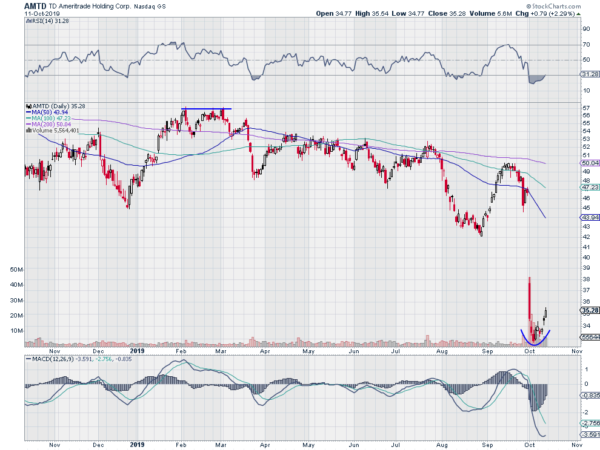

TD Ameritrade Ticker: $AMTD

TD Ameritrade Holding Corporation (NASDAQ:AMTD), was drifting lower with the falling 200 day SMA as resistance until late September. It then gapped down on strong volume and found support. Last week ended with the start of a reversal higher. The RSI is also moving up out of oversold territory with the MACD turning to cross up. Look for continuation to participate.

Apache Ticker: $APA

Apache Corporation (NYSE:APA), started lower in April and found a bottom in August. It bounced from there but stalled as it reached the 200 day SMA and reversed back lower. Now it appears to be reversing higher again. The RSI is also reversing and the MACD is leveling. Look for continuation higher to participate.

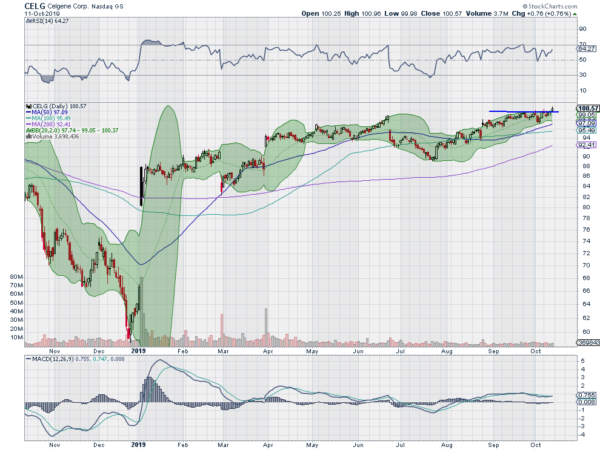

Celgene Ticker: $CELG

Celgene Corporation (NASDAQ:CELG), started higher off of a December low. It gapped up into January and then slowed its move up. After a top in June it gapped down and has been drifting higher. It ended last week making a new 20 month high with the RSI rising and bullish and the MACD level and positive. Look for continuation to participate.

Fiserv Ticker: $FISV

Fiserv Inc (NASDAQ:FISV), started to rise out of consolidation in June. It accelerated into August and then slowed to a top in September. It pulled back from there and has consolidated under resistance. The RSI is rising back towards the bullish zone and the MACD is crossed up and positive. Look for a push over resistance to participate.

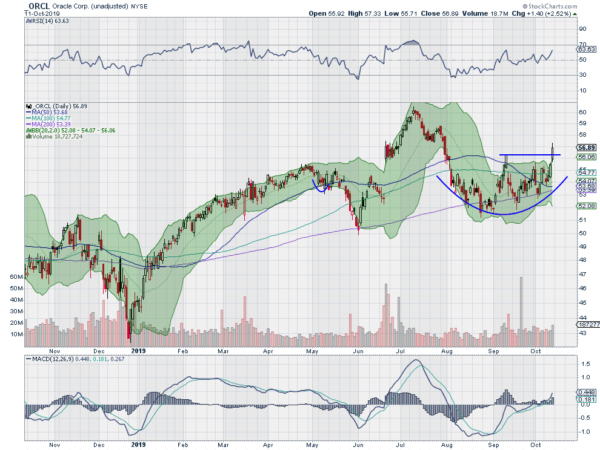

Oracle Ticker: $ORCL

Oracle Corporation (NYSE:ORCL), started off of a December low and continued to a top in July. Since then it has pulled back to the 200 day SMA and has been riding it slowly. Last week it pushed up to a higher high with the MACD rising and bullish and the MACD positive and moving up. Look for continuation to participate.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.