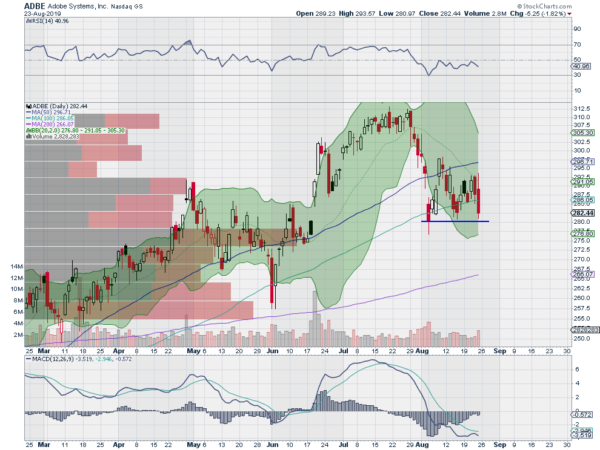

Adobe (NASDAQ:ADBE), Ticker: $ADBE

Adobe (NASDAQ:ADBE), $ADBE, rose from a December low and met resistance in the end of April. It pulled back, consolidating the move, to a low at the end of May and then reversed. The move higher plateaued in July and it has pulled back again in August. The RSI is stalled and running flat as the MACD is avoiding a cross up with price on support. Look for a break down to participate…..

Amgen (NASDAQ:AMGN), Ticker: $AMGN

Amgen (NASDAQ:AMGN), $AMGN, bottomed in May after a break of support. It stalled on a move higher in early July and reversed to a higher low. It came back to retest resistance and then moved higher after a brief digestion. Since then it has consolidated but Friday fell back hard to support. The RSI is pulling back from overbought with the MACD about to cross down. Look for a break of support to participate…..

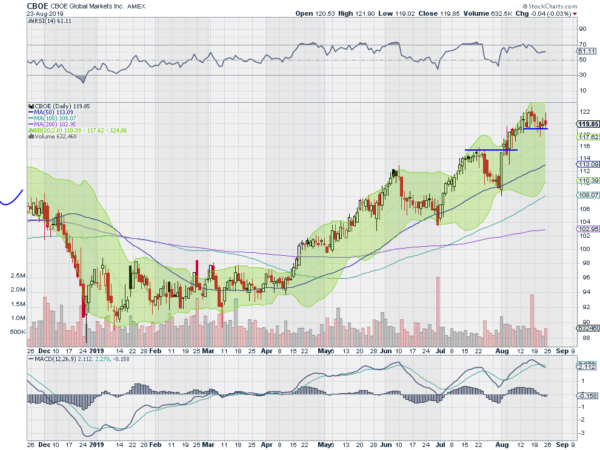

CBOE, Ticker: $CBOE

CBOE, $CBOE, has risen steadily out of a base ending in April. It has had a couple of consolidative pullbacks along the way to the current peak. As it sits on support the RSI is pulling back in the bullish zone with the MACD crossed down. Look for a break of support to participate….

Walt Disney (NYSE:DIS), Ticker: $DIS

Walt Disney (NYSE:DIS), $DIS, gapped up over resistance in April and rose to a peak. It could not hold and pulled back to support for the month of May. Another push higher made a higher high, but this also did not hold and it is now back at support. The RSI is into the bearish zone with the MACD failing to cross up. Look for a break of support to participate…..

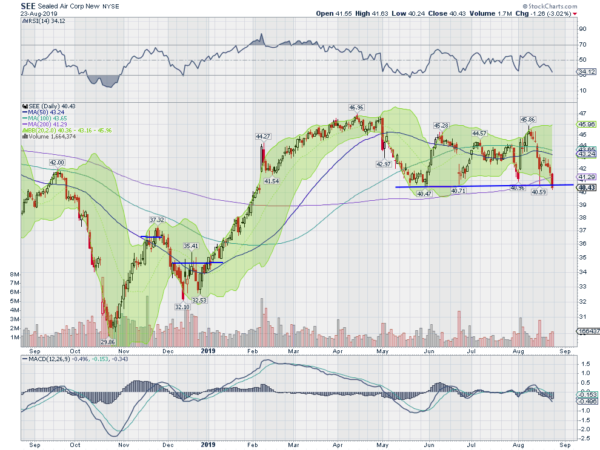

Sealed Air (NYSE:SEE), Ticker: $SEE

Sealed Air (NYSE:SEE), $SEE, started higher in October and stalled into November. It pulled back to a higher low and reversed in December leading to a top in April. It pulled back from there and has been bouncing over support since. The RSI is falling in the bearish zone with the MACD falling and negative. Look for a continued drop through support to participate…..

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.