Investing.com’s stocks of the week

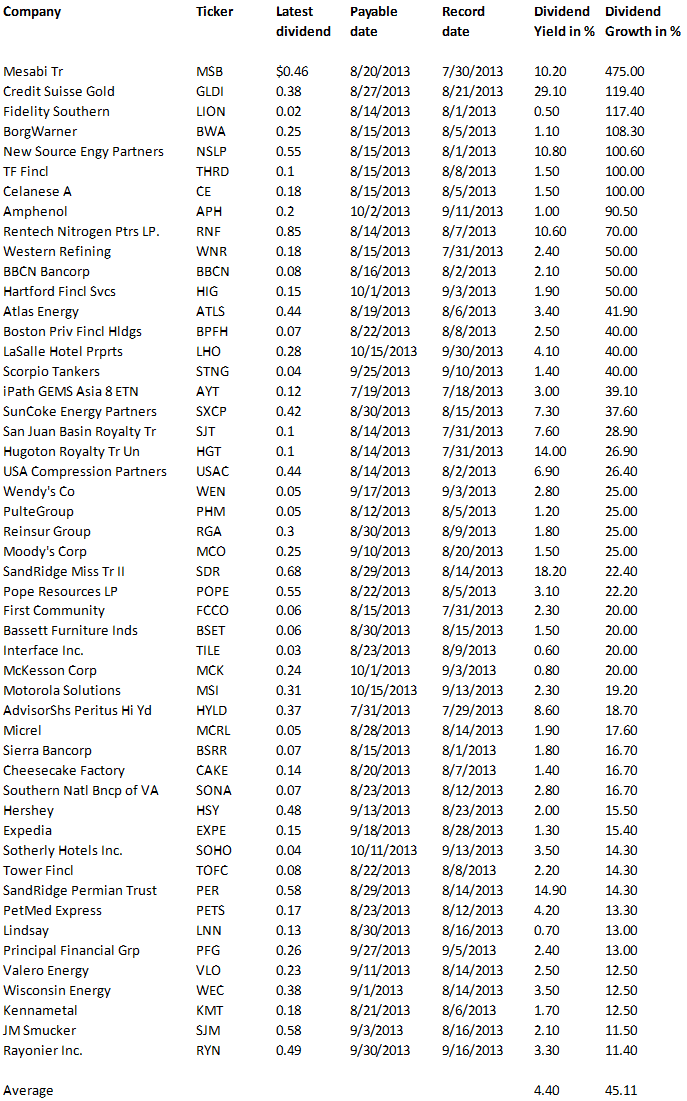

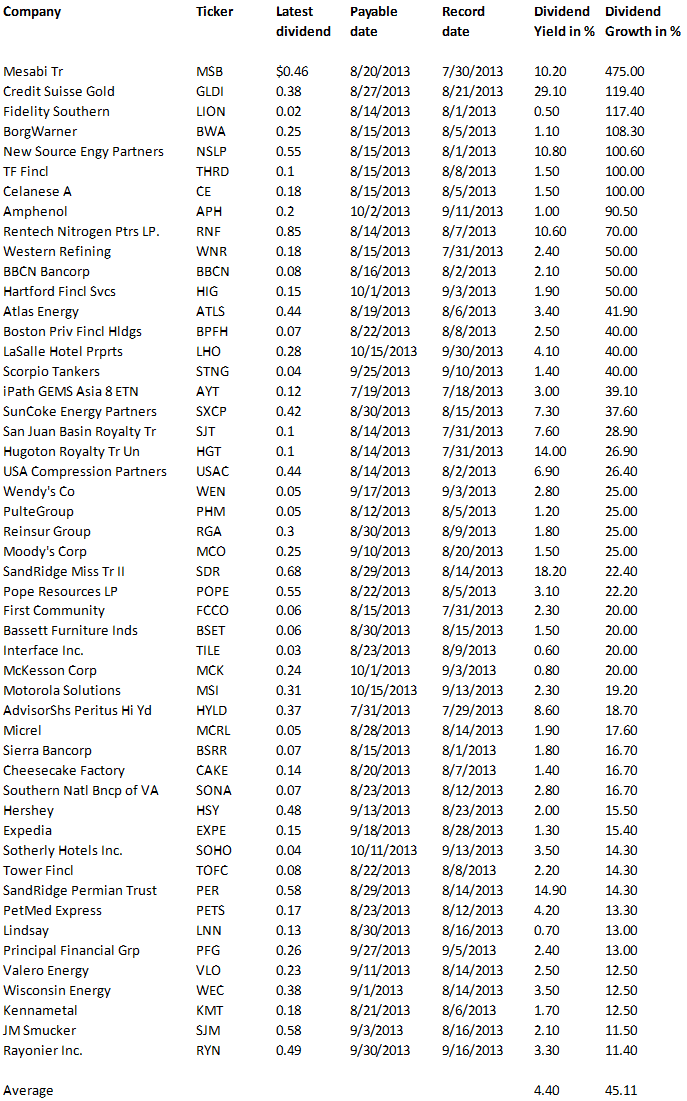

Today I'm updating the 50 fastest dividend growers from the past month. Once again, there are some pretty good stocks with very good growth rates. The average dividend growth of the 50 best stocks amounts to 45.11 percent. Four of the 50 dividend growers have a double-digit dividend yield and ten have a high-yield over 5 percent. Around half of the results still have a buy or better rating.

Wendy's (WEN) has a market capitalization of $2.78 billion. The company employs 44,000 people, generates revenue of $2.505 billion and has a net income of $7.96 million. Wendy's earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $368.51 million. The EBITDA margin is 14.71 percent (the operating margin is 1.90 percent and the net profit margin 0.32 percent).

Financial Analysis: The total debt represents 33.87 percent of Wendy's assets and the total debt in relation to the equity amounts to 73.40 percent. Due to the financial situation, a return on equity of 0.28 percent was realized by Wendy's. Twelve trailing months earnings per share reached a value of $0.03. Last fiscal year, Wendy's paid $0.10 in the form of dividends to shareholders. WEN increased dividends by 25.0 percent.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 224.37, the P/S ratio is 1.12 and the P/B ratio is finally 1.41. The dividend yield amounts to 2.80 percent and the beta ratio has a value of 1.00.

Moody's (MCO) has a market capitalization of $14.43 billion. The company employs 6,831 people, generates revenue of $2.730 billion and has a net income of $699.70 million. Moody's earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $1.183 billion. The EBITDA margin is 43.33 percent (the operating margin is 39.46 percent and the net profit margin 25.63 percent).

Financial Analysis: The total debt represents 42.19 percent of Moody's assets and the total debt in relation to the equity amounts to 433.85 percent. Due to the financial situation, a return on equity of 638.30 percent was realized by Moody's. Twelve trailing months earnings per share reached a value of $3.35. Last fiscal year, Moody's paid $0.68 in the form of dividends to shareholders. MCO increased dividends by 25.0 percent.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 19.34, the P/S ratio is 5.20 and the P/B ratio is finally 37.31. The dividend yield amounts to 1.55 percent and the beta ratio has a value of 1.38.

Expedia (EXPE) has a market capitalization of $6.26 billion. The company employs 12,330 people, generates revenue of $4.030 billion and has a net income of $302.98 million. Expedia’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $627.68 million. The EBITDA margin is 15.57 percent (the operating margin is 10.71 percent and the net profit margin 7.52 percent).

Financial Analysis: The total debt represents 17.63 percent of Expedia’s assets and the total debt in relation to the equity amounts to 54.79 percent. Due to the financial situation, a return on equity of 13.51 percent was realized by Expedia. Twelve trailing months earnings per share reached a value of $0.99. Last fiscal year, Expedia paid $0.96 in the form of dividends to shareholders. EXPE increased dividends by 1.3 percent.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 46.53, the P/S ratio is 1.58 and the P/B ratio is finally 2.80. The dividend yield amounts to 1.10 percent and the beta ratio has a value of 15.40.

McKesson (MCK) has a market capitalization of $28.41 billion. The company employs 43,500 people, generates revenue of $122.455 billion and has a net income of $1.338 billion. McKesson’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $2.899 billion. The EBITDA margin is 2.37 percent (the operating margin is 1.73 percent and the net profit margin 1.09 percent).

Financial Analysis: The total debt represents 14.01 percent of McKesson’s assets and the total debt in relation to the equity amounts to 68.93 percent. Due to the financial situation, a return on equity of 19.25 percent was realized by McKesson. Twelve trailing months earnings per share reached a value of $5.82. Last fiscal year, McKesson paid $0.80 in the form of dividends to shareholders. MCK increased dividends by 20.0 percent.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 21.34, the P/S ratio is 0.23 and the P/B ratio is finally 4.01. The dividend yield amounts to 0.77 percent and the beta ratio has a value of 0.80.

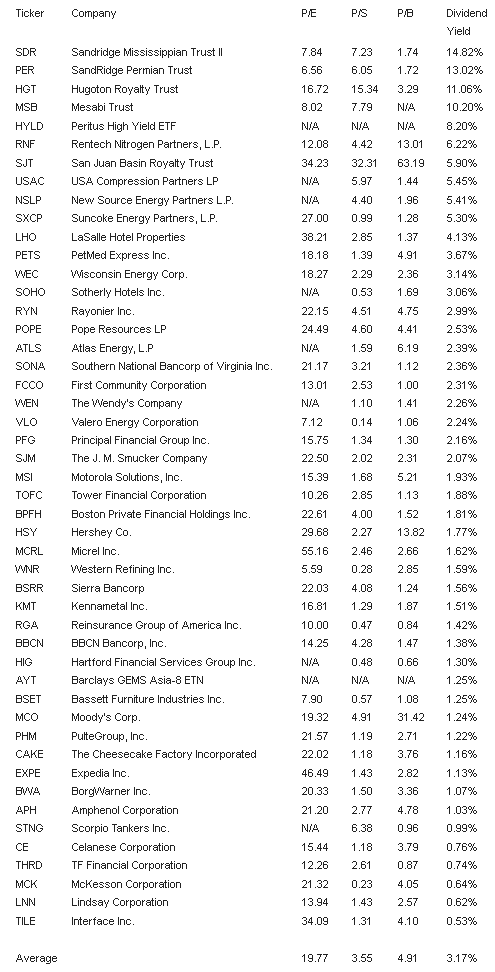

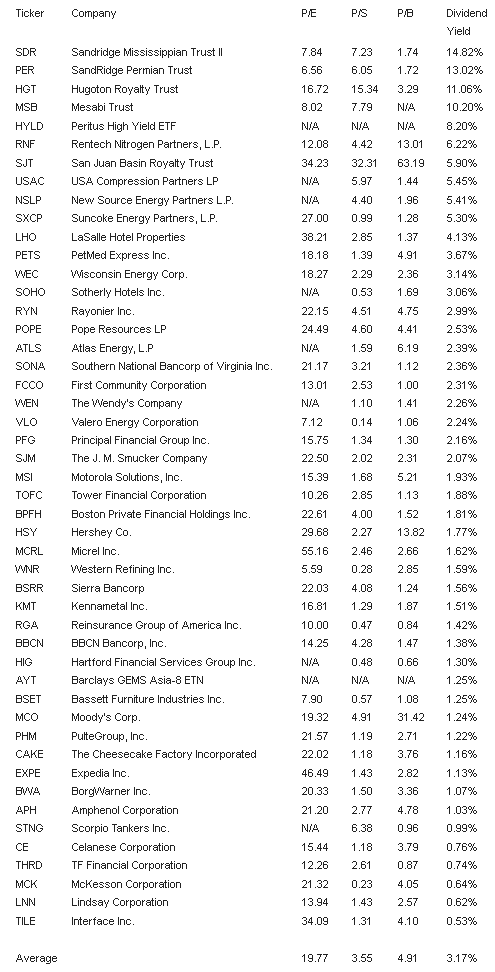

Take a closer look at the full list of the 50 top stocks with fastest dividend growth from last month. The average P/E ratio amounts to 19.77. The dividend yield has a value of 3.17 percent. Price to book ratio is 4.91 and price to sales ratio 3.55.

These are the 50 fastest dividend growers of the past month:

Related Stock Ticker:

MSB,GLDI,LION,BWA,NSLP,THRD,CE,APH,RNF,WNR,BBCN,HIG,ATLS,BPFH,LHO,STNG,AYT,SXCP,

SJT,HGT,USAC,WEN,PHM,RGA,MCO,SDR,POPE,FCCO,BSET,TILE,MCK,MSI,HYLD,MCRL,BSRR,CAKE,

SONA,HSY,EXPE,SOHO,TOFC,PER,PETS,LNN,PFG,VLO,WEC,KMT,SJM,RYN

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I receive no compensation to write about any specific stock, sector or theme.

Wendy's (WEN) has a market capitalization of $2.78 billion. The company employs 44,000 people, generates revenue of $2.505 billion and has a net income of $7.96 million. Wendy's earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $368.51 million. The EBITDA margin is 14.71 percent (the operating margin is 1.90 percent and the net profit margin 0.32 percent).

Financial Analysis: The total debt represents 33.87 percent of Wendy's assets and the total debt in relation to the equity amounts to 73.40 percent. Due to the financial situation, a return on equity of 0.28 percent was realized by Wendy's. Twelve trailing months earnings per share reached a value of $0.03. Last fiscal year, Wendy's paid $0.10 in the form of dividends to shareholders. WEN increased dividends by 25.0 percent.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 224.37, the P/S ratio is 1.12 and the P/B ratio is finally 1.41. The dividend yield amounts to 2.80 percent and the beta ratio has a value of 1.00.

Moody's (MCO) has a market capitalization of $14.43 billion. The company employs 6,831 people, generates revenue of $2.730 billion and has a net income of $699.70 million. Moody's earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $1.183 billion. The EBITDA margin is 43.33 percent (the operating margin is 39.46 percent and the net profit margin 25.63 percent).

Financial Analysis: The total debt represents 42.19 percent of Moody's assets and the total debt in relation to the equity amounts to 433.85 percent. Due to the financial situation, a return on equity of 638.30 percent was realized by Moody's. Twelve trailing months earnings per share reached a value of $3.35. Last fiscal year, Moody's paid $0.68 in the form of dividends to shareholders. MCO increased dividends by 25.0 percent.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 19.34, the P/S ratio is 5.20 and the P/B ratio is finally 37.31. The dividend yield amounts to 1.55 percent and the beta ratio has a value of 1.38.

Expedia (EXPE) has a market capitalization of $6.26 billion. The company employs 12,330 people, generates revenue of $4.030 billion and has a net income of $302.98 million. Expedia’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $627.68 million. The EBITDA margin is 15.57 percent (the operating margin is 10.71 percent and the net profit margin 7.52 percent).

Financial Analysis: The total debt represents 17.63 percent of Expedia’s assets and the total debt in relation to the equity amounts to 54.79 percent. Due to the financial situation, a return on equity of 13.51 percent was realized by Expedia. Twelve trailing months earnings per share reached a value of $0.99. Last fiscal year, Expedia paid $0.96 in the form of dividends to shareholders. EXPE increased dividends by 1.3 percent.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 46.53, the P/S ratio is 1.58 and the P/B ratio is finally 2.80. The dividend yield amounts to 1.10 percent and the beta ratio has a value of 15.40.

McKesson (MCK) has a market capitalization of $28.41 billion. The company employs 43,500 people, generates revenue of $122.455 billion and has a net income of $1.338 billion. McKesson’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $2.899 billion. The EBITDA margin is 2.37 percent (the operating margin is 1.73 percent and the net profit margin 1.09 percent).

Financial Analysis: The total debt represents 14.01 percent of McKesson’s assets and the total debt in relation to the equity amounts to 68.93 percent. Due to the financial situation, a return on equity of 19.25 percent was realized by McKesson. Twelve trailing months earnings per share reached a value of $5.82. Last fiscal year, McKesson paid $0.80 in the form of dividends to shareholders. MCK increased dividends by 20.0 percent.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 21.34, the P/S ratio is 0.23 and the P/B ratio is finally 4.01. The dividend yield amounts to 0.77 percent and the beta ratio has a value of 0.80.

Take a closer look at the full list of the 50 top stocks with fastest dividend growth from last month. The average P/E ratio amounts to 19.77. The dividend yield has a value of 3.17 percent. Price to book ratio is 4.91 and price to sales ratio 3.55.

These are the 50 fastest dividend growers of the past month:

Related Stock Ticker:

MSB,GLDI,LION,BWA,NSLP,THRD,CE,APH,RNF,WNR,BBCN,HIG,ATLS,BPFH,LHO,STNG,AYT,SXCP,

SJT,HGT,USAC,WEN,PHM,RGA,MCO,SDR,POPE,FCCO,BSET,TILE,MCK,MSI,HYLD,MCRL,BSRR,CAKE,

SONA,HSY,EXPE,SOHO,TOFC,PER,PETS,LNN,PFG,VLO,WEC,KMT,SJM,RYN

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I receive no compensation to write about any specific stock, sector or theme.