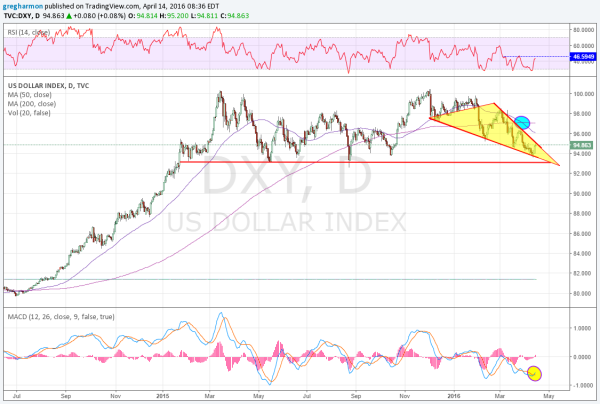

The US dollar index had a strong run higher from July 2014 until peaking in March 2015. Since then it has done nothing. Oh it is not a flat line for a year but there has certainly been stability. Bouncing off of support around the 92 level and resistance just over 100, it has traded in an 8 point range for that entire time. Yawn. So what makes it interesting now? There are 5 things you should watch that may signal a change of character.

The first is the most obvious one. As the mood since the start of March has been driving the Dollar Index lower, continue to watch the 92 level. Although it has acted as support 3 times already it may not the 4th time if it get to that level. A drop below could start a significant retracement to 88 (a 61.8% retracement of the up leg) or lower. Next is the Death Cross. The 50 day SMA crossing down through the 200 day SMA, which happened at the end of March, indicates accelerating short term momentum to the downside at the expense of longer term trend.

The Death Cross has often proven to be unreliable though and many times marked the bottom of a move lower. Which brings us to the other 3 items to watch which might indicate an upside move. The first is the falling wedge. This is often a reversal pattern and is triggered by a move over the top of the falling line. With the US dollar index at that line it is time to watch today. momentum is at a critical juncture as well. The MACD is crossing up, a bullish signal but just a bullish divergence for now. Should price follow that would add strength. The RSI is also on the edge of a push over the mid line in the bull zone. A move higher would add to the bullish divergence and make for a higher high in momentum. All positives.

The short term trend is down for now. But be aware of these potential bullish developments. If they prevail it may move the Dollar Index back to the top of the range, or even higher.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.