- European and U.S. banks closely watch interest rate decisions by the Federal Reserve and the European Central Bank, with significant shifts expected.

- There is a list of banks on both sides that are trading below their fair value and that the market consensus gives them potential.

- Notable banks like Deutsche Bank, Citi, UniCredit, Wells Fargo, Santander, and Truist Financial reveal key financial insights and future prospects.

- Want to invest by taking advantage of market opportunities? Don't hesitate, try InvestingPro now. Sign up HERE & NOW for less than $9 per month!

European and U.S. banks are closely monitoring the forthcoming interest rate decisions by the Federal Reserve and the European Central Bank.

In Europe, the landscape has already shifted with interest rate reductions implemented by the Bank of Switzerland and the Bank of Sweden. The upcoming months, particularly June, are anticipated to witness similar actions by the ECB and the Bank of England.

In the United States, initial projections hinted at as many as four rate cuts for the year. However, the persistence of uncontrolled inflation has necessitated a reassessment, leading to a potential delay or even the possibility of no rate adjustments.

Overall, European banks are exhibiting stronger performance compared to their U.S. counterparts, attributable to strategic cost-cutting, improved balance sheets, and minimal loan loss provisions. Notably, in 2024, these banks are poised to allocate a substantial 120 billion euros towards share buybacks and dividends.

The recent announcement by Bank of Ireland, alongside others such as BNP Paribas (OTC:BNPQY), Deutsche Bank, and Santander, underscores this trend of bolstering investor returns.

Projections indicate a noteworthy increase in dividend yield for the top 50 European banks, from 5.8% in 2022 to 7.3% in 2024, with a slight dip to 7.2% in 2025 before rebounding to 7.4% in 2026.

In tandem, the average European interbank lending rate is expected to surpass 2023 levels in 2024, with only marginal declines in interest income. Presently, banks are experiencing robust earnings outpacing distribution capabilities, leading to an augmentation of capital ratios.

These trends are mirrored in the stock market, where the 15 largest European banks outshone their U.S. counterparts in 2023, marking a significant deviation from the norm observed over the past decade. Meanwhile, the Stoxx 600 Banks index has surged to heights unseen since 2015.

On Wall Street, the leading five banks disclosed fourth-quarter year-over-year reductions in commercial and investment banking revenues, registering declines of 20% and 17%, respectively. However, the downturns for the entire year were notably less pronounced.

Now, turning our attention to some noteworthy banks, both in the U.S. and Europe, we'll leverage the InvestingPro tool to delve into pertinent data and insights.

1. Deutsche Bank (Germany)

Deutsche Bank (ETR:DBKGn) (NYSE:DB) is Germany's biggest lender and was founded in 1870. The behemoth bank is headquartered in Frankfurt am Main, Germany, the country's financial capital.

On May 21 it distributes a dividend of 0.45 euros per share and to receive it you must have shares before May 17.

Source: InvestingPro

It reports its earnings results on July 24 and EPS is expected to increase by 11.89%.

Source: InvestingPro

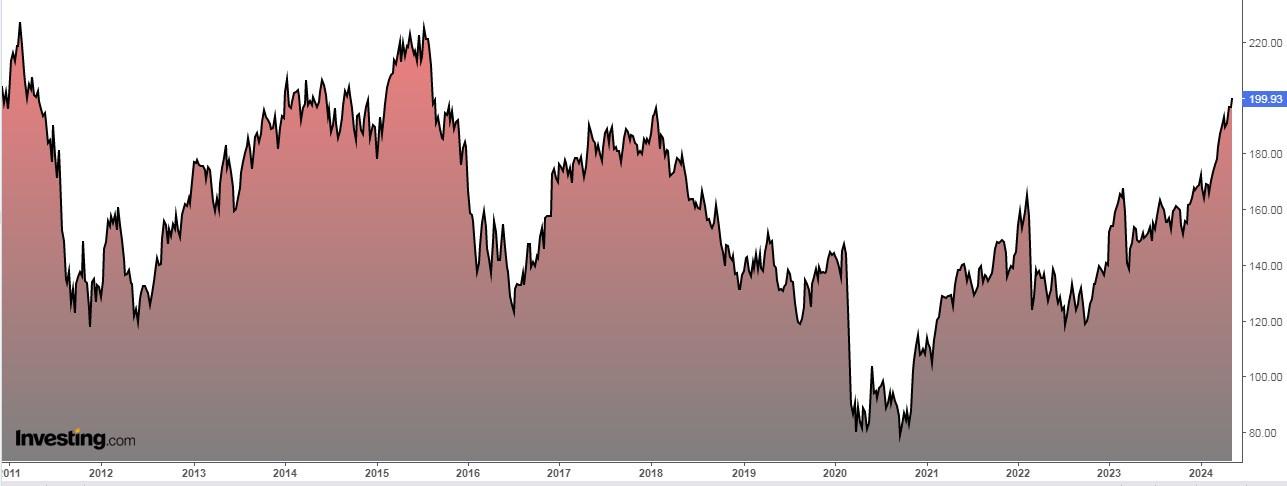

Shares have risen 70.40% in the last 12 months.

Its fair value, based on its fundamentals, stands at 17.69 euros, which represents a potential of around 11% (at the close of the week).

Source: InvestingPro

2. Citi (USA)

Established in 1812 in New York City, Citigroup Inc (NYSE:C) has evolved into a formidable global presence, boasting operations spanning across continents.

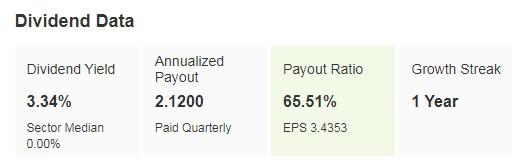

It currently pays a dividend yield of 3.34%.

Source: InvestingPro

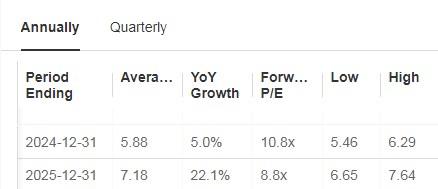

It will present earnings again on July 12. Looking ahead to the year, EPS is expected to increase by 5% and 22.1% the following year.

Source: InvestingPro

Citi recently made a strategic investment in Cicada Technologies, a company that enables electronic trading of 28 Mexican government bonds.

It also completed a restructuring of its trade lending business to improve its profitability and valuation.

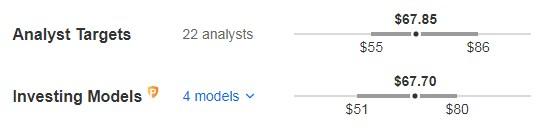

Its shares are up 44% in the last 12 months. The market sees potential for it at $67.85 and its fair value is at $67.70.

Source: InvestingPro

3. Unicredit (BIT:CRDI) (Italy)

UniCredit (OTC:UNCRY) (ETR:CRIG) was founded in 1870 and is based in Milan, Italy.

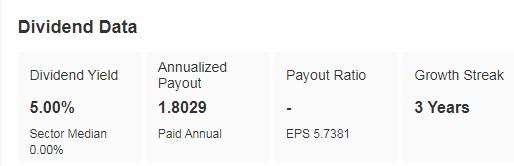

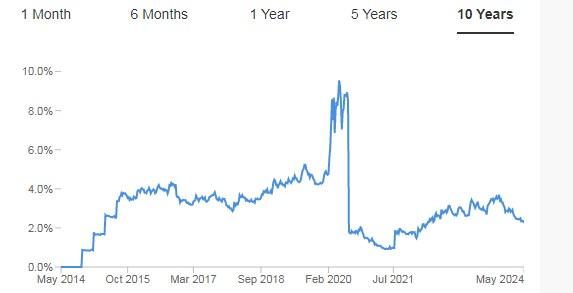

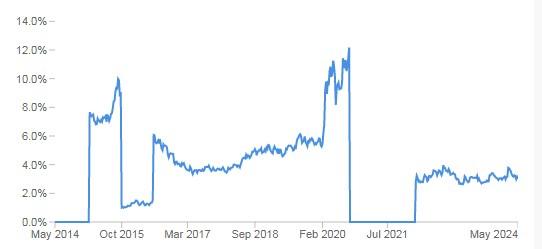

Its dividend yield is 5%.

Source: InvestingPro

On July 24, we will know its quarterly accounts and it is expected to increase EPS by 10.38% and revenue by 4.44%.

Source: InvestingPro

It has excess capital of €10 billion with which it needs to decide what to do with.

Its shares are up 101.20% in the last 12 months.

Market consensus sees potential at €41.43.

Source: InvestingPro

4. Wells Fargo (U.S.)

Wells Fargo was founded in 1852 in New York City, but is now headquartered in San Francisco, California.

Its dividend yield is 2.26%.

Source: InvestingPro

It will release its numbers on July 12, with EPS expected to increase by 10.73% and revenue by 4.57%.

Source: InvestingPro

The bank announced a few days ago the launch of Signify Business Cash World Elite Mastercard (NYSE:MA), its new business credit card with cash rewards. Offering unlimited cash rewards of 2% on business purchases, with no limits and no annual fee, it provides business owners with easy-to-understand rewards and attractive value.

Its shares are up 66% over the past 12 months.

Its fair value on fundamentals would be at $65.90.

Source: InvestingPro

5. Santander (Spain)

The company was formerly known as Banco Santander Central Hispano and changed its name to Banco Santander (BME:SAN) (NYSE:SAN) in February 2007. It was founded in 1856 and is headquartered in Spain.

The estimated dividend yield for 2024 is 4.63%.

Source: InvestingPro

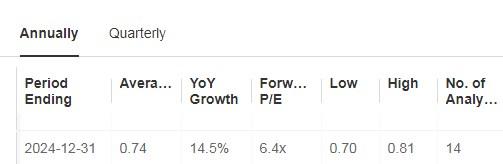

On July 24 it presents its quarterly accounts. For 2024 the forecast is for EPS growth of 14.5% and revenue of 5.6%.

Source: InvestingPro

The shares are up 56% in the last 12 months.

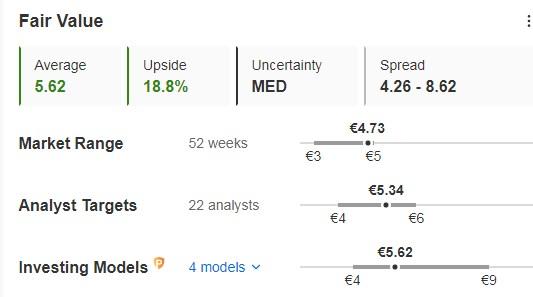

Its fair value stands at €5.62 and the market gives it potential at €5.34.

Source: InvestingPro

6. Truist Financial

The company was formerly known as BB&T Corporation and changed its name to Truist Financial (NYSE:TFC) in December 2019. It was founded in 1872 and is headquartered in Charlotte, North Carolina.

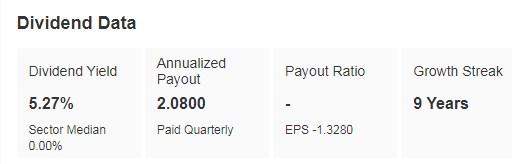

Its dividend yield is 5.27% and has maintained its dividend payments for 52 consecutive years.

Source: InvestingPro

It will release its earnings report on July 22. In the previous one it beat forecasts by 11.8% (EPS).

Source: InvestingPro

The recent sale of Truist Insurance Holdings resulted in a substantial after-tax gain. The sale has strengthened the capital position that supports further balance sheet restructuring, share buybacks and organic growth.

Its shares are up 56.52% over the last 12 months.

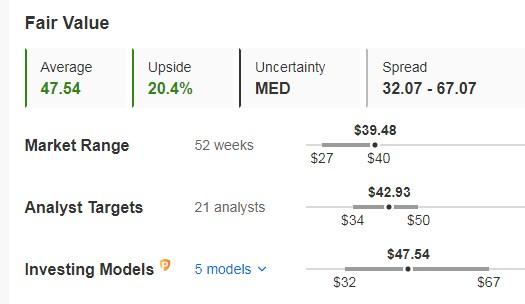

Its fair value stands at $47.54 and the market sees it rising to $42.93.

Source: InvestingPro

How can you consistently seize market opportunities? Seize the moment RIGHT HERE AND NOW to secure InvestingPro's annual plan for under $9 per month. Use the code INVESTINGPRO1 and unlock a 40% discount on your 1-year subscription - costing you less than a Netflix (NASDAQ:NFLX) membership! (Plus, you'll reap greater rewards from your investments too).

With InvestingPro, you gain access to:

- ProPicks: AI-managed portfolios exhibiting proven performance.

- ProTips: Simplified insights distilling complex financial data into actionable advice.

- Advanced Stock Finder: Locate top-performing stocks tailored to your expectations, considering a multitude of financial metrics.

- Comprehensive historical financial data for thousands of stocks, empowering fundamental analysis professionals to explore every detail.

And that's just the beginning! Stay tuned for additional services in the pipeline.