In order to cushion portfolio, it is important for investors to exit underperforming stocks, which may dent returns. Global manufacturer of flexible packaging products and pressure sensitive materials, Bemis Company Inc. (BMS) seems to be an underachiever of late and needs to be plucked out of investors’ stock garden immediately.

We note that the industry occupies a space in the bottom 16% of the Zacks industries (216 out of the 256).

Estimates Moving South: The estimates for the company in third-quarter 2017, fiscal 2017 and fiscal 2018, have moved south in the past 30 days, reflecting the negative outlook of analysts. For the third quarter, the estimate has gone down 8% to 66 cents per share. For fiscal 2017, the estimate has dipped 7% to $2.37 in the past 30 days. For fiscal 2018, the estimate has gone down 6% to $2.67 per share.

Bemis Company, Inc. (BMS): Free Stock Analysis Report

Terex Corporation (TEX): Free Stock Analysis Report

Caterpillar, Inc. (CAT): Free Stock Analysis Report

AGCO Corporation (AGCO): Free Stock Analysis Report

Original post

Let’s delve deeper to find out what’s weighing upon investor sentiment.

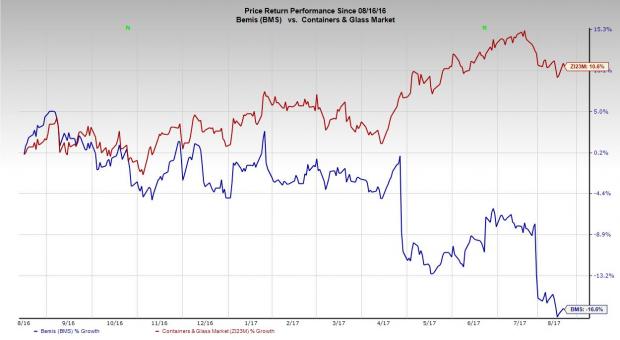

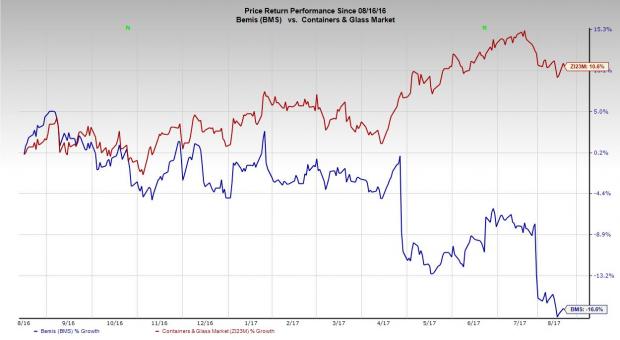

An Underperformer: This Zacks Rank #4 (Sell) stock has declined 16.6% in the past one year, grossly underperforming the industry's gain of 11%.

We note that the industry occupies a space in the bottom 16% of the Zacks industries (216 out of the 256).

Lackluster Q2, Guidance: Bemis' top and bottom lines witnessed a respective 1% and 28% year-over-year decline in second-quarter 2017, missing the Zacks Consensus Estimate on both counts. Results in the quarter were affected by challenging economic environment in Brazil due to the political instability.

Bemis lowered 2017 adjusted earnings per share guidance range to $2.35-$2.50 from the prior range of $2.50-$2.60 due to the impact of the sharp contraction and tough economic environment in Brazil.

Riddled With Near-Term Headwinds: The Brazilian economy is likely to remain challenging for the balance of 2017. However, Bemis is working aggressively to take out incremental variable and fixed costs from business, but it will be difficult to meet original profit plans in the region due to extreme declines and lower mix of product due to the economic environment. Further, restructuring expenses will be a drag on earnings in the near term.

Bemis continues to bear the brunt of a flat-to-declining U.S. packaged food market. In eight of the past nine years, volumes in the core flexible packaging business have been flat to down as the company continues to struggle within a complex supply chain. The top line has been on a downward spiral over the past few years as is evident from the chart below.

Estimates Moving South: The estimates for the company in third-quarter 2017, fiscal 2017 and fiscal 2018, have moved south in the past 30 days, reflecting the negative outlook of analysts. For the third quarter, the estimate has gone down 8% to 66 cents per share. For fiscal 2017, the estimate has dipped 7% to $2.37 in the past 30 days. For fiscal 2018, the estimate has gone down 6% to $2.67 per share.

Negative Surprise History: Bemis delivered a negative earnings surprise of 14.29% in the last reported quarter. The company has an average negative earnings surprise history of 5.89% in the trailing four quarters.

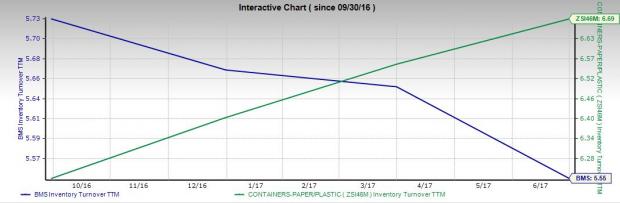

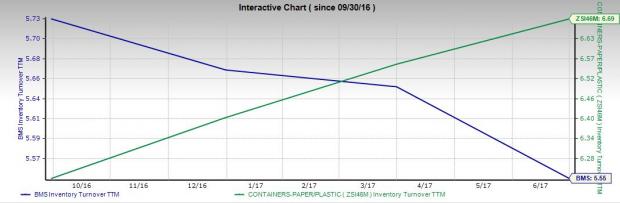

Lower Inventory Turnover Ratio: In the trailing 12 months, the inventory turnover ratio for Bemis has been 5.55% compared with the industry’s level of 6.69%. This is a signal of inefficiency, and implies either poor sales or excess inventory.

Stocks to Consider

Some better-ranked stocks in the same sector are AGCO Corporation (AGCO), Caterpillar Inc. (CAT) and Terex Corporation (TEX). All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AGCO has an expected long-term growth rate of 13.51%.

Caterpillar has an expected long-term growth rate of 9.50%.

Terex has an expected long-term growth rate of 19.67%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

In order to cushion portfolio, it is important for investors to exit underperforming stocks, which may dent returns. Global manufacturer of flexible packaging products and pressure sensitive materials, Bemis Company Inc. (NYSE:BMS) seems to be an underachiever of late and needs to be plucked out of investors’ stock garden immediately.

Let’s delve deeper to find out what’s weighing upon investor sentiment.

An Underperformer: This Zacks Rank #4 (Sell) stock has declined 16.6% in the past one year, grossly underperforming the industry's gain of 10.6%.

We note that the industry occupies a space in the bottom 16% of the Zacks industries (216 out of the 256).

Lackluster Q2, Guidance: Bemis' top and bottom lines witnessed a respective 1% and 28% year-over-year decline in second-quarter 2017, missing the Zacks Consensus Estimate on both counts. Results in the quarter were affected by challenging economic environment in Brazil due to the political instability.

Bemis lowered 2017 adjusted earnings per share guidance range to $2.35-$2.50 from the prior range of $2.50-$2.60 due to the impact of the sharp contraction and tough economic environment in Brazil.

Riddled With Near-Term Headwinds: The Brazilian economy is likely to remain challenging for the balance of 2017. However, Bemis is working aggressively to take out incremental variable and fixed costs from business, but it will be difficult to meet original profit plans in the region due to extreme declines and lower mix of product due to the economic environment. Further, restructuring expenses will be a drag on earnings in the near term.

Bemis continues to bear the brunt of a flat-to-declining U.S. packaged food market. In eight of the past nine years, volumes in the core flexible packaging business have been flat to down as the company continues to struggle within a complex supply chain. The top line has been on a downward spiral over the past few years as is evident from the chart below.

Estimates Moving South: The estimates for the company in third-quarter 2017, fiscal 2017 and fiscal 2018, have moved south in the past 30 days, reflecting the negative outlook of analysts. For the third quarter, the estimate has gone down 8% to 66 cents per share. For fiscal 2017, the estimate has dipped 7% to $2.37 in the past 30 days. For fiscal 2018, the estimate has gone down 6% to $2.67 per share.

Negative Surprise History: Bemis delivered a negative earnings surprise of 14.29% in the last reported quarter. The company has an average negative earnings surprise history of 5.89% in the trailing four quarters.

Lower Inventory Turnover Ratio: In the trailing 12 months, the inventory turnover ratio for Bemis has been 5.55% compared with the industry’s level of 6.69%.

This is a signal of inefficiency, and implies either poor sales or excess inventory.

This is a signal of inefficiency, and implies either poor sales or excess inventory.

Stocks to Consider

Some better-ranked stocks in the same sector are AGCO Corporation (NYSE:AGCO) , Caterpillar Inc. (NYSE:CAT) and Terex Corporation (NYSE:TEX) . All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AGCO has an expected long-term growth rate of 13.51%.

Caterpillar has an expected long-term growth rate of 9.50%.

Terex has an expected long-term growth rate of 19.67%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

Bemis Company, Inc. (BMS): Free Stock Analysis Report

Terex Corporation (TEX): Free Stock Analysis Report

Caterpillar, Inc. (CAT): Free Stock Analysis Report

AGCO Corporation (AGCO): Free Stock Analysis Report

Original post