Micron Technology, Inc. (NASDAQ:MU) is currently one of the top-performing stocks in the technology sector and a rise in share price and strong fundamentals signal its bullish run. Therefore, if you haven’t taken advantage of the share price appreciation yet, it’s time you add the stock to your portfolio.

The company has performed extremely well so far this year and has the potential to carry on the momentum in the near term.

Why an Attractive Pick?

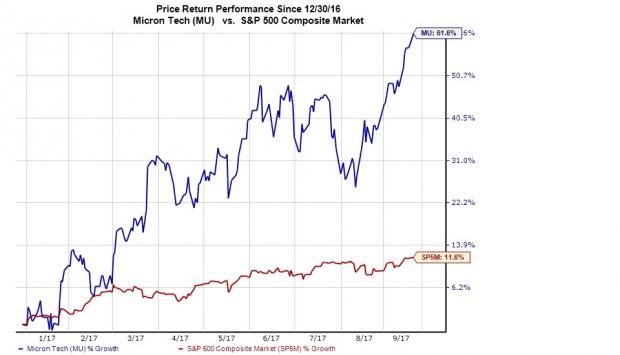

Share Price Appreciation: A glimpse of the company’s price trend reveals that the stock has had an impressive run on the bourse year to date. Micron returned a whopping 61.6%, which compared favorably with the S&P 500’s gain of 11.7%.

Solid Rank & VGM Score: Micron currently carries a Zacks Rank #1 (Strong Buy) and has a VGM Score of A. Our research shows that stocks with a VGM Score of A or B when combined with a Zacks Rank #1 or #2 (Buy) offer the best investment opportunities for investors. Thus, the company appears to be a compelling investment proposition at the moment.

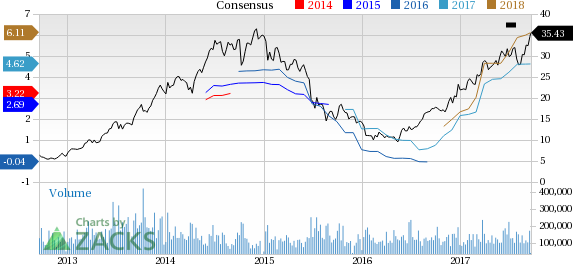

Northward Estimate Revisions: Four estimates for the current year moved north over the past 60 days versus no southward revisions, reflecting analysts’ confidence in the company. Over the same period, the Zacks Consensus Estimate for the current year increased 1.3%.

Micron Technology, Inc. Price and Consensus

Positive Earnings Surprise History: Micron has an impressive earnings surprise history. The company outpaced the Zacks Consensus Estimate in the trailing four quarters, delivering a positive average earnings surprise of 23.1%.

Strong Growth Prospects: The company’s Zacks Consensus Estimate for 2017 earnings of $4.62 reflects year-over-year growth of 7,602.2%. Moreover, earnings are expected to register 32.2% growth in 2018. The stock has long-term expected earnings per share growth rate of 10%.

Growth Drivers: Micron offers both DRAM and NAND products. While DRAM chips are key components in PCs, NAND flash chips are crucial for portable electronic devices.

Improving prices for DRAM and NAND chips make us confident about Micron’s growth. Per various sources, the prices for these specific chips have improved primarily due to a better product mix optimization and higher-than-expected demand for PCs, servers and mobiles.

Mergers and acquisitions are actively expanding Micron's core business. Notably, the company acquired the remaining stake in Inotera in December and made the brand a wholly owned subsidiary in Taiwan.

It is worth mentioning that Inotera will have some operational benefits, leading to efficient management of investment levels and cadence, followed by alignment with global manufacturing operations.

Going forward, the acquisitions of Elpida and Rexchip (now known as Micron Memory Japan, Inc. and Micron Memory Taiwan Co., Ltd., respectively) will increase Micron’s traction in the memory market.

Micron is positive about the product launches and growing demand, particularly that of SSD products. We also believe that any increase in prices will have a favorable impact on the company’s overall results. We anticipate these benefits to be a tailwind for the company, going forward.

Other Stocks to Consider

Other stocks worth considering in the broader technology sector include Activision Blizzard, Inc. (NASDAQ:ATVI) , Applied Materials, Inc. (NASDAQ:AMAT) and Lam Research Corporation (NASDAQ:LRCX) , each carrying a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings per share growth rate for Activision, Applied Materials and Lam Research is projected to be 13.6%, 17.1% and 17.2%, respectively.

4 Promising Stock Picks to Keep an Eye On

With news stories about computer hacking and identity theft becoming increasingly commonplace, the cybersecurity industry looks like a promising investment opportunity. But which stocks should you buy? Zacks just released Cybersecurity: An Investor’s Guide to Locking Down Profits to help answer this question.

This new Special Report gives you the information you need to make well-informed investment choices in this space. More importantly, it also highlights 4 cybersecurity picks with strong profit potential.

Get the new Investing Guide now>>

Activision Blizzard, Inc (ATVI): Free Stock Analysis Report

Micron Technology, Inc. (MU): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Original post

Zacks Investment Research