The 17th of February, 2014, marked the annual observation of George Washington's birthday and the 5th anniversary of the American Recovery and Reinvestment Act. Given that is has been half a decade since President Obama signed that bill into law, it would not surprise me if you did not immediately recognize what it entailed. However, the term "Government Bailout" will certainly jolt your recollection.

The WSJ penned a great opener:

"The $830 billion spending blowout was sold by the White House as a way to keep unemployment from rising above 8%. But the stimulus would fail on its own terms. 2009 marked the first of four straight years when unemployment averaged more than 8%. And of course the unemployment rate would have been even worse in those years and still today if so many people had not quit the labor force, driving labor-participation rates to 1970s levels."

Given that Governments are generally the worst allocators of capital it should come as no real surprise that the money was squandered on non-productive investments.

"$783,000 was spent on a study of why young people consume malt liquor and marijuana. $92,000 went to the Army Corps of Engineers for costumes for mascots like Bobber the Water Safety Dog. $219,000 funded a study of college 'hookups.'"

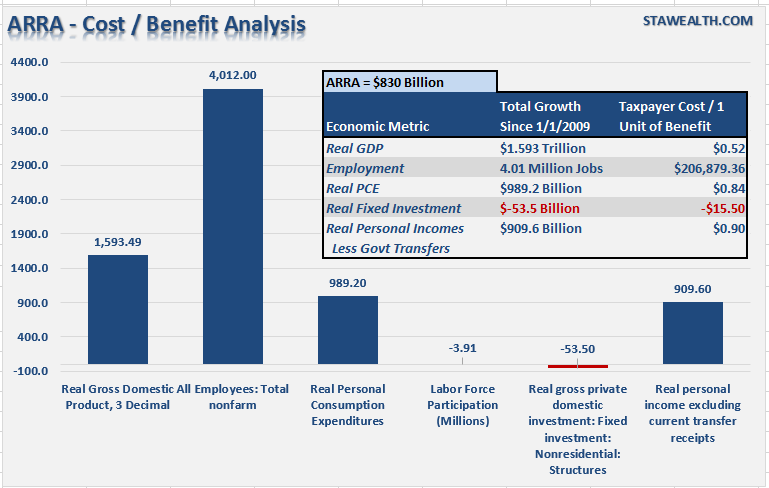

However, it really is much worse than that. The table below shows the "taxpayer cost" of the bailout on various economic metrics.

It cost taxpayers roughly more than $0.50 for each and every dollar of economic growth over the last 5 years. $206,879 for every job created. $0.84 for every dollar of real personal consumption expenditures and $0.90 for every dollar of increase in real personal incomes (not including government transfers).

The ARRA was supposed to boost "shovel ready" infrastructure and investment projects by businesses which would have created jobs and economic prosperity. Sadly, that was not to be the case as fixed investment has fallen $53.50 for every dollar of government funded bailout while the labor force participation declined by almost 4 million.

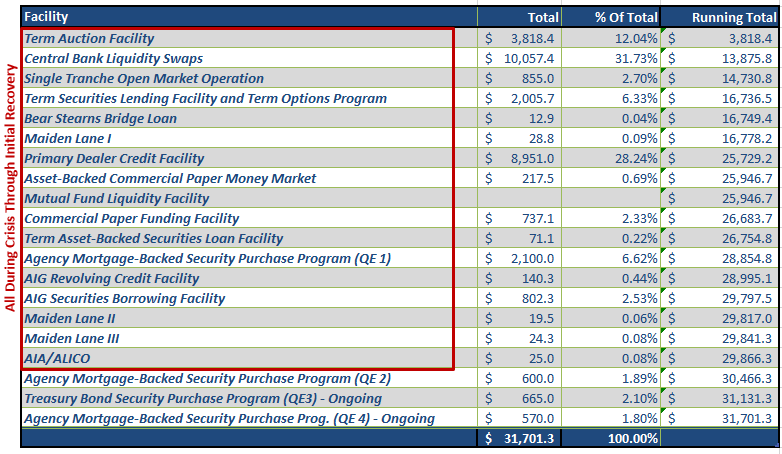

However, that is really not the whole story to be told of government bailouts and interventions. As I discussed previously, the real total of government interventions, bailouts and artificial supports far exceeds the initial ARRA of $830 billion. Today, as shown in the table below, that number has risen above $31 Trillion.

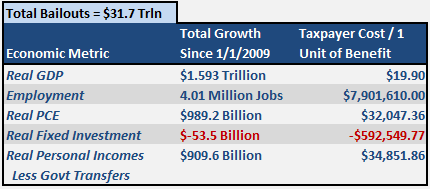

If we apply the total of all government interventions into the same analysis as above, we find a far more disappointing result.

At a cost of $19.90 for each dollar of economic growth, almost $8 million for each job created and a loss of nearly $600,000 of fixed investment, it is hard to suggest that the government interventions have been successful. The Wall Street journal really summed it up best:

"The failure of the stimulus was a failure of the neo-Keynesian belief that economies can be jolted into action by a wave of government spending. In fact, people are smart enough to realize that every dollar poured into the economy via government spending must eventually be taken out of the productive economy in the form of taxes. The way to jolt an economy to life and to sustain long-term growth is to create more incentives for people to work, save and invest. Let's hope Washington's next stimulus plan is aimed at reducing the tax and regulatory burden on American job creators."

This is exactly correct. It is also something I discuss each month when I review the NFIB's monthly small business survey. The government has done an extremely poor job of allocating capital and trying to pick "winners over losers." Increased regulations and taxes have inhibited job growth while the Fed's artificial interventions have created the greatest "wealth transfer" from the middle class to the rich in U.S. history. This has led to a toxic mix of economic slack, low labor force participation, suppressed wage growth, and high levels of government dependency.

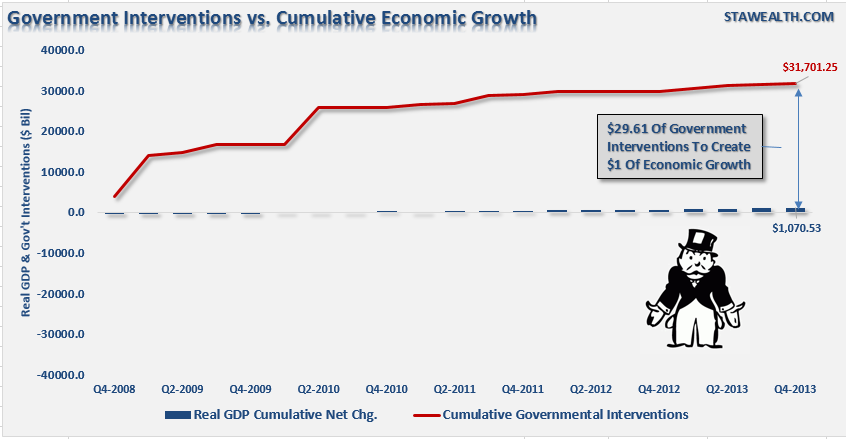

I do not disagree with the argument that, without government interventions, the economic recession would have been far worse. However, there is also no real evidence that the economy is gaining any organic traction either. This is due to the continued misallocation of resources, combined with ever increasing levels of government debt, which continue to rob future economic growth for short term stability. This is clearly shown by the chart below.

Of course, five years after all the bailouts began, the Keynesian argument remains "fool proof." The only reason that the economy is not growing faster is because the government is not doing enough. However, if the economy slips back into a recession, it will simply be because the government did not do enough. You simply can't argue against logic like that.