The technology sector continues to attract investors due to its dynamic nature. It is benefiting from increasing demand for cloud-based platforms, growing adoption of Artificial Intelligence (AI) solutions, Augmented/Virtual reality devices (AR/VR), autonomous cars, advanced driver assisted systems (ADAS) and Internet of Things (IoT) related software.

The technology sector has been a prolific performer on a year-to-date basis with the Technology Select Sector SPDR ETF (NYSE:XLK) registering a return of 22.8% year to date. The positive data suggests that the sector will grow further in 2017. According to a recent forecast provided by Gartner Inc. (IT), global IT spending for 2017 will rise 2.4%, up from 0.3% in 2016.

Per the research firm, the worldwide public cloud services market is anticipated to increase 18% in 2017 to $246.8 billion, up from $209.2 billion in 2016. It also forecasted that the number of connected things will increase 31% to 8.4 billion in 2017 from 6.4 billion in 2016.

So, we believe that this is the right time to invest in this space. However, picking the right stocks is always a tough task. To zero in on stocks that are winning currently and have the potential to gain further, we have opted for one tried and tested technique – picking stocks near their 52-week highs.

Making the Right Choice

The 52-week investment strategy loosely borrows from the basics of Momentum investing and is one of the relatively new entries in the investing rulebook. The basic idea is “buy high and sell higher” since once a trend is established, it is likely to continue. In other words, stocks that are growing will continue to grow.

The surge is driven by a broad set of factors including impressive sales, robust profitability and bullish earnings prospects. Major developments may also send stocks soaring. On the flipside, stocks that are trading near their 52-week highs carry the risk of falling fast as the market might consider them overvalued. But the positives seem to outweigh the drawbacks.

Still, to be on the safer side, why not bet on stocks that besides trading near their 52-week highs and have a positive earnings history. The stocks carry a Zacks Rank #1 (Strong Buy) or 2 (Buy) and have a Momentum Score of A or B. Notably, back-tested results show that this favorable combination handily outperforms other stocks.

5 Stocks to Scoop Up

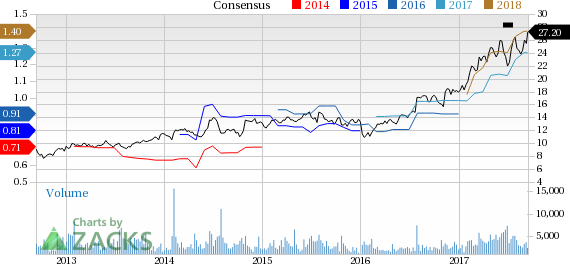

Entegris, Inc. (NASDAQ:ENTG) is engaged in developing, manufacturing and supplying micro contamination control products, specialty chemicals, and advanced materials handling solutions for manufacturing processes in the semiconductor and other high-technology industries globally. The stock has a Momentum Score of A and sports a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

The company has delivered positive earnings surprises in all the last four quarters, with an average beat of 11.9%. Moreover, the long-term expected earnings growth rate for Entegris is 11.3%. Closing at $27.23 on Sep 13, 2017, the stock has rallied almost 52% year to date, which is closed to the 52-week high of $27.35.

Entegris, Inc. Price and Consensus

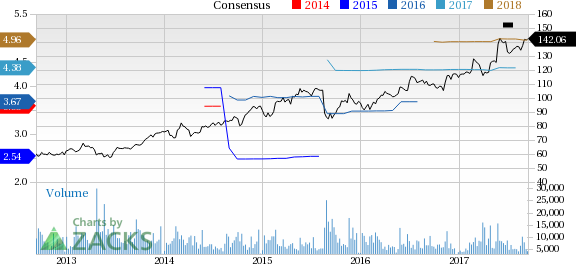

Intuit Inc. (NASDAQ:INTU) is a global business and financial software company that develops and sells financial, accounting and tax preparation software and related services for small businesses, consumers, and accounting professionals. The stock has a Momentum Score of A and a Zacks Rank #2.

The company has delivered positive earnings surprises in each of the last four quarters, with an average beat of 32.5%. The long-term expected earnings growth rate for Intuit is 14.6%. Closing at $142.06 on Sep 13, 2017, the stock has gained almost 24% year to date, which is closed to its 52-week high of $143.81.

Intuit Inc. Price and Consensus

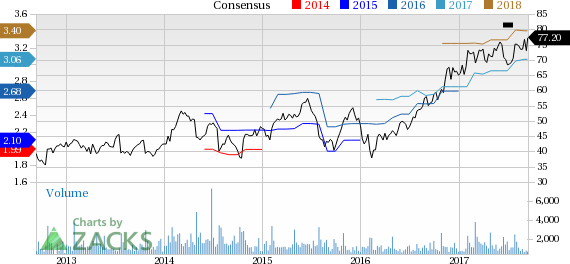

Silicon Laboratories Inc. (NASDAQ:SLAB) is a global fabless semiconductor company involved in designing, developing and marketing mixed-signal analog intensive integrated circuits (ICs). The stock has a Momentum Score of A and a Zacks Rank #2.

The company has delivered positive earnings surprises in the last four quarters, with an average beat of 12.2%. The long-term expected earnings growth rate for Silicon Laboratories is 15%. Closing at $77.18 on Sep 13, 2017, the stock has gained 18.8% so far in 2017, which is closed to its 52-week high of $79.15.

Silicon Laboratories, Inc. Price and Consensus

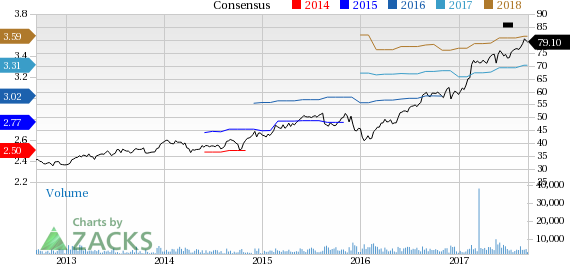

Synopsys, Inc. (NASDAQ:SNPS) is one of the leading suppliers of electronic design automation software to the global electronics industry. The stock has a Momentum Score of A and a Zacks Rank #2.

The company has delivered positive earnings surprises in two of the last four quarters and matched estimates on the other two occasions, with an average beat of 5.7%. The long-term expected earnings growth rate for Synopsys is 9.1%. Closing at $79.10 on Sep 13, 2017, the stock has gained 34.4% so far in 2017, which is closed to its 52-week high of $80.70.

Synopsys, Inc. Price and Consensus

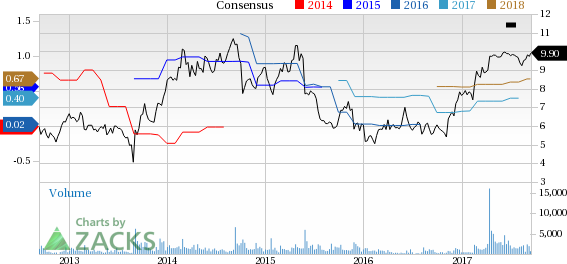

Xcerra Corporation (NASDAQ:XCRA) provides test and handling capital equipment, interface products, test fixtures and related services to the semiconductor and electronics manufacturing industries globally. The stock has a Momentum Score of B and a Zacks Rank #2.

The company has delivered positive earnings surprises in the last four quarters, with an average beat of 168.3%. The long-term expected earnings growth rate for Xcerra is 16%. Closing at $9.90 on Sep 13, 2017, the stock has gained 29.6% this year so far, which is closed to its 52-week high of $10.01.

Xcerra Corporation Price and Consensus

Wrapping Up

We are more or less sure that investing in these stocks will yield strong returns for your portfolio in the short term. This is because they have managed to deliver strong performances, supported by solid earnings and impressive growth projections.

New Report: An Investor’s Guide to Cybersecurity

Cyberattacks have become more frequent and destructive than ever. In fact, they’re expected to cause $6 trillion per year in damage by 2020.

The cybersecurity industry is expanding quickly in response to these threats. In fact, a projected $170 billion per year will be spent to protect consumer and corporate assets. Zacks has just released Cybersecurity: An Investor’s Guide to Locking Down Profits which reveals 4 promising investment candidates.

Entegris, Inc. (ENTG): Free Stock Analysis Report

Intuit Inc. (INTU): Free Stock Analysis Report

Synopsys, Inc. (SNPS): Free Stock Analysis Report

Xcerra Corporation (XCRA): Free Stock Analysis Report

Silicon Laboratories, Inc. (SLAB): Free Stock Analysis Report

Original post

Zacks Investment Research