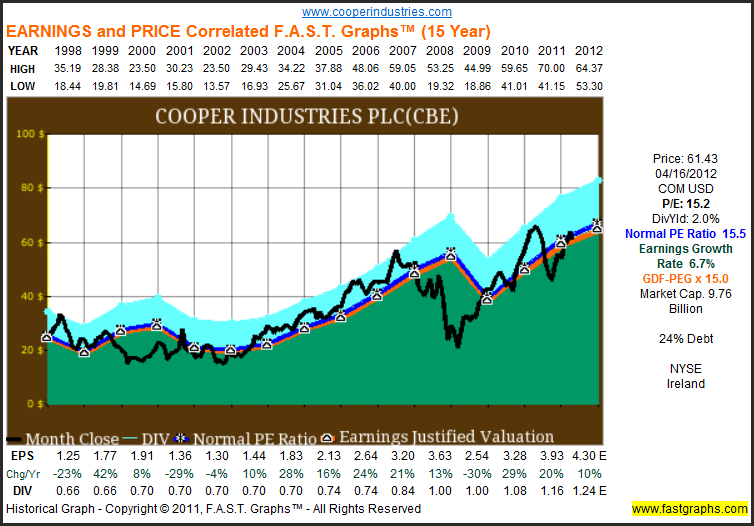

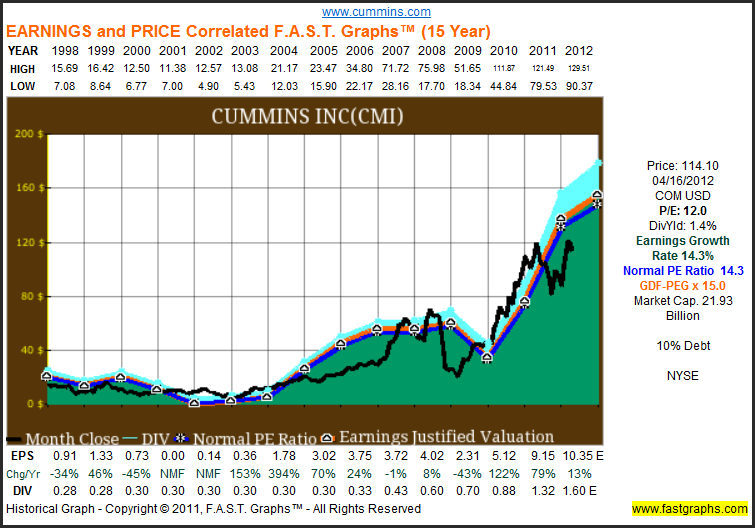

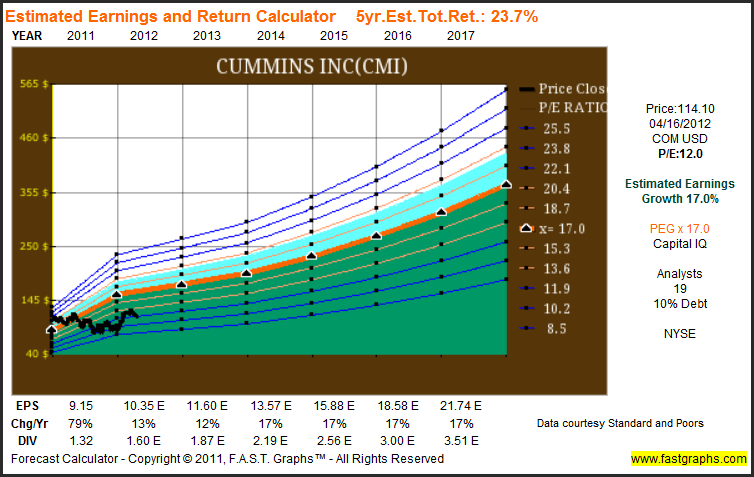

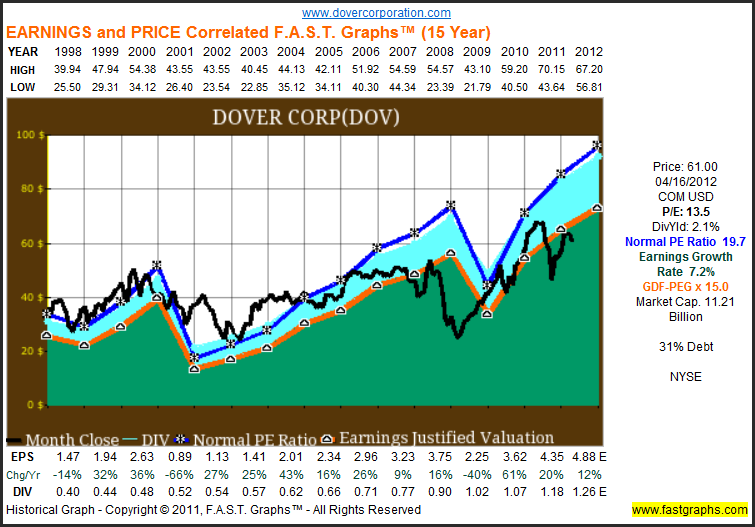

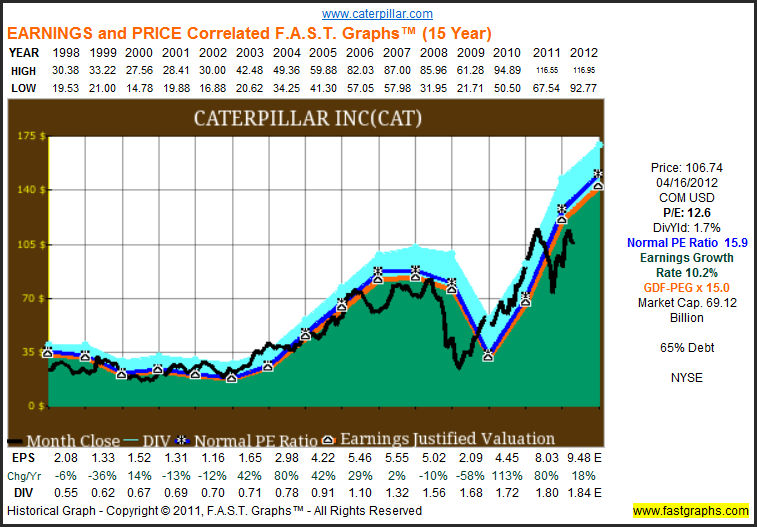

Earnings Determine Market Price: The following earnings and price correlated historical graphs clearly illustrates the importance of earnings. The Earnings Growth Rate Line or True Worth™ Line (orange line with white triangles) is correlated with the historical stock price line. On graph after graph the lines will move in tandem. If the stock price strays away from the earnings line (over or under), inevitably it will come back to earnings. The historical normal PE ratio line (dark blue line with*) depicts a PE ratio that the market has historically applied.

The orange True Worth™ line and the blue normal PE ratio line provide perspectives on valuation. The orange line reflects the fair value of each company’s earnings relative to its growth rate achievement, and the blue line reflects how the market has traditionally valued the company’s stock relative to its fair value. The blue line represents a trimmed historical normal PE ratio (the highest and lowest PEs are trimmed). These lines should be viewed as barometers or aids for ascertaining sound buy, sell or hold decisions. Rather than seen as absolutes, they should be seen as guides to better thinking.

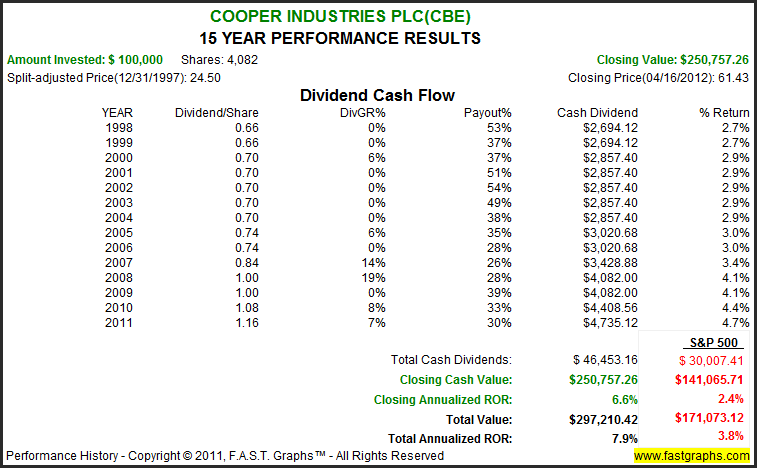

“Cooper Industries plc (NYSE: CBE) is a global electrical products manufacturer with 2011 revenues of $5.4 billion. Founded in 1833 Cooper's sustained success is attributable to a constant focus on innovation and evolving business practices, while maintaining the highest ethical standards and meeting customer needs. The Company has seven operating divisions with leading market positions and world-class products and brands, including Bussmann electrical and electronic fuses; Crouse-Hinds and CEAG explosion-proof electrical equipment; Halo and Metalux lighting fixtures; and Kyle and McGraw-Edison power systems products. With this broad range of products, Cooper is uniquely positioned for several long-term growth trends including the global infrastructure build-out, the need to improve the reliability and productivity of the electric grid, the demand for higher energy-efficient products and the need for improved electrical safety. In 2011 sixty-two percent of total sales were to customers in the industrial and utility end-markets and forty percent of total sales were to customers outside the United States.”

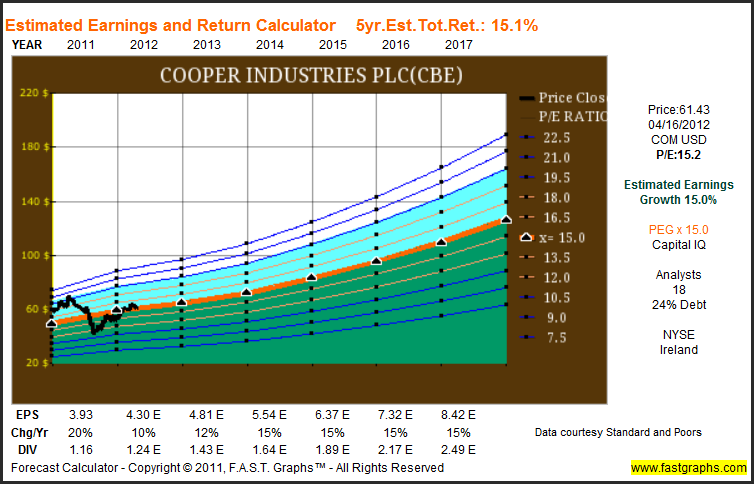

The consensus of 18 leading analysts reporting to Capital IQ forecast Cooper Industries’ long-term earnings growth at 15%. Cooper Industries has low long-term debt at 24% of capital. Cooper Industries is currently trading at a P/E of 15.2, which is inside the value corridor (defined by the five orange lines) of a maximum P/E of 18. If the earnings materialize as forecast, Cooper Industries’ True Worth™ valuation would be $126.32 at the end of 2017, which would be a 15.1% annual rate of return from the current price.

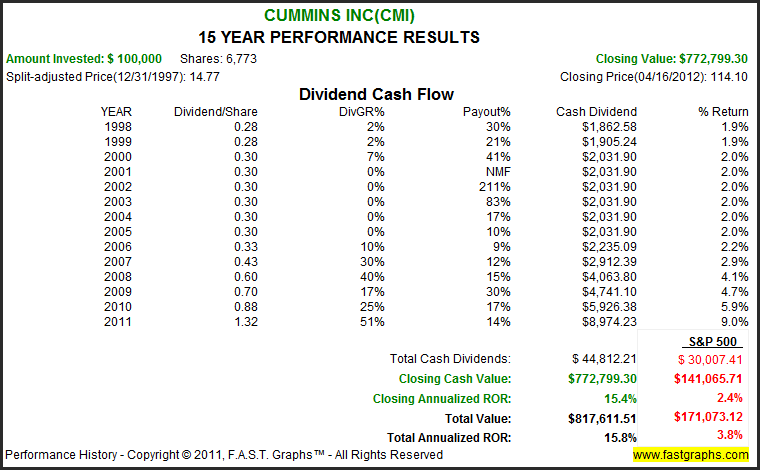

“Cummins Inc., a global power leader, is a corporation of complementary business units that design, manufacture, distribute and service engines and related technologies, including fuel systems, controls, air handling, filtration, emission solutions and electrical power generation systems. Headquartered in Columbus, Indiana, (USA) Cummins employs approximately 44,000 people worldwide and serves customers in approximately 190 countries and territories through a network of more than 600 company-owned and independent distributor locations and approximately 6,500 dealer locations. Cummins earned $1.85 billion on sales of $18.0 billion in 2011.”

The consensus of 19 leading analysts reporting to Capital IQ forecast Cummins Inc’s long-term earnings growth at 17%. Cummins Inc has low long-term debt at 10% of capital. Cummins Inc is currently trading at a P/E of 12, which is below the value corridor (defined by the five orange lines) of a maximum P/E of 20.4. If the earnings materialize as forecast, Cummins Inc’s True Worth™ valuation would be $369.53 at the end of 2017, which would be a 23.7% annual rate of return from the current price.

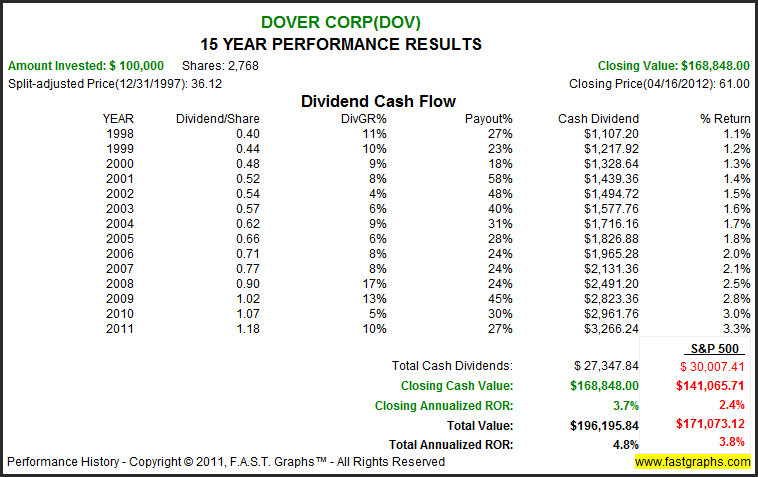

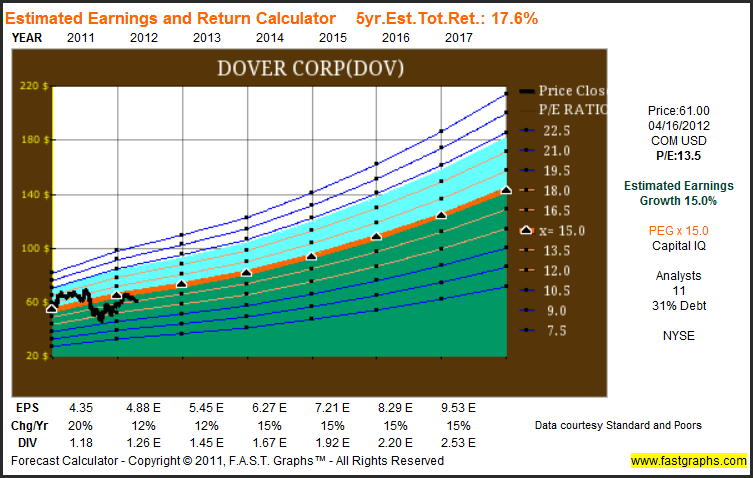

“Dover Corporation is a multi-billion dollar diversified global manufacturer. For over 50 years, Dover has been providing its customers with outstanding products and services that reflect the company's commitment to operational excellence, innovation and market leadership. The company focuses on innovative equipment and components, specialty systems and support services through its four major operating segments: Communication Technologies, Energy, Engineered Systems and Printing & Identification. Dover is headquartered in Downers Grove, Illinois and employs over 33,000 people worldwide. Dover Corporation is traded on the New York Stock Exchange under "DOV".”

The consensus of 11 leading analysts reporting to Capital IQ forecast Dover Corp’s long-term earnings growth at 15%. Dover Corp has medium long-term debt at 31% of capital. Dover Corp is currently trading at a P/E of 13.5, which is inside the value corridor (defined by the five orange lines) of a maximum P/E of 18. If the earnings materialize as forecast, Dover Corp’s True Worth™ valuation would be $142.98 at the end of 2017, which would be a 17.6% annual rate of return from the current price.

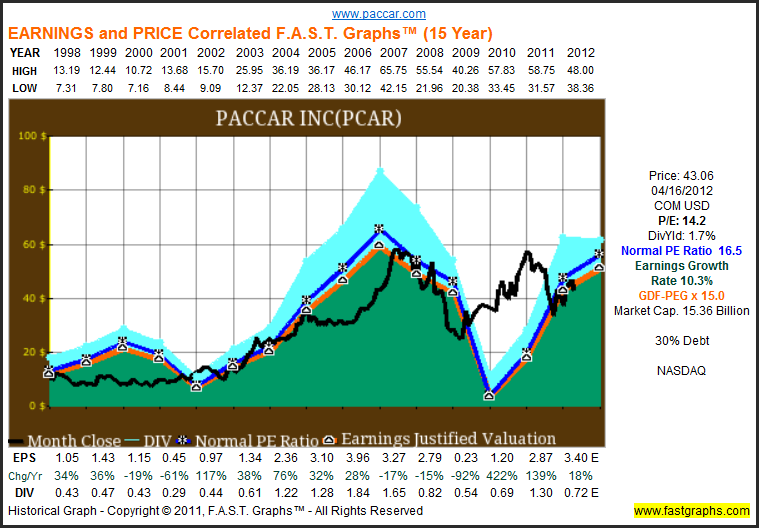

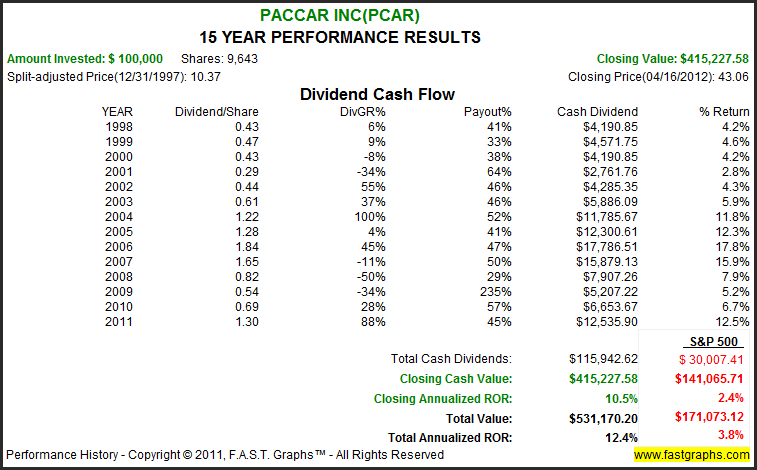

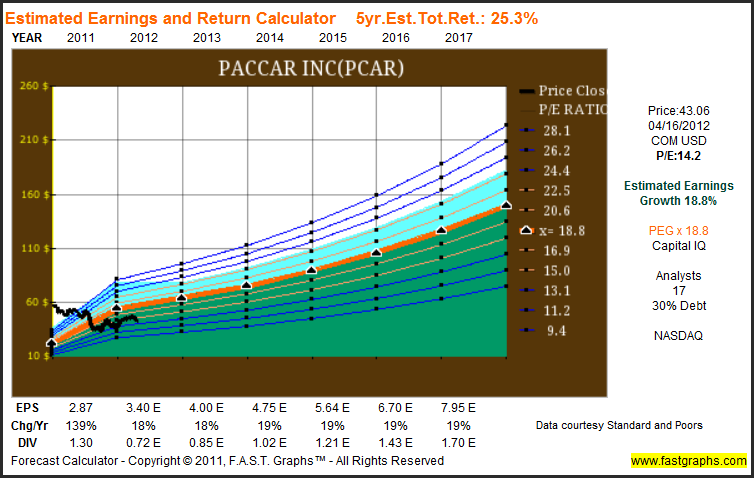

“PACCAR is a global technology leader in the design, manufacture and customer support of high-quality light-, medium- and heavy-duty trucks under the Kenworth, Peterbilt and DAF nameplates. PACCAR also designs and manufactures advanced diesel engines and provides financial services and information technology and distributes truck parts related to its principal business. PACCAR shares are traded on the Nasdaq Global Select market, symbol PCAR, and its homepage is www.paccar.com.”

The consensus of 17 leading analysts reporting to Capital IQ forecast PACCAR Inc’s long-term earnings growth at 18.8%. PACCAR Inc has medium long-term debt at 30% of capital. PACCAR Inc is currently trading at a P/E of 14.2, which is below the value corridor (defined by the five orange lines) of a maximum P/E of 22.5. If the earnings materialize as forecast, PACCAR Inc’s True Worth™ valuation would be $149.54 at the end of 2017, which would be a 25.3% annual rate of return from the current price.

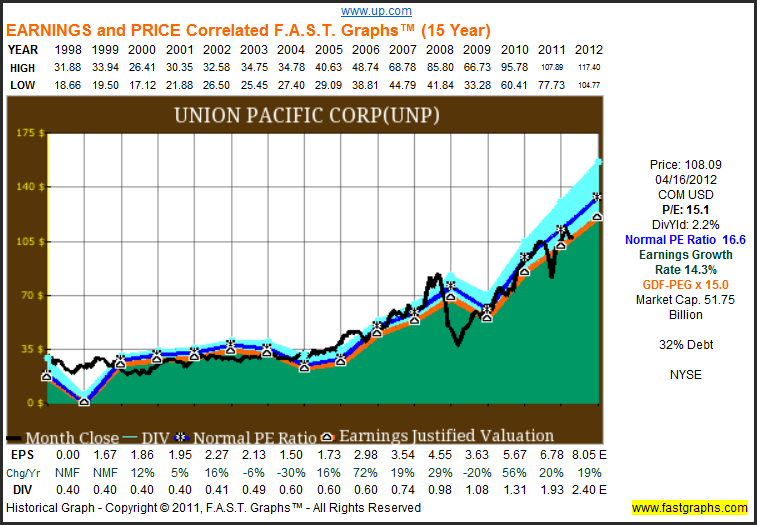

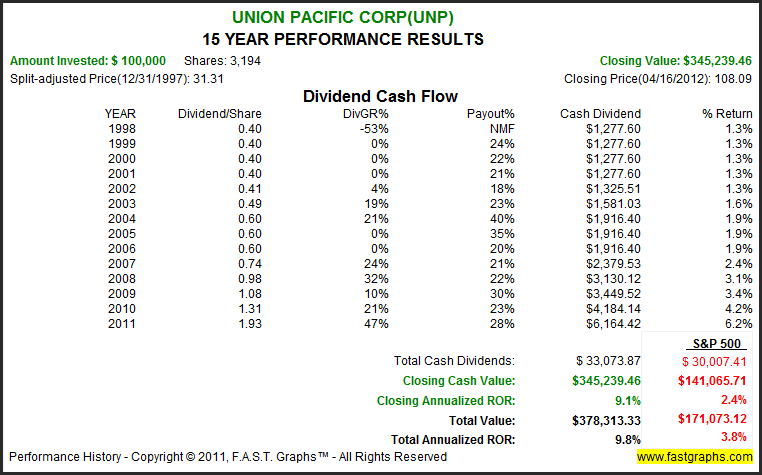

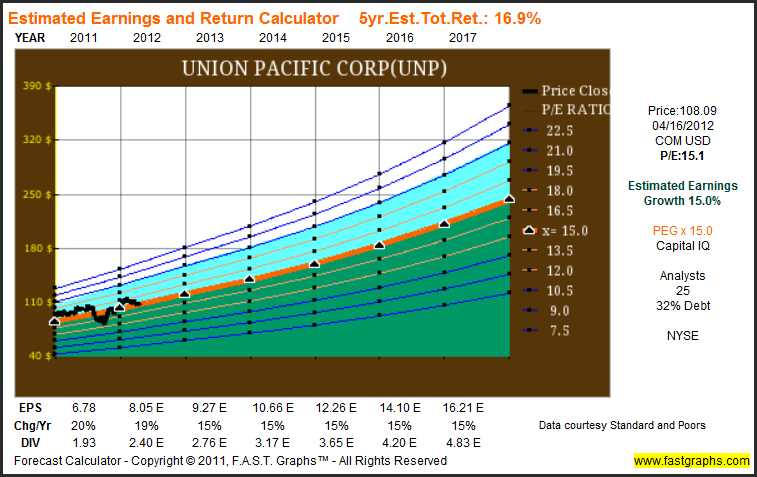

“It was 150 years ago that Abraham Lincoln signed the Pacific Railway Act of July 1, 1862, creating the original Union Pacific. One of America's iconic companies, today, Union Pacific Railroad is the principal operating company of Union Pacific Corporation (NYSE: UNP), linking 23 states in the western two-thirds of the country by rail and providing freight solutions and logistics expertise to the global supply chain. From 2000 through 2011, Union Pacific spent more than $31 billion on its network and operations, making needed investments in America's infrastructure and enhancing its ability to provide safe, reliable, fuel-efficient and environmentally responsible freight transportation. Union Pacific's diversified business mix includes Agricultural Products, Automotive, Chemicals, Energy, Industrial Products and Intermodal. The railroad serves many of the fastest-growing U.S. population centers and emphasizes excellent customer service. Union Pacific operates competitive routes from all major West Coast and Gulf Coast ports to eastern gateways, connects with Canada's rail systems and is the only railroad serving all six major Mexico gateways.”

The consensus of 25 leading analysts reporting to Capital IQ forecast Union Pacific Corp’s long-term earnings growth at 15%. Union Pacific Corp has medium long-term debt at 32% of capital. Union Pacific Corp is currently trading at a P/E of 15.1, which is inside the value corridor (defined by the five orange lines) of a maximum P/E of 18. If the earnings materialize as forecast, Union Pacific Corp’s True Worth™ valuation would be $243.19 at the end of 2017, which would be a 16.9% annual rate of return from the current price.

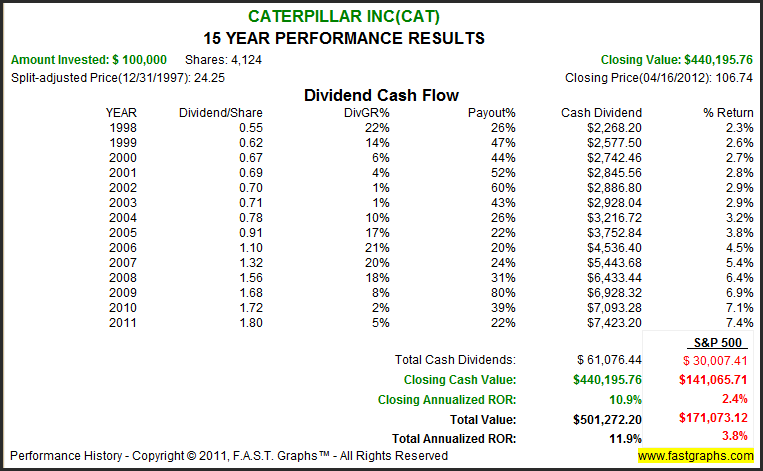

“For more than 85 years, Caterpillar Inc. has been making sustainable progress possible and driving positive change on every continent. With 2011 sales and revenues of $60.138 billion, Caterpillar is the world’s leading manufacturer of construction and mining equipment, diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives. The company also is a leading services provider through Caterpillar Financial Services, Caterpillar Remanufacturing Services, Caterpillar Logistics Services and Progress Rail Services.”

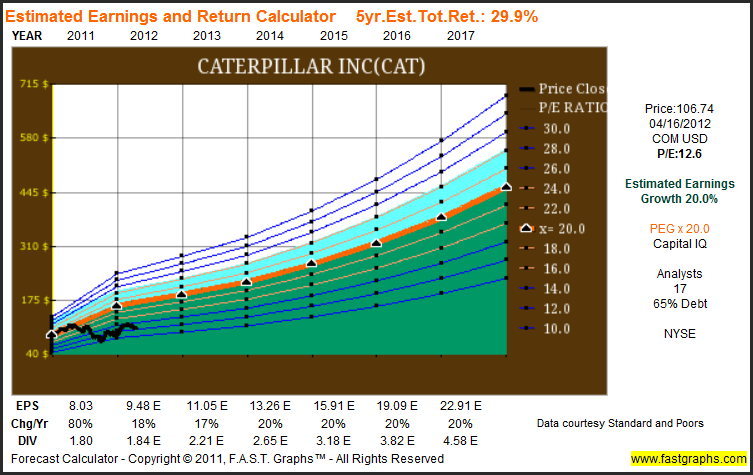

The consensus of 17 leading analysts reporting to Capital IQ forecast Caterpillar Inc’s long-term earnings growth at 20%. Caterpillar Inc has high long-term debt at 65% of capital. Caterpillar Inc is currently trading at a P/E of 12.6, which is below the value corridor (defined by the five orange lines) of a maximum P/E of 24. If the earnings materialize as forecast, Caterpillar Inc’s True Worth™ valuation would be $458.27 at the end of 2017, which would be a 29.9% annual rate of return from the current price.

Summary and Conclusions

Each of the six large-cap industrial companies reviewed in this article are expected to deliver significantly above-average growth for at least the next 3 to 5 years. But most importantly, each of these selections are trading at fair to low valuations based on current expectations for growth. Therefore, if the estimates prove correct they would offer the opportunity for above-average capital gains and a potentially growing dividend income stream. However, prospective investors should carefully consider the cyclical nature of each of these industrial stalwarts’ historical business results. If they were to be purchased, they also need to be carefully monitored regarding the health of their respective business levels.

Disclosure: No positions at the time of writing.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

6 Value, Large-Cap Industrial Stocks With Forecast Growth Of 15% Or Better

Published 04/18/2012, 06:27 AM

6 Value, Large-Cap Industrial Stocks With Forecast Growth Of 15% Or Better

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.