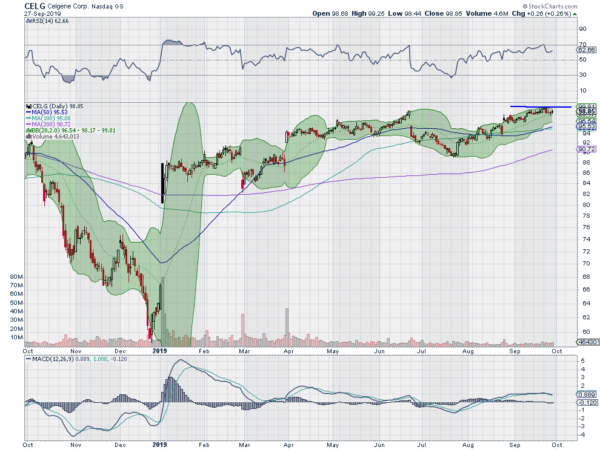

Celgene Corporation (NASDAQ:CELG)

Celgene (NASDAQ:CELG), $CELG, gapped higher in January and then settled into a more of a drift, mostly sideways. It is currently moving over the 20 day SMA toward the highs. The RSI is turning up in the bullish zone with the MACD leveling and positive. Look for a push higher to participate…..

Graphic Packaging Holding Company (NYSE:GPK)

Graphic Packaging, $GPK, rose out of a double bottom at the end of January. It paused there for 2 months then continued higher in a series of steps and pullback to a top in July. The drop from there retested the 200 day SMA and reversed in August. It paused as it broke the June and July highs and Friday started a second move higher. The RSI is rising in the bullish zone with the MACD rising and positive. Look for continuation to participate…..

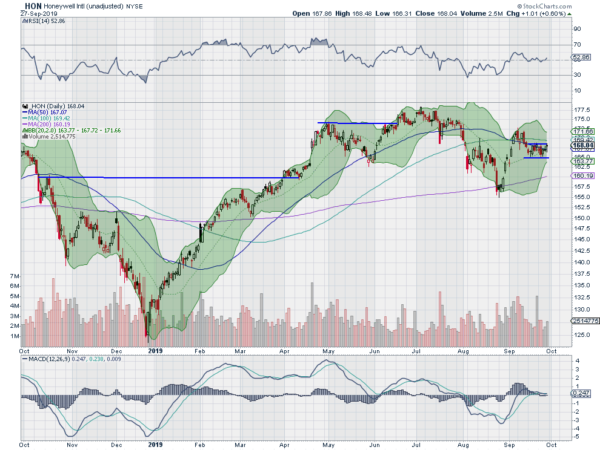

Honeywell International Inc (NYSE:HON)

Honeywell (NYSE:HON), $HON, rose from a December low and made a top in July. It pulled back from there, touching the 200 day SMA, and then reversed. It rose to a lower high and then digested that with a pullback into consolidation. Friday it ended at the top of that consolidation. The RSI is holding in the bullish zone with the MACD flat at zero. Look for a new push higher to participate…..

Interactive Brokers Group Inc (NYSE:IBKR)

Interactive Brokers, $IBKR, went through a long broad consolidation From October last year until dropping lower in August. It confirmed a double bottom as it rose higher in September and enters the week breaking short term resistance. The RSI is rising and bullish with the MACD turning back up. Look for continuation to participate…..

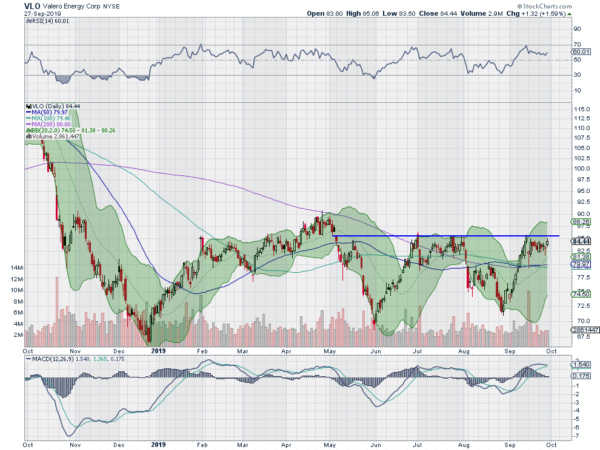

Valero Energy Corporation (NYSE:VLO)

Valero Energy (NYSE:VLO), $VLO, bottomed after a long move lower in December. It bounced and moved to a peak at the end of April only to fall back again. Another bounce found a lower high before another downturn. It is rising out of that drop now and in short term consolidation. The RSI is holding in the bullish zone with the MACD flat and positive. Look for a push higher to participate…..

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.