2016 has been a busy year for the Biotech industry. Let’s take a look 5 of the strongest year-to-date (YTD) performers.

Here are five Biotech stocks that have experienced a YTD price change of >20% and sit at a Zacks Rank #2 (Buy) or better:

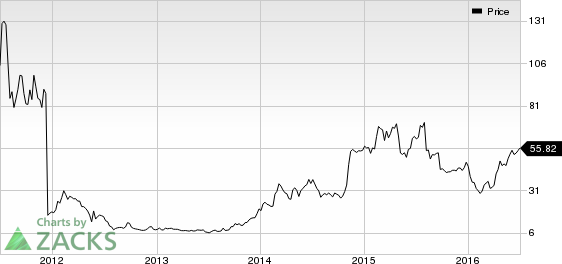

Ani Pharmaceutical (NASDAQ:ANIP) is a specialty pharmaceutical company that develops generic prescription medicines. Their products range from cough/cold products to laxatives, amongst others.

ANIP has gained 23.7% YTD, and has a 100% agreement in upward earnings estimate revisions for this fiscal year. Analysts have revised Q2 estimates to $0.87 per share, up from $0.44 60 days ago.

ANIP currently sits at a Zacks Rank #1 (Strong Buy).

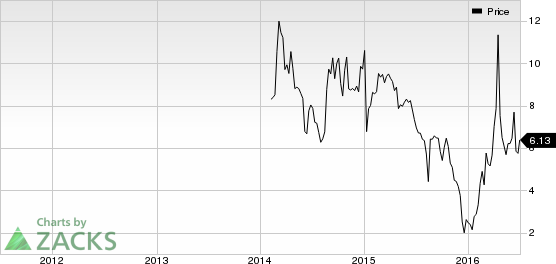

Argos Therapeutic (NASDAQ:ARGS) develops personalized immunotherapies for the treatment of cancer and other infectious diseases.

ARGS has gained a stellar 165.4% YTD, and has a 100% agreement upward in earnings estimate revisions for this fiscal year and 75% Agreement for next fiscal year. Analysts have revised Q2 estimates to -$0.40 per share, up from $-0.52 per share 60 days ago.

ARGS currently sits at a Zacks Rank #2 (Buy).

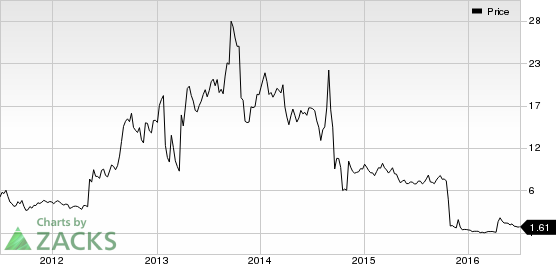

Xbiotech Inc. (NASDAQ:XBIT) discovers and develops monoclonal antibodies for treating diseases under their “True Human” brand.

XBIT has gained 92.5% YTD, and has 100% agreement in upward earnings estimate revisions for this fiscal year. Analysts have revised Q2 earnings estimates to -$0.38 per share, up from -$0.43 per share 60 days ago.

XBIT currently sits at Zacks Rank #2 (Buy).

Opexa Therapeutic (NASDAQ:OPXA) develops cell therapies to treat autoimmune diseases such as MS (multiple sclerosis), rheumatoid arthritis, and diabetes.

OPXA has gained 49.1% YTD, and has 100% agreement in upward earnings estimate revisions for this fiscal year. Current Q2 estimates sit at -$0.35 per share and have not been revised in 60 days, but analysts estimate earnings of $0.50 per share next fiscal year.

OPXA currently sits at a Zacks Rank #2 (Buy).

Repros Therapeutic (NASDAQ:RPRX) develops products for the human reproductive system.

RPRX has gained 33% YTD, and has 100% agreement in upward earnings estimate revisions for this fiscal year. Currently, there are no estimates for Q2 earnings, however estimates for this fiscal year are at -$0.74 per share, up from -$0.77 60 days ago.

RPRX currently sits at a Zacks Rank #2 (Buy).

Bottom Line

While these stocks have surged, they are all still looking great from an earnings estimate revision perspective. This suggests that these stocks could continue to see even more gains ahead. Any of them may still be worth a closer look even though they have already started 2016 on a very positive note.

REPROS THERAPEU (RPRX): Free Stock Analysis Report

OPEXA THERAPEUT (OPXA): Free Stock Analysis Report

ARGOS THERAPEUT (ARGS): Free Stock Analysis Report

XBIOTECH INC (XBIT): Free Stock Analysis Report

ANI PHARMACEUT (ANIP): Free Stock Analysis Report

Original post

Zacks Investment Research