5-Year Bond Non-Commercial Speculator Positions:

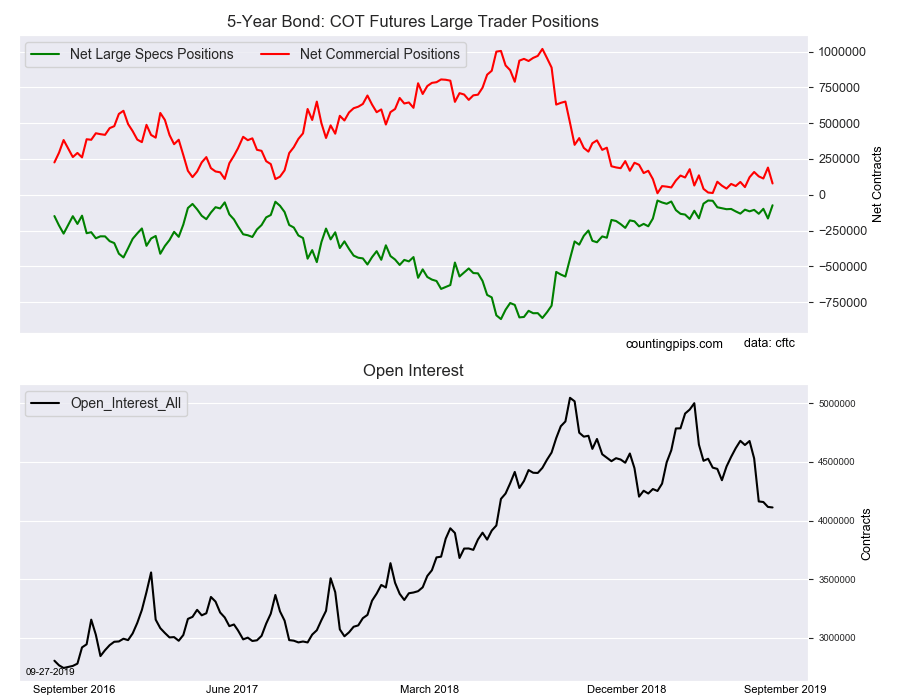

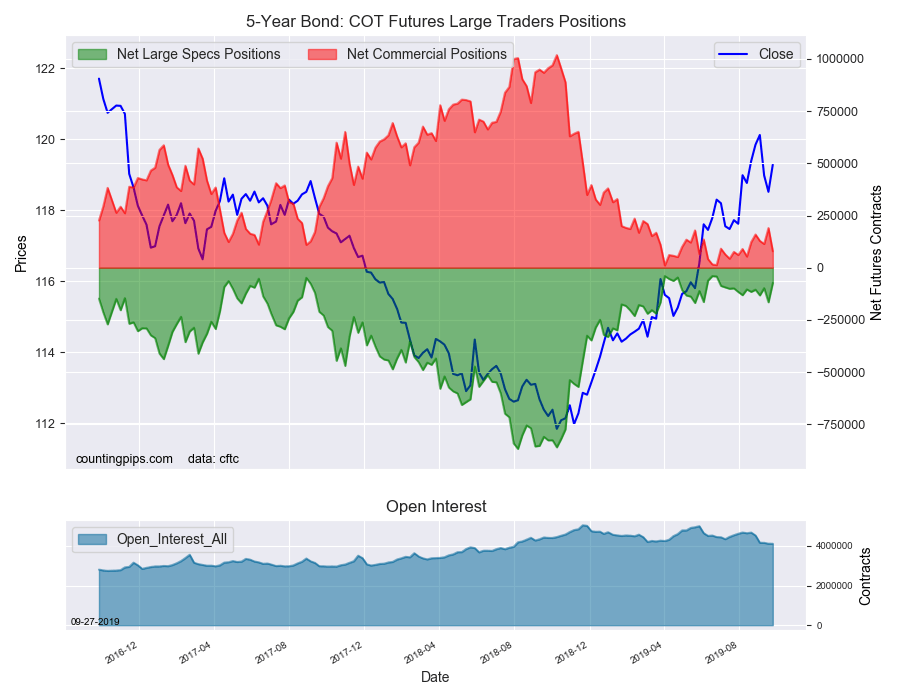

Large bond speculators reduced their bearish net positions in the 5-Year Bond futures markets last week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 5-Year Bond futures, traded by large speculators and hedge funds, totaled a net position of -72,968 contracts in the data reported through Tuesday September 24th. This was a weekly change of 92,409 net contracts from the previous week which had a total of -165,377 net contracts.

The week’s net position was the result of the gross bullish position (longs) ascending by 36,497 contracts (to a weekly total of 727,916 contracts) while the gross bearish position (shorts) fell by -55,912 contracts for the week (to a total of 800,884 contracts).

Five-year speculators sharply reduced their existing bearish positions last week for the second time in three weeks. The decline represented the largest one-week drop in fifteen weeks and brought the net position to the least bearish level of the past thirteen weeks.

Overall, the current bearish position is just a fraction of the speculator’s bearishness in 2018 which saw bearish bets get as high as -850,000 contracts.

5-Year Bond Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 79,093 contracts on the week. This was a weekly decrease of -110,919 contracts from the total net of 190,012 contracts reported the previous week.

5-Year Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 5-Year Futures (Front Month) closed at approximately $119.28 which was a boost of $0.76 from the previous close of $118.51, according to unofficial market data.