5 Trade ideas excerpted from the detailed analysis and plan for premium subscribers:

Amneal Pharmaceuticals Inc Class A (NYSE:AMRX)

Amneal Pharmaceuticals, AMRX, topped in September last year and started to move lower. It found support at the 200 day SMA and bounced, but to a lower high. It held there over the 200 day SMA for 2 months, building falling trend resistance before a dump into May. That was followed by another test of resistance and pullback to a higher low. The next test of that falling resistance did not hold and it broke to the upside. Now it has made a higher high and testing 4 month resistance. The RSI is bullish and rising with the MACD also moving higher and positive. Look for a push higher to participate.

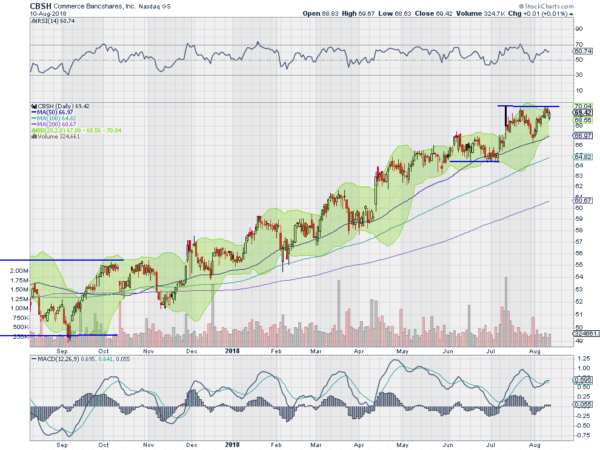

Commerce Bancshares Inc (NASDAQ:CBSH)

Commerce Bancshares, CBSH, has moved steadily higher after breaking out of consolidation in November. It peaked in July after earnings and pulled back to its 50 day SMA. Now it has reversed back to resistance. The RSI is in the bullish zone with the MACD crossed up and rising. Look for a new high to participate.

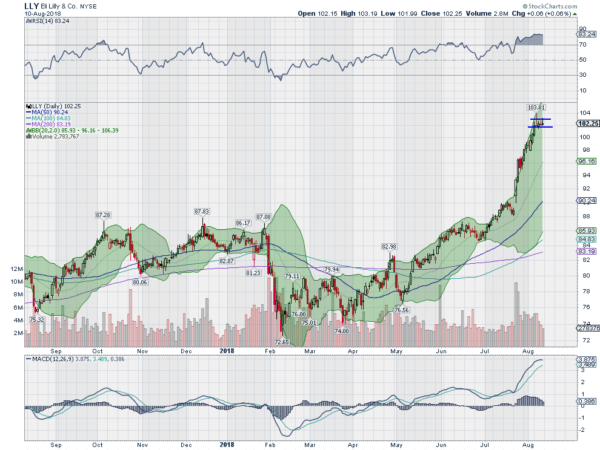

Eli Lilly and Company (NYSE:LLY)

Eli Lilly, LLY, started higher in February, crossing the 200 day SMA and staying there in May. Since then it has skyrocketed higher. For the last week it has been consolidating, awaiting the next move. The RSI is deep into overbought territory with the MACD leveling at highs. Look for a break of consolidation to participate.

Marathon Petroleum Corporation (NYSE:MPC)

Marathon Petroleum, MPC, started higher in September and continued to a January peak. It pulled back from there to the 100 day SMA in February before making another surge higher. This met resistance at the end of April. Since then it has pulled back 3 times, each finding support and reversing back to resistance. The RSI is in the bullish zone with the MACD flat and positive after reaching resistance again. Look for a push to a new high to participate.

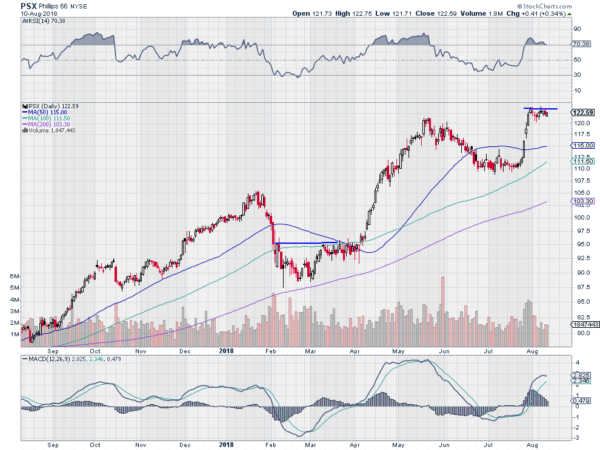

Phillips 66 (NYSE:PSX)

Phillips 66, PSX, broke above consolidation in April and quickly ran to a top in May. It had a drawn out pullback from there to a low that lasted 1 month into the middle of July. Since then it has moved back higher and is now consolidating at the prior high. The RSI is working off an overbought condition during the consolidation with the MACD flat. Look for a break of consolidation to participate.

Up Next: Bonus Idea

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.