General Dynamics), Ticker: $GD

General Dynamics (NYSE:GD) started higher in December and continued to a top in April. It pulled back to a higher low at the end of May and then reversed higher again. This move ended near the prior high and it dropped back again. It has been consolidating at a higher low for the past month. The RSI is rising toward the bullish zone with the MACD lifting as well. Look for a break of consolidation to participate…..

MetLife, Ticker: $MET

MetLife (NYSE:MET) ran to a top in July out of a short consolidation in the spring. Since then it has made a couple of higher lows and a lower high, tightening in a triangle. It ended last week at the top of the triangle and short term resistance. The RSI is rising and bullish with the MACD positive and moving higher. Look for a break higher to participate…..

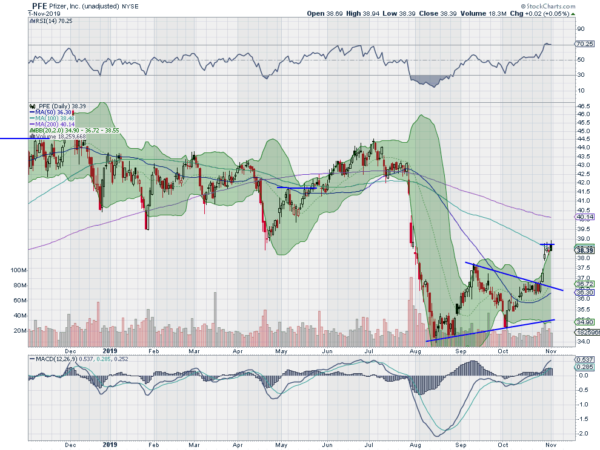

Pfizer) , Ticker: $PFE

Pfizer (NYSE:PFE) broke a symmetrical triangle and moved higher last week. It stalled and consolidated with the RSI bullish and near overbought while the MACD rises. Look for a break of consolidation to participate…..

Union Pacific, Ticker: $UNP

Union Pacific (NYSE:UNP) made a top in early May and has been unable to move higher since. it began making lower lows with the latest in October. Since then it has moved higher, and broke a bull flag last week. The RSI is rising and bullish with the MACD rising and positive. Look for a push over short term resistance to participate…..

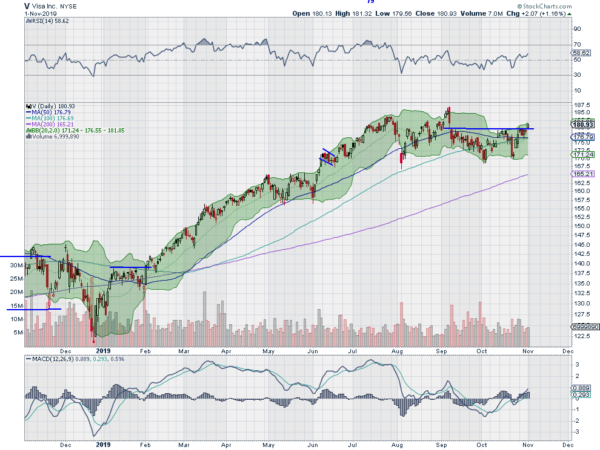

Visa, Ticker: $V

Visa (NYSE:V) started higher off of a bottom in December. It continued to a top in July and then pulled back. Another surge made it to a higher high in September before pulling back again.Since then it has consolidated under resistance with the RSI rising and bullish and the MACD positive and moving up. Look for continuation over resistance to participate…..

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.