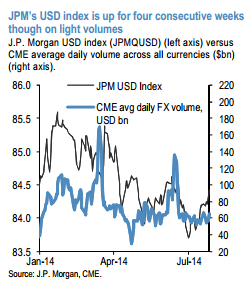

In a month some might label dull given tepid volumes , the dollar index is doing something somewhat interesting, says JP Morgan.

"It is posting four consecutive weekly advances and its largest monthly gain since January. FX volatility has failed to decline on the month for only the second time this year," JPM notes.

"Whether the dollar is threatening new highs or just nestling back into its 2014 range depends on which dollar index one references: DXY seems to be doing the former while JPM’s broader trade-weighted index including emerging market currencies is doing the latter. We still think advances in either index require higher US rates since there isn’t enough policy or data drama outside the US to push many non-dollar currencies lower," JPM argues.

Thus with full recognition of the complacency risk, and that ranges could persist for a few weeks longer, JPM reviews five strategies to play the FX markets in this low-vol environment.

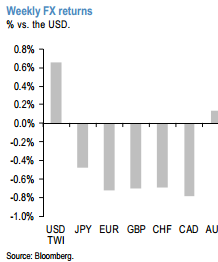

1- The obvious strategy is to reject the summer range and position for Q4 USD breakout. That is fine against currencies like EUR, JPY and CHF which do not cost to carry.

2- Alternatively, focus on USD longs versus currencies with idiosyncratic risk, like NOK due to Norges Bank dovishness or GBP due to the Scotland referendum.

3- The third strategy is to earn carry in cash markets. We only do this in emerging markets, since both absolute and risk-adjusted carry are much higher than in G10. CNY is our preferred trade. For vol carry, BRL and MXN are the top pairs.

4- Another strategy is to trade short-term mean reversion where positions look stretched. Selling GBP is preferred, though BRL positions are also large (carry is too punitive, however).

5- Finally, investors could consider removing the USD element and focus on cross-rates. We think there is enough inflation divergence within Europe to make this a rich source of trades, but we are mostly sidelined here for the moment except for a short in EUR/CHF. Instead, we like short CAD/MXN and long MXN/CLP as two cross-rate trades in our Technical Analysis portfolio.